Issue Summary

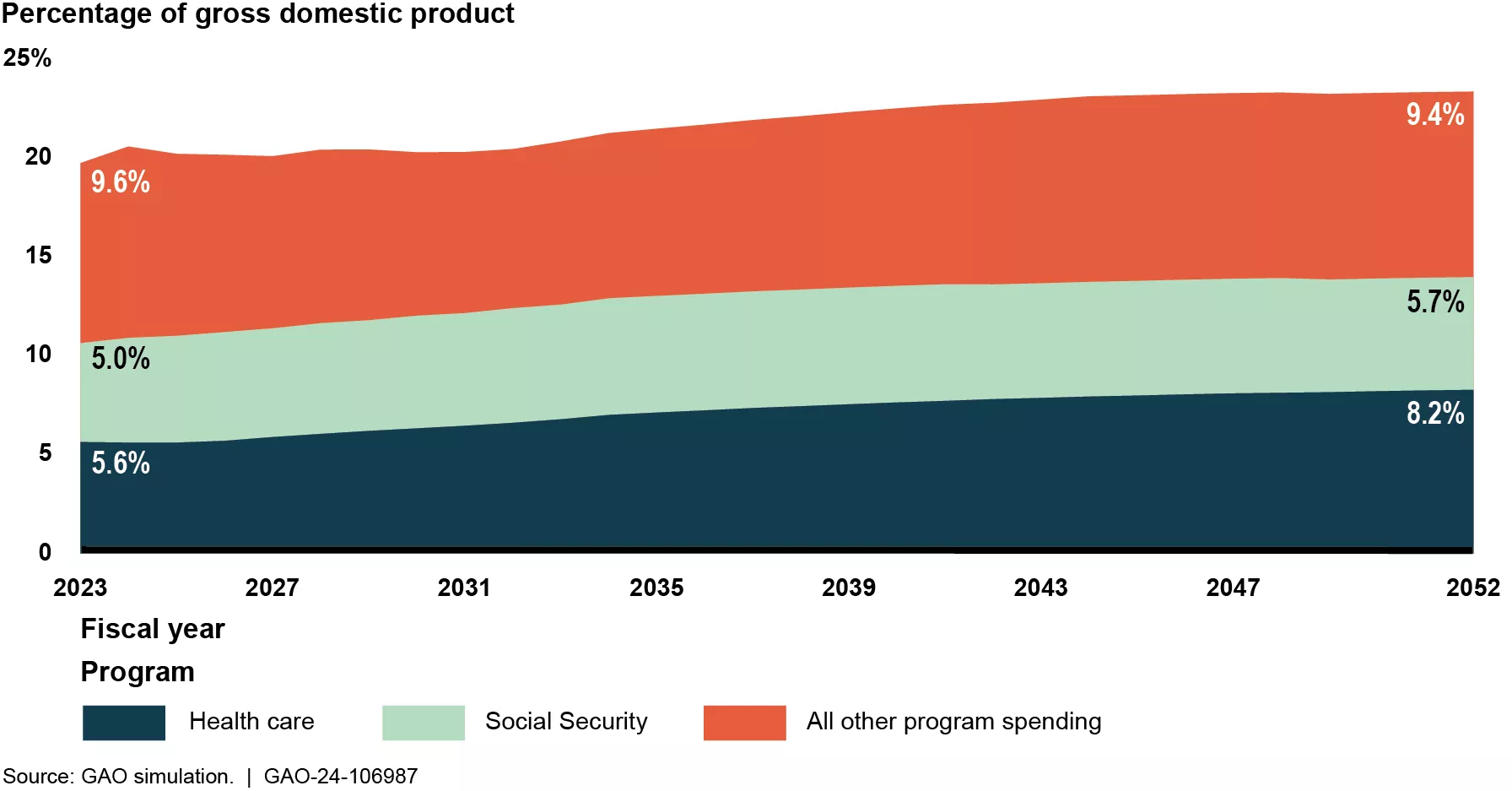

Federal spending on major health care programs—as a share of GDP—is projected to increase 47% over the next two decades, continuing to contribute to the unsustainable long-term fiscal future of the nation.

For instance, Medicare will likely face a funding shortfall within the decade because enrollment in and spending on Medicare (which is on the High Risk List) are both expected to increase as the number and proportion of people over age 65 increases. Similarly, federal Medicaid spending (also on the High Risk List) is expected to total $750 billion by 2030.

Projected Growth in Health Care and Other Major Areas of Program Spending

Image

Both Medicare and Medicaid could help address future funding shortfalls by improving how they use funds.

For example:

- Equalizing Medicare payments. Medicare currently pays a higher rate for certain services, such as evaluation and management office visits, when these visits are performed in a hospital outpatient setting rather than a physician office. Equalizing payments across care settings could reduce Medicare spending by billions of dollars.

- Payment adjustments. Diagnostic coding practices have contributed to Medicare Advantage plans receiving higher payments for beneficiaries. Improving the accuracy of the payment adjustments for these plans, such as incorporating more recent data and fully accounting for historical coding differences, would better ensure accurate payments and reduce Medicare spending by billions of dollars.

- Uncompensated care. Hospitals have historically incurred billions of dollars in costs for services provided to uninsured and other low-income individuals. Multiple types of Medicaid and Medicare payments to hospitals help offset these uncompensated care costs. However, larger portions of the Medicare payments offset costs for which hospitals may have also received Medicaid payments. To better target billions of dollars, Medicare should account for Medicaid payments made when making uncompensated care payments to individual hospitals.

- Medicaid demonstrations. Many states conduct Medicaid demonstrations, which allow them to test new approaches for delivering services. Medicaid monitors spending under these demonstrations to ensure that the federal government does not pay more for them than it would have paid for the state's traditional Medicaid program. But over the last decade, Medicaid has spent increasing amounts on these demonstrations and has been inconsistent in how it monitors these funds.

- Healthcare providers. States must screen and enroll health care providers in Medicaid according to federal and state rules. These rules are designed to exclude providers who don’t meet minimum standards, which can help prevent fraud, waste, and abuse. Congress established new federal rules in 2010 and 2016, but some states haven’t implemented all of them. Medicaid should expand its oversight of state compliance with these new rules.

- Medicaid funding. States and the federal government share in financing Medicaid. States mostly use their general funds to finance the nonfederal share, but they can also use funds from care providers and local governments. From 2008 to 2018, states relied more heavily on the other funds. Since the federal government matches all nonfederal funds, responsibility for a larger portion of Medicaid payments effectively shifted to the federal government and away from states. Medicaid should collect and document complete and consistent information about the sources of funding for the nonfederal share of payments to providers.

- Managed care plans. States and the federal government pay managed care plans based on the number of Medicaid beneficiaries. The managed care plans then pay health care providers for services. Since 2017, states have been allowed to steer additional payments to providers to help the state achieve certain Medicaid goals. State-directed payments should have been exceptions to the regular payment process, but they now comprise a significant and growing proportion of managed care spending. Medicaid should improve its oversight and evaluation to ensure that these payments are effective.