For Veterans Starting a New Business and New Life, Federal Programs Could Help With Financial Hurdles

After leaving the military, veterans may struggle in their transition to civilian life, including with managing personal finances or kick-starting a new business.

While supporting veterans after military service is important, so are the contributions veterans make after service. For example, veteran-owned businesses play an important role in the U.S. economy.

Today’s WatchBlog post looks at our recent report about some of the financial hurdles many veterans face when transitioning to civilian life and the federal resources that can help them.

Image

Veterans may face financial hurdles that impact new businesses and other opportunities

Transitioning from active duty to civilian life can be a challenging time for veterans. They may struggle with employment, financial stability, and navigating family and social relationships.

Financially, some veterans have experienced declining credit scores and increased delinquencies and defaults on loans after leaving the military. Research suggested veterans’ credit scores may have declined because of financial issues like unemployment or medical costs. And veterans who move to a new area after service may struggle to establish credit or develop business relationships in their new community.

Veterans may also have a hard time getting loans for their businesses. For example, some lenders may be unfamiliar with the skills and experience veterans gained during military service or the specific business type for which veterans are seeking financing.

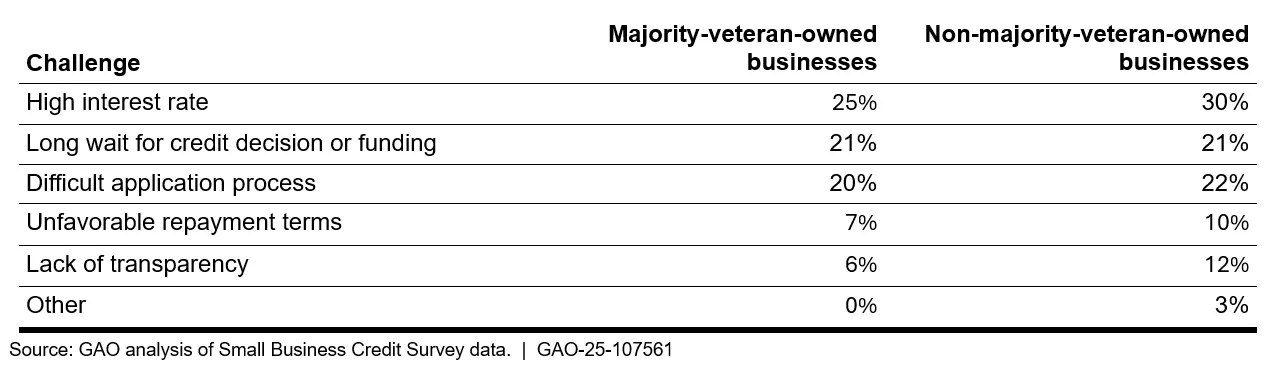

Reported Challenges Obtaining Financing from Large Banks, by Veteran Ownership Status, 2024

Image

But supporting these efforts is important. Veteran-owned businesses made an estimated $884.5 billion and employed 3.2 million people in 2022, according to the Census Bureau.

What are some federal efforts aiming to help veteran small business owners?

The federal government provides a variety of resources to help veterans with financial literacy and access to small business loans.

Financial literacy. There are 24 financial literacy programs that can help veterans with both business and personal financial decisions. For example, DOD’s Transition Assistance Program can help ensure that service members have a viable plan for transitioning to civilian life, including a financial plan, before they leave the military.

The Small Business Administration (SBA) also maintains a nationwide network that provides counseling, training, mentoring, and funding guidance to small business owners, including veterans. This network includes Veterans Business Outreach Centers, which offer resources to veterans interested in starting or growing a small business.

Loans. Some federal agencies also give small business loans to veterans. For example, SBA offers loans that can help veterans through its 7(a), 504, and Microloan lending programs. The U.S. Department of Agriculture (USDA) also offers loans for veterans’ small businesses engaged in farming, ranching, and other agricultural activities in rural communities.

While these programs exist, veterans may not know about them. Agencies have been working to raise veterans’ awareness of their lending and financial literacy programs. For example, SBA and USDA have promoted their programs through online and in-person presentations, networking events, and targeted social media outreach.

Our recent report includes more information on the supports for veterans, available in the appendix here. Many of these programs are also available to military spouses and family members, reservists, and current servicemembers.

Learn more about this issue and the federal programs available to veterans by checking out our latest report.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.

- Got a question or comment? Email us at blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.