Management Report: IRS Should Test Videoconference Visits with Paid Preparers

Fast Facts

IRS estimates that 23% of the payments it issued to taxpayers in FY 2021 for refundable tax credits were made in error—costing about $26 billion.

IRS identifies paid tax preparers who may not comply with tax credit rules. IRS visits these preparers in person to educate them about compliance or request evidence of their compliance. But, due to COVID-19 and a staffing shortage, IRS suspended educational visits and reduced its number of compliance reviews in FYs 2021-2022.

We recommended IRS test using video conferencing for these visits and expand its use if the benefits outweigh the costs.

Highlights

What GAO Found

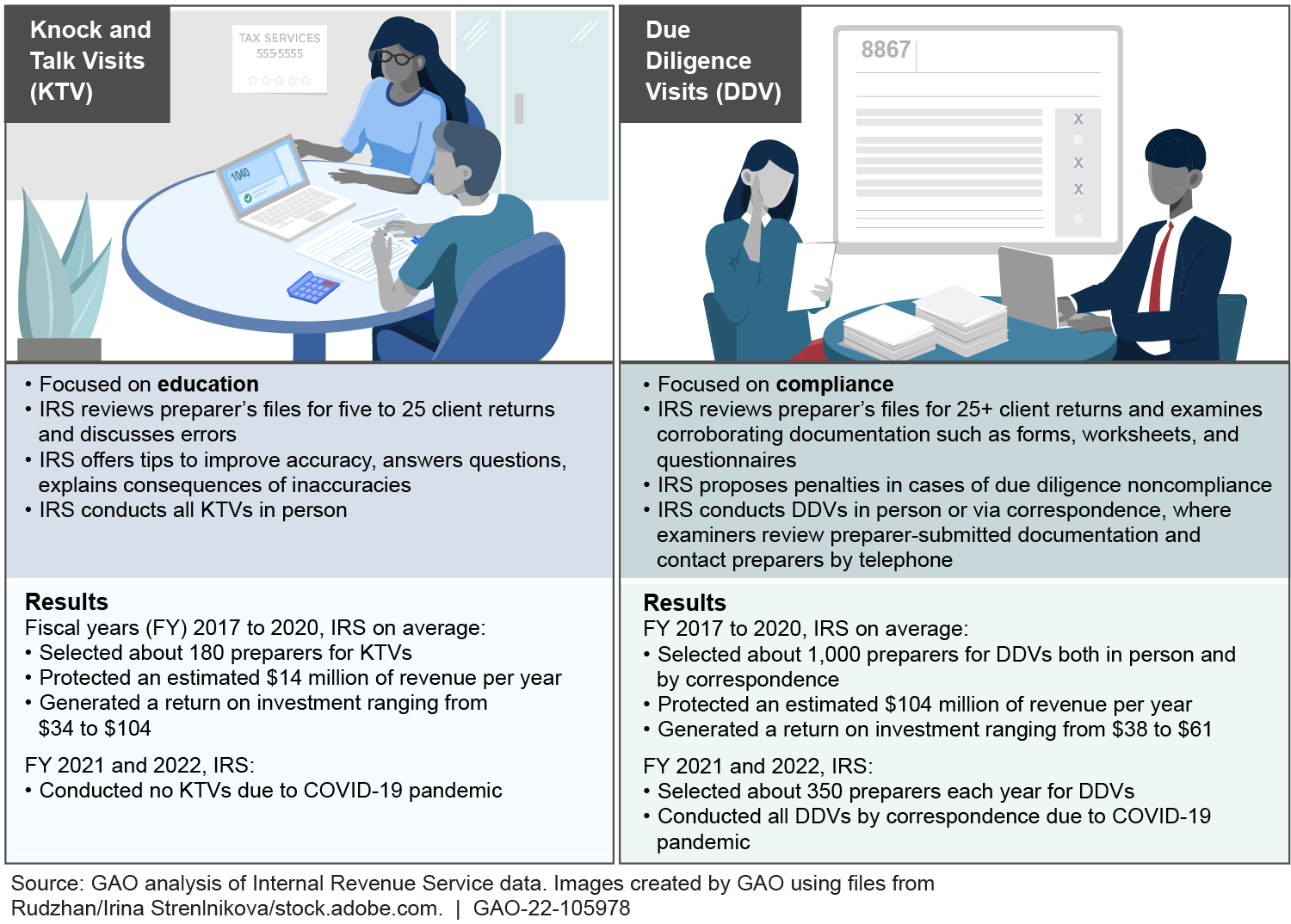

IRS faces challenges in conducting visits with paid preparers due to COVID-19 in-person restrictions and limited staff availability. This limits IRS’s ability to improve compliance and reduce improper payments. Recent declines in the number of knock and talk visits and due diligence visits conducted through IRS’s Refundable Credits Return Preparer Strategy have limited the amount of revenue IRS can protect from improper claims of refundable credits and other tax benefits.

Types of IRS Visits with Preparers and Results

According to IRS officials, in-person visits to paid preparers offer IRS an important opportunity to interact with preparers, identify problems, and help improve compliance with due diligence requirements. These requirements are set by law and help to ensure accurate preparation of tax returns when claiming certain refundable credits and tax benefits. While due diligence visits and knock and talk visits can be the most expensive compliance effort, they help IRS address millions of dollars in potentially improper claims at a relatively low cost. From fiscal years 2017 to 2020, IRS estimated that these visits on average protected about $118 million of tax revenue per year at an average cost of $3.3 million per year.

IRS's Refundable Credits Return Preparer Strategy includes pilot testing of new compliance actions most years. The annual planning process occurs during the summer months. IRS should consider including a videoconference pilot as part of its Refundable Credits Return Preparer Strategy for the upcoming fiscal year. IRS officials said they have not tested a videoconferencing option for preparer visits and raised questions about its potential benefits and challenges.

Videoconference visits could help IRS mitigate in-person restrictions in the near term and provide additional benefits over the long term such as increased flexibility, modernization of IRS compliance activities, and operational cost savings. Without plans to test videoconferencing visits with preparers, IRS will remain limited in its efforts to address preparer noncompliance. It may also miss opportunities to innovate its compliance actions and align with agency-wide efforts to expand digital services to taxpayers and professionals.

Why GAO Did This Study

Refundable credits—such as the Earned Income Tax Credit, Additional Child Tax Credit, and American Opportunity Tax Credit—provide relief to millions of taxpayers, some of whom are low income and may belong to vulnerable populations. However, IRS reported that it issued an estimated $26 billion of these payments improperly in fiscal year 2021. Further, half of taxpayers who claim refundable credits work with paid preparers to file complete, accurate, and compliant returns. However, many preparers lack professional credentials and have high error rates on their returns.

GAO was asked to review IRS’s Refundable Credits Return Preparer Strategy. This report provides an immediate action IRS could take to test videoconference visits with paid preparers for the upcoming fiscal year to supplement its current efforts. GAO will report additional findings in a forthcoming report.

Recommendations

GAO is making two recommendations to IRS, including that (1) IRS should pilot test and evaluate the costs, benefits, and challenges of using videoconferencing technology for its education and compliance visits with paid preparers; and (2) if the benefits outweigh the costs, further implement the use of videoconferencing. IRS agreed with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should pilot test and evaluate the costs, benefits, and challenges of using videoconferencing technology for its education and compliance visits with paid preparers. (Recommendation 1) |

IRS agreed with this recommendation. As of January 2025, IRS concluded a 2-year pilot test to evaluate the costs, benefits, and challenges of using videoconferencing for its education and compliance visits with paid preparers. At the conclusion of the pilot, IRS decided not to implement videoconferencing for these visits. Nevertheless, IRS has found other ways to use videoconferencing to promote preparer compliance with due diligence requirements. For example, in fiscal year 2024 IRS hosted a live educational webinar for hundreds of paid preparers with potential compliance issues. It also offered some preparers that were given a warning phone call the option to have a follow-up videoconference with IRS staff. These actions meet the intent of the original recommendation and demonstrate how IRS can use videoconferencing to enhance preparer compliance, improve the accuracy of tax preparation services, and protect revenue.

|

| Internal Revenue Service | If IRS finds the benefits outweigh the costs, IRS should implement the use of videoconferencing as a method for conducting and potentially expanding its education and compliance visits with paid preparers. (Recommendation 2) |

IRS agreed with this recommendation. As of January 2025, IRS concluded a 2-year pilot test to evaluate the costs, benefits, and challenges of using videoconferencing for its education and compliance visits with paid preparers. At the conclusion of the pilot, IRS decided not to implement videoconferencing for these visits. Nevertheless, IRS has found other ways to use videoconferencing to promote preparer compliance with due diligence requirements. For example, in fiscal year 2024 IRS hosted a live educational webinar for hundreds of paid preparers with potential compliance issues. It also offered some preparers that were given a warning phone call the option to have a follow-up videoconference with IRS staff. These actions meet the intent of the original recommendation and demonstrate how IRS can use videoconferencing to enhance preparer compliance, improve the accuracy of tax preparation services, and protect revenue.

|