Financial Literacy and Small Business Lending: Resources Available to Military-Affiliated People

Fast Facts

Small businesses owned by veterans, active military members, their spouses, and other military-affiliated people are an important part of the U.S. economy. We looked at some of their challenges and the resources available to them.

Data shows that veterans can have trouble getting business financing from large banks.

The Small Business Administration and Department of Agriculture offer loans to military-affiliated business owners. SBA lending to veterans generally increased over FYs 2019–2024.

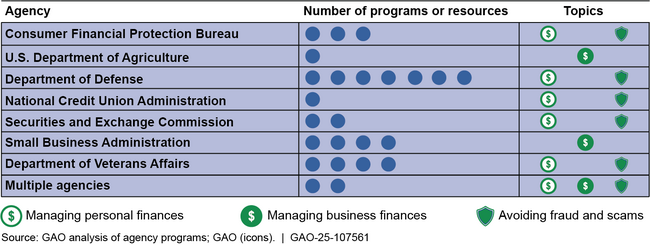

We also found 9 federal agencies offer 24 financial literacy programs to help military-affiliated people with business and personal financial decisions.

A person in a military uniform fills out a form.

Highlights

What GAO Found

Military-affiliated people—including active-duty service members, reservists, transitioning service members, veterans, and military and veteran spouses—may face challenges building credit and accessing capital to fund their small businesses. For example, veterans who relocate to a new area after military service can have difficulty establishing credit and developing business relationships. Officials told us military-affiliated people may also face limited access to mentors and professional networks that can help their businesses.

Military-affiliated people can access financial literacy programs and resources through federal agencies including the Department of Defense (DOD), the Department of Veterans Affairs (VA), and the Small Business Administration (SBA). These resources provide help with managing personal or business finances, and tips for avoiding fraud and scams.

Federal Financial Literacy Programs and Resources Targeted to Military-Affiliated People or Small Business Owners

Military-affiliated people can access capital for small businesses through various private funding sources and federal lending programs. Private sources include self-funding, investors, and business loans. However, according to self-reported responses in the 2024 Small Business Credit Survey, veteran business owners reported facing challenges obtaining financing from large banks, such as high interest rates and difficult application processes. Federal lending options include SBA’s 7(a) program and Department of Agriculture loans for agricultural businesses. SBA lending to veteran-owned businesses generally increased from fiscal year 2019 through fiscal year 2024.

Federal agencies raise awareness of financial literacy and lending programs for military-affiliated people through in-person and virtual presentations, networking events, and the use of social media and websites. For example, SBA’s Office of Veterans Business Development conducted more than 100 presentations annually in fiscal years 2023 and 2024. Agencies such as SBA and DOD have online tools, including program-specific webpages, to improve access to financial education and loan information.

Why GAO Did This Study

Military-affiliated people play a vital role in the nation’s economy, including through veteran-owned businesses. According to the Census Bureau’s 2023 Annual Business Survey, veteran-owned businesses had an estimated $884.5 billion in receipts, 3.2 million employees, and $179.7 billion in annual payroll in 2022.

GAO was asked to review financial literacy and lending resources for military-affiliated people. This report examines (1) challenges military-affiliated people may face in building credit or accessing capital to fund their small businesses, (2) federal financial literacy resources available to them, (3) sources of capital available to them, and (4) agency efforts to raise awareness among this population about financial literacy and lending programs.

GAO interviewed or received written comments from nine agencies, including SBA, VA, and DOD, selected based on prior work, or because they serve the military community. GAO analyzed participation and usage data for financial literacy programs for fiscal years 2019–2023. GAO reviewed national small business survey data from the Census Bureau for 2023 and the Federal Reserve Banks for 2024, the most recent available. GAO also reviewed small business lending data from SBA and Department of Agriculture for 2019–2024, the most recent available. In addition, GAO interviewed or received written comments from representatives of four nonprofit organizations and five financial services firms, selected for their work with military-affiliated people and their businesses.

For more information, contact Courtney LaFountain at lafountainc@gao.gov.