Tax Compliance: IRS Audit Trends for Individual Taxpayers Vary by Income

Fast Facts

IRS audits individuals to verify if they accurately reported their taxes and, if they didn't, to determine if more taxes are owed.

We testified that audit trends vary by taxpayer income. In recent years, IRS audited taxpayers with incomes below $25,000 and those with incomes of $500,000 or more at higher-than-average rates. But, audit rates have dropped for all income levels—decreasing the most for taxpayers with incomes of $200,000 or more.

IRS officials said audit rates declined due to staffing decreases and because it takes more staff time and expertise to handle complex higher-income audits. Our report details these and other audit trends.

Highlights

What GAO Found

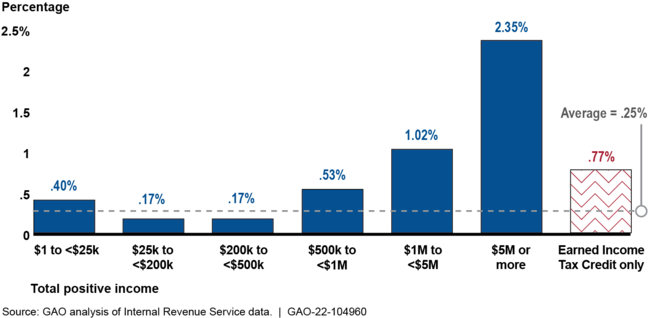

Audit Rates. From tax years 2010 to 2019, audit rates of individual income tax returns decreased for all income levels. On average, the audit rate for these returns decreased from 0.9 percent to 0.25 percent. Internal Revenue Service (IRS) officials attributed this trend primarily to reduced staffing as a result of decreased funding. Audit rates decreased the most for taxpayers with incomes of $200,000 and above. According to IRS officials, these audits are generally more complex and require staff's review. Lower-income audits are generally more automated, allowing IRS to continue these audits even with fewer staff.

Although audit rates decreased more for higher-income taxpayers, IRS generally audited them at higher rates compared to lower-income taxpayers, as shown in the figure. However, the audit rate for lower-income taxpayers claiming the Earned Income Tax Credit (EITC) was higher than average. IRS officials explained that EITC audits require relatively few resources and prevent ineligible taxpayers from receiving the EITC.

Audit Rates by Total Positive Income, Tax Year 2019

Audit Results and Resources. From fiscal years 2010 to 2021, the majority of the additional taxes IRS recommended from audits came from taxpayers with incomes below $200,000. However, the additional taxes recommended per audit increased as taxpayer income increased. Over this time, the average number of hours spent per audit was generally stable for lower-income taxpayers but more than doubled for those with incomes of $200,000 and above. According to IRS officials, greater complexity of higher-income audits and increased case transfers due to auditor attrition contributed to the time increase.

Audits of the lowest-income taxpayers, particularly those claiming the EITC, resulted in higher amounts of recommended additional tax per audit hour compared to all income groups except for the highest-income taxpayers. IRS officials explained that EITC audits are primarily pre-refund audits and are conducted through correspondence, requiring less time. Also, lower-income audits tend to have a higher rate of change to taxes owed.

Why GAO Did This Study

This testimony summarizes the information contained in GAO's May 2022 report, entitled Tax Compliance: Trends of IRS Audit Rates and Results for Individual Taxpayers by Income (GAO-22-104960).

For more information, contact James R. McTigue, Jr. at (202) 512-6806 or mctiguej@gao.gov.