Nonbank Mortgage Companies: Ginnie Mae and FHFA Could Enhance Financial Monitoring

Fast Facts

Many mortgage companies aren't banks and don't take deposits to fund loans. "Nonbank" mortgage companies rely on short-term funding instead, which can leave them more vulnerable to failure in economic downturns.

Nonbanks make and service most of the loans packaged into federally backed mortgage securities. Sales of these securities to investors help fund more loans. A major nonbank failure could disrupt mortgage lending and leave the government on the hook to cover losses.

Ginnie Mae and the Federal Housing Finance Agency monitor nonbanks' financial conditions but don't fully assess their funding risks.

Our recommendations address this and more.

Stock image of a house and coins.

Highlights

What GAO Found

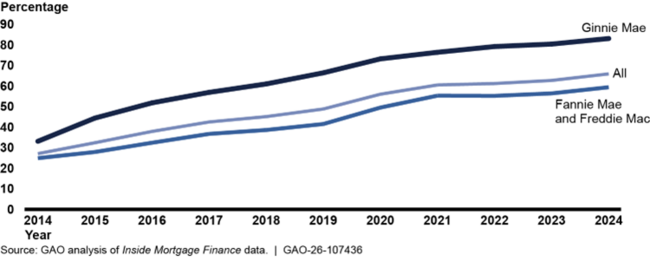

Over the past decade, housing finance increasingly relied on nonbank mortgage companies (nondepository institutions specializing in mortgage lending). Nonbanks now originate and service most loans in the over $9 trillion in securities guaranteed by Ginnie Mae, a government-owned corporation, and by Fannie Mae and Freddie Mac, which are under Federal Housing Finance Agency (FHFA) conservatorship. From 2014 to 2024, the share of such loans serviced by nonbanks grew from 27 percent to 66 percent. But nonbanks have certain risks, such as reliance on short-term credit that may become unavailable during economic downturns. The failure of a large nonbank—or multiple smaller ones—could disrupt mortgage markets and increase federal fiscal exposure.

Percentage of Mortgage Loans in Federally Backed Securities Serviced by Nonbanks, by Dollar Volume, 2014–2024

Ginnie Mae and FHFA have processes to assess the financial condition of nonbanks, but opportunities exist to enhance their processes.

- Financial data. Both agencies analyze nonbanks’ self-reported financial data to support their nonbank monitoring. However, GAO found that FHFA does not have written procedures to assess the reliability of these data, reducing assurance that its analytical results are dependable.

- Watch lists. Both agencies produce watch lists of nonbanks that pose relatively higher risks, based partly on financial data. But, based on GAO’s analysis, both agencies’ processes do not fully assess key risks of certain short-term credit lines. As a result, the agencies may not be fully considering information material to watch list determinations.

- Scenario analyses. Both agencies analyze the effect of changing economic conditions on nonbank financial health. To help manage its counterparty risk from nonbanks, Ginnie Mae performs a detailed analysis and uses a comprehensive economic stress scenario. But Ginnie Mae’s focus on a single adverse scenario does not reflect a fuller range of possible outcomes—potentially diminishing its ability to prepare for how different scenarios could affect its portfolio and financial exposure.

Why GAO Did This Study

Nonbank mortgage companies generally do not have a federal regulator overseeing their safety and soundness. But Ginnie Mae and FHFA, which support the stability of markets for mortgage-backed securities, play a role in monitoring these entities.

Since 2013, GAO has designated the federal role in housing finance as a high-risk area. This report examines the (1) role of nonbanks in the mortgage market since 2014, including their benefits and risks; and (2) extent to which Ginnie Mae and FHFA designed processes to assess the financial condition of nonbank mortgage companies.

GAO reviewed Ginnie Mae and FHFA policies, procedures, and analysis of nonbanks. GAO analyzed industry and government data on mortgage loans originated or serviced by nonbanks in 2014–2024. GAO also interviewed FHFA, Ginnie Mae, and Financial Stability Oversight Council officials, as well as researchers and subject matter experts from industry and consumer groups.

Recommendations

GAO is making four recommendations: for FHFA to develop procedures to assess the reliability of nonbank data it uses for monitoring, FHFA and Ginnie Mae to improve their processes for assessing risks of nonbank use of short-term credit lines, and Ginnie Mae to consider additional nonbank stress scenarios. FHFA and Ginnie Mae agreed with GAO’s recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Federal Housing Finance Agency | The Director of FHFA should ensure that the Counterparty Risk and Policy Branch develops procedures for assessing the reliability of MBFRF data used for monitoring activities and for treating potentially unreliable data. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Government National Mortgage Association (Ginnie Mae) | The President of Ginnie Mae should ensure that the Office of Enterprise Risk develops guidance requiring analysts to consistently review key components of warehouse lending risk, including the committed funding amount, as part of the manual credit review process. (Recommendation 2) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Federal Housing Finance Agency | The Director of FHFA should ensure that the Counterparty Risk and Policy Branch assesses the feasibility and utility of incorporating all key components of warehouse lending risk in its risk scoring process. (Recommendation 3) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Government National Mortgage Association (Ginnie Mae) | The President of Ginnie Mae should ensure that the Office of Enterprise Risk incorporates consideration of alternative economic scenarios into Ginnie Mae's stress testing framework. (Recommendation 4) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|