Medicaid: CMS Needs More Information on States' Financing and Payment Arrangements to Improve Oversight

Fast Facts

States and the federal government share in financing Medicaid, a health care program for low-income and medically needy people. States mostly use their general funds to finance the nonfederal share, but they can also use funds from care providers and local governments.

From 2008 to 2018, states relied more heavily on the other funds. Since the federal government matches all nonfederal funds, responsibility for a larger portion of Medicaid payments effectively shifted to the federal government and away from states.

We recommended improving data collection on states' financing and payments to better identify permissible arrangements.

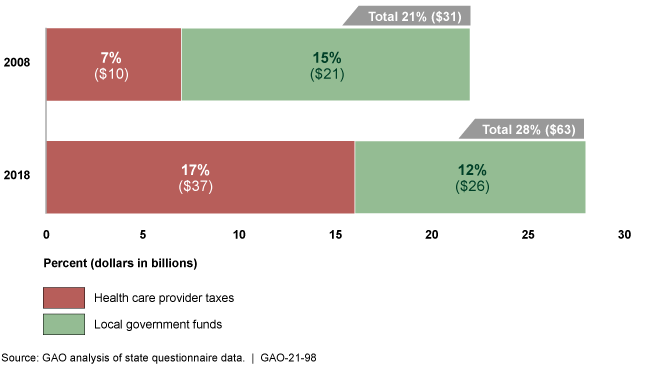

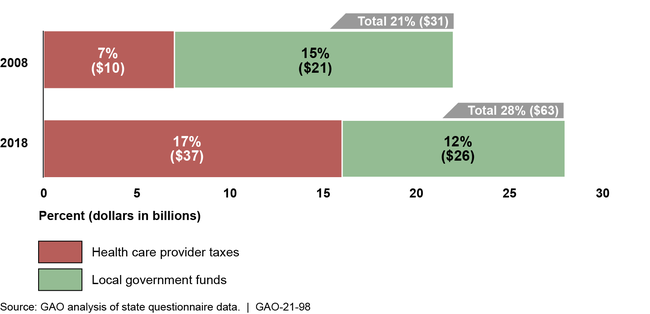

Change in States' Reliance on Provider Taxes and Local Government Funds from State Fiscal Years 2008 and 2018

Highlights

What GAO Found

States and the federal government share in financing Medicaid, a health care program for low-income and medically needy individuals. States finance the nonfederal share with state general funds and other sources, such as taxes on health care providers and funds from local governments. GAO's analysis showed a change in how states finance their Medicaid programs. In particular, states relied on provider taxes and local government funds for about 28 percent, or $63 billion, of the estimated $224 billion total nonfederal share of Medicaid payments in state fiscal year 2018—7 percentage points more than state fiscal year 2008.

Nonfederal Share of Medicaid Payments from Provider Taxes and Local Government Funds, State Fiscal Years 2008 and 2018

Note: Percentages do not add up due to rounding.

Furthermore, GAO estimated that states' reliance on provider taxes and local government funds decreased states' share of net Medicaid payments (total state and federal payments) and effectively increased the federal share of net Medicaid payments by 5 percentage points in state fiscal year 2018. It also resulted in smaller net payments to some providers after the taxes and local government funds they contribute to their payments are taken into account. While net payments are smaller, the federal government's contribution does not change. This effectively shifts responsibility for a larger portion of Medicaid payments to the federal government and away from states.

The Centers for Medicare & Medicaid Services (CMS)—which oversees Medicaid—collects some information on states' sources of funds and payments, but it is not complete, consistent, or sufficiently documented, which hinders the agency's oversight. For example, CMS does not require states to report on the source of the nonfederal share for all payments. Absent complete, consistent, and sufficiently documented information about all Medicaid payments, CMS cannot adequately determine whether payments are consistent with statutory requirements for economy and efficiency, and with permissible financing, such as the categories of services on which provider taxes may be imposed.

Why GAO Did This Study

Medicaid cost $668 billion in fiscal year 2019. GAO has previously reported on concerns about states' use of various funding sources for the nonfederal share. Although such financing arrangements are allowed under certain conditions, they can also result in increasing the share of net costs paid by the federal government and decreasing reliance on state general funds.

GAO was asked to review the sources of funds states used for Medicaid and the types of payments made to providers. This report describes states' reliance on provider and local government funds for these arrangements; the estimated effect of these arrangements on the federal share of net Medicaid payments; and the extent to which CMS collects information on these arrangements. To do this work, GAO reviewed CMS information; administered a questionnaire to all state Medicaid agencies; analyzed the estimated effects of reliance on provider and local government funds; and interviewed CMS officials, as well as Medicaid officials in 11 states selected, in part, on Medicaid spending and geographic diversity.

Recommendations

The Administrator of CMS should collect and document complete and consistent information about the sources of funding for the nonfederal share of payments to providers. CMS neither agreed nor disagreed with GAO's recommendation, but acknowledged the need for additional financing and payment data for Medicaid oversight.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Centers for Medicare & Medicaid Services |

Priority Rec.

The Administrator of CMS should collect and document complete and consistent provider-specific information about Medicaid payments to providers, including new state-directed managed care payments, and states' sources of funding for the nonfederal share of these payments. (Recommendation 1) |

As of February 2025, this recommendation remains not addressed. HHS neither agreed nor disagreed with our recommendation but acknowledged the need for additional state Medicaid financing and payment data to oversee the Medicaid program. Regarding state directed managed care payments, HHS noted that CMS has begun work to improve the collection of financing and payment information through a revised data collection form and that CMS would explore additional actions to do so. In February 2024, CMS officials said the agency has developed the tools and process for collecting standardized information on state directed payments, including on the source of funding of the nonfederal share. However, the standardized information on state directed payments and source of funding is not always provider specific. Regarding supplemental payments, in December 2021, CMS issued guidance on new reporting requirements beginning with information about payments made on or after October 1, 2021. In February 2024, CMS officials said states have begun reporting supplemental payments. In November 2024, CMS stated the agency was still performing its validation work on the supplemental payment reporting. CMS officials also confirmed the new state reporting does not include information on the sources of funds used to finance the nonfederal share of Medicaid payments. To fully implement our recommendation, HHS needs to demonstrate how its ongoing and planned actions in this area will ensure complete, consistent, and sufficiently documented provider-specific information about the nonfederal sources of funding for all Medicaid payments.

|