Image

Financial Markets and Institutions

Image

Recent Reports

Open Recommendations

Nonbank Mortgage Companies: Ginnie Mae and FHFA Could Enhance Financial Monitoring

GAO-26-107436

Feb 10, 2026

Show

4 Open Recommendations

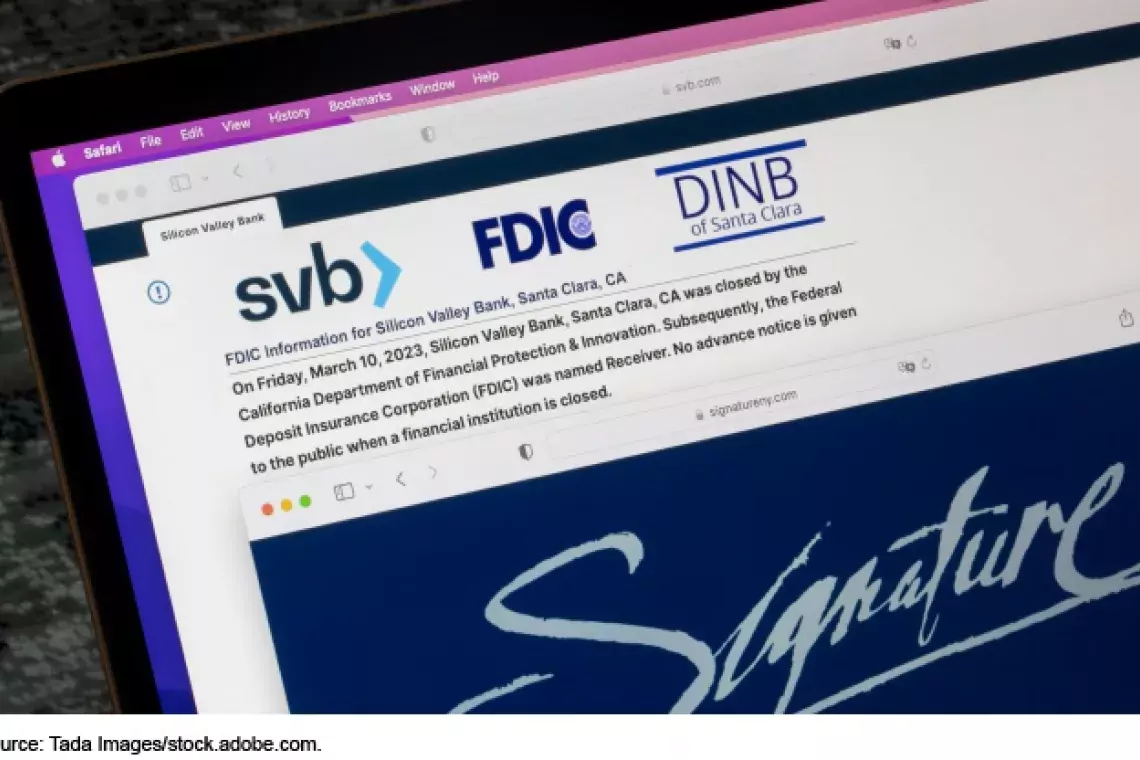

Bank Capital Reforms: The Office of the Comptroller of the Currency Should Clarify Policy for Retaining Documents

GAO-26-108015

Jan 29, 2026

Show

1 Open Recommendations

Artificial Intelligence: Use and Oversight in Financial Services

GAO-25-107197

May 19, 2025

Show

1 Open Recommendations