Federal Reserve Lending Programs: Status of Monitoring and Main Street Lending Program

Fast Facts

In response to COVID-19, the Federal Reserve System Board of Governors authorized 13 emergency lending programs to help provide credit to certain parts of the economy, including businesses and employers.

The Main Street Lending Program targeted small and mid-sized businesses and nonprofits. Since the program ended in January 2021, borrowers have generally made scheduled payments on-time. As of August 2023, about 64% of program loans—roughly $11.3 billion—remain outstanding. However, the rate of past-due payments has increased and could remain higher than average as borrowers face potential increases in the interest rate on their loans.

Highlights

What GAO Found

In response to the COVID-19 pandemic, the Board of Governors of the Federal Reserve System authorized 13 emergency lending programs—known as facilities—to ensure the flow of credit to various parts of the economy. To improve oversight, the Federal Reserve issued five internal reports from December 2020 through June 2023 that identified opportunities to enhance internal processes and controls, including for collateral and asset management. GAO found that Federal Reserve Banks, which manage the facilities, addressed almost all of these opportunities. As of September 2023, no new enhancement opportunities had been identified. GAO also found the Federal Reserve's plans for ongoing monitoring of the facilities generally aligned with federal internal control standards for ongoing monitoring of an entity's internal control system.

GAO analysis shows that while uncertainties exist in the credit markets targeted by the facilities, vulnerabilities remain low. Corporate bond issuances are higher than prepandemic levels, and credit spreads (which reflect borrowing costs) generally remain low. These factors indicate that corporations have relatively easy access to credit. However, according to GAO analysis of available data and survey results, small businesses' access to credit has decreased since 2022, as banks have tightened credit standards in response to a less positive economic outlook and industry-specific problems. Also, municipal bond issuances have decreased since mid-2022 and are at prepandemic levels. This trend reflects challenges for raising new debt or refinancing existing debt, especially given that interest rates have increased. However, debt levels carried in sectors the facilities targeted appear sustainable.

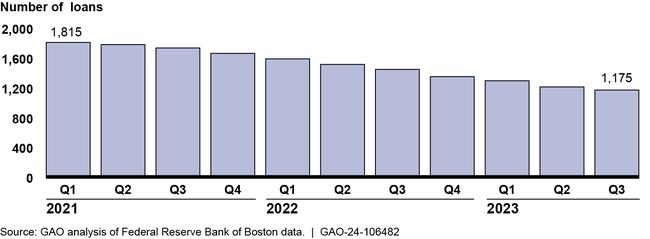

Of the 1,830 loans made through the Main Street Lending Program,1,175 (or 64 percent) remained outstanding as of the end of August 2023, the most recent data available (see figure). Since required interest payments began in August 2021, most borrowers have been making them on time. However, delinquent payments increased to about 7.6 percent in August 2023, which may reflect the effects of increased interest payments as variable rates on Main Street loans have risen. GAO found that 610 loans (or about 33 percent) had been fully repaid, and 45 loans (or about 2.5 percent) had recorded losses.

Main Street Lending Program Outstanding Loans, First Quarter 2021–Third Quarter 2023

Note: Third quarter 2023 reflects data as of the end of August 2023.

Why GAO Did This Study

As of September 2023, several of the Federal Reserve's 13 lending facilities continued to hold large amounts of outstanding assets and loans. Nine of the 13 facilities received funds appropriated through the CARES Act (section 4003). Of these nine, six had a total of about $12 billion in outstanding assets and loans. About 72 percent of this amount—about $8.6 billion—was held by facilities under the Main Street Lending Program, which supported loans to small and midsize businesses and nonprofits. The Federal Reserve is required to monitor and report on the facilities until they no longer hold outstanding assets or loans.

The CARES Act includes a provision for GAO to periodically report on section 4003 loans, loan guarantees, and investments. This report examines (1) the Federal Reserve's oversight and monitoring of the CARES Act facilities, (2) trends in the credit markets that the facilities targeted, and (3) the status and performance of Main Street Lending Program loans.

GAO reviewed Federal Reserve Bank documentation and analyzed agency and other data on the facilities and credit markets, including data on short- and long-term corporate credit market indicators. GAO also conducted loan-level analysis of Main Street Lending Program loans and interviewed Federal Reserve officials.

For more information, contact Michael E. Clements at (202) 512-8678 or clementsm@gao.gov.