Tax Filing: Preliminary Observations on IRS's Efforts to Address Persistent Challenges

Fast Facts

During the 2021 filing season, IRS struggled with an unprecedented workload. The agency began with a backlog of 8 million returns from the prior year. It reduced that backlog, but as of Dec. 2021, IRS still had about 10.5 million new 2021 returns to process. For the 2022 filing season, IRS will need to process millions of remaining 2021 returns alongside incoming returns, and may need to rely on overtime to do so.

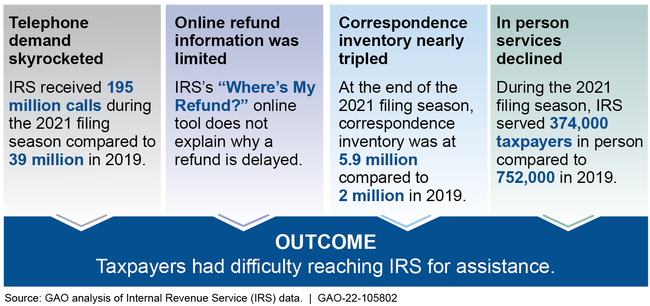

We also testified that during the 2021 filing season, taxpayers struggled to get help from IRS as:

- Telephone demand skyrocketed

- Online refund information was scant

- Correspondence nearly tripled

- In-person service declined

Highlights

What GAO Found

IRS experienced multiple challenges during the 2021 filing season as it struggled to respond to an unprecedented workload that included delivering COVID-19 relief. IRS began the filing season with a backlog of 8 million individual and business returns from the prior year that it processed alongside incoming returns. IRS reduced the backlog of prior year returns, but as of late December 2021, had about 10.5 million returns to process from 2021. For the current filing season, IRS will need to process the remaining returns from 2021 along with incoming returns from 2022 and may need to rely on overtime to do so. IRS also expects about 21 million returns to be stopped for errors associated with recent tax law changes.

Challenges with IRS Customer Service during the 2021 Filing Season

In 2021 IRS answered more phone calls than in recent years, but taxpayers had a difficult time reaching IRS due to high call volumes. IRS expects customer service representatives to answer about 35 percent of incoming calls during the 2022 filing season.

To help manage high call volumes, IRS urged taxpayers to access its “Where's My Refund” online tool to get refund status information. This tool provides limited information on refund status and delays. GAO's preliminary observations indicate IRS has no plans to modernize “Where's My Refund,” although this could help IRS better serve taxpayers, lower call volume, and reduce costs. In ongoing work, GAO plans to further review this issue.

IRS also struggled to respond to taxpayer correspondence. IRS's correspondence inventory grew to more than 8 million by the start of 2022. IRS expects this inventory to exceed 10 million by the end of fiscal year 2022—more than triple what it was as of the end of fiscal year 2020. This backlog will be difficult to manage as IRS balances prioritizing telephone calls from taxpayers with responding to incoming correspondence in 2022.

Finally, in-person service visits have significantly declined since 2015. IRS officials attributed the decline to the ongoing impacts of the pandemic and the option for taxpayers to use services via the phone and online.

Why GAO Did This Study

During the annual tax filing season, generally from January to mid-April, IRS processes more than 150 million individual and business tax returns and provides telephone, correspondence, online, and in-person services to tens of millions of taxpayers. To accommodate new tax legislation and provide additional relief to taxpayers, IRS extended the 2021 individual filing and payment deadline by 1 month to May 17, 2021.

GAO was asked to testify on IRS's performance during the 2021 filing season. This statement summarizes GAO's findings from prior reports and preliminary observations from ongoing work describing IRS's performance during the 2021 filing season on (1) processing individual and business income tax returns, and implications for the 2022 filing season; and (2) providing customer service to taxpayers.

GAO analyzed IRS documents and data on filing season performance, refund interest payments, hiring, and employee overtime; and interviewed cognizant officials. GAO also updated selected information from March 2021 (GAO-21-251), January 2020 (GAO-20-55), and March 2019 (GAO-19-176) reports.

For more information, contact Jessica Lucas-Judy at (202) 512-6806 or lucasjudyj@gao.gov.