Internal Revenue Service: Strategic Human Capital Management is Needed to Address Serious Risks to IRS's Mission

Fast Facts

Fewer individual and corporate tax returns have been audited in recent years, largely because IRS doesn't have the people it needs to enforce existing tax laws while implementing new laws. As a result, billions of dollars in taxes go unpaid every year. Enforcing tax laws, a High Risk area, is critical to promoting voluntary compliance and collecting unpaid taxes.

IRS's workforce is the key to addressing its challenges. Cultivating a well-equipped and engaged workforce requires strategic human capital management that will help IRS focus its current and future hiring needs.

We made 6 recommendations to improve IRS's human capital management.

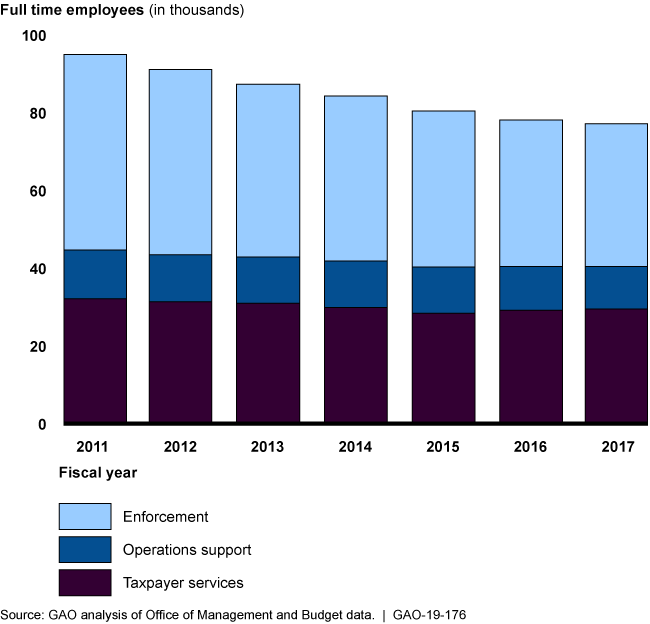

Hiring freezes, retirements, and low morale have shrunk IRS's workforce, largely in enforcement

Chart showing steadily declining staffing levels for enforcement and operations support staff fiscal years 2011 through 2017

Highlights

What GAO Found

The Internal Revenue Service (IRS) has scaled back strategic workforce planning activities in recent years. IRS officials told GAO that resource constraints and fewer staff with strategic workforce planning skills due to attrition required IRS to largely abandon strategic workforce planning activities.

However, a number of indicators, such as increasing rates of retirement eligible employees and declining employee satisfaction, led IRS to determine that continuing to make short-term, largely nonstrategic human capital decisions was unsustainable. One way IRS sought to address these issues was to develop a strategic workforce plan and associated workforce planning initiative. Initiative implementation, however, is behind schedule and on hold. IRS attributed the delay to a combination of: 1) personnel resources redirected to implement Public Law 115-97—commonly referred to as the Tax Cuts and Jobs Act, 2) lack of workforce planning skills within its Human Capital Office, and 3) delayed deployment at the Department of the Treasury (Treasury) related to a new workforce planning system. As a result, IRS lacks information about what mission critical skills it has on board, where skills gaps exist, and what skills will be needed in the future.

IRS staffing has declined each year since 2011, and declines have been uneven across different mission areas. GAO found the reductions have been most significant among those who performed enforcement activities, where staffing declined by around 27 percent (fiscal years 2011 through 2017). IRS attributed staffing declines primarily to a policy decision to strictly limit hiring. Agency officials told GAO that declining staffing was a key contributor in decisions to scale back activities in a number of program and operational areas, particularly in enforcement, where the number of individual returns audited from fiscal years 2011 through 2017 declined by nearly 40 percent.

IRS has skills gaps in mission critical occupations, and the agency's efforts to address these skills gaps do not target the occupations in greatest need, such as tax examiners and revenue officers. However, the results of an interagency working group effort that began in 2011, and was intended to address skill gaps among IRS revenue agents and other occupations with skills gaps across the government, may hold important lessons for addressing skills gaps in other mission critical occupations at IRS.

IRS's Human Capital Office has limited staffing capacity to hire employees in hard to fill positions, which holds risks for the agency's ability to implement the Tax Cuts and Jobs Act. IRS is undertaking a variety of activities to improve its hiring capacity, but has not determined how each activity will be evaluated and will contribute to increased hiring capacity or associated outcomes. In addition, changes in the agency's hiring processes have been confusing to managers and contributed to hiring delays. Clear guidance on hiring request requirements would better position IRS to avoid the risk of hiring delays for mission critical occupations.

Why GAO Did This Study

IRS faces a number of challenges that pose risks to meeting its mission if not managed effectively. Key to addressing IRS's challenges is its workforce. Cultivating a well-equipped, diverse, flexible, and engaged workforce requires strategic human capital management.

GAO was asked to review IRS's enterprise-wide strategic workforce planning efforts. GAO assessed (1) how IRS defines its workforce needs and develops strategies for shaping its workforce; (2) the extent to which IRS identified the critical skills and competencies it will require to meet its goals, and its strategy to address skills gaps in its workforce; and (3) the extent to which IRS's Human Capital Office has the capacity to hire employees in hard to fill positions.

GAO analyzed trends in staffing across IRS and in selected mission critical occupations; compared IRS strategic workforce management processes, practices, and activities with federal regulations and leading practices; analyzed IRS documents and interviewed agency officials.

Recommendations

GAO is making six recommendations to IRS that include implementing its delayed workforce planning initiative, evaluate actions to improve the agency's hiring capacity, and address changes in its processes that have contributed to hiring delays. IRS agreed with GAO's recommendations. GAO also recommends Treasury clarify guidance to IRS on a forthcoming workforce planning system. Treasury agreed with the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service |

Priority Rec.

The Commissioner of the IRS should fully implement the workforce planning initiative, including taking the following actions: (1) conducting enterprise strategy and planning, (2) conducting workforce analysis, (3) creating a workforce plan, (4) implementing the workforce plan, and (5) monitoring and evaluating the results. (Recommendation 1) |

IRS agreed with and has taken some steps to implement its workforce planning initiative. In December 2020, IRS reported it had established a workforce plan, including an enterprise strategy, and had initiated the associated workforce analysis. GAO's review of the workforce plan found that IRS was scheduled to implement the plan and have a process to monitor and evaluate the results of the effort in December 2021. However, IRS reported in December 2021 that it was providing additional time to facilitate concurrence with key stakeholder organizations across IRS, among other reasons. On June 15, 2024, IRS issued its FY2024-FY2026 Workforce Plan. The plan documents actions the agency will take to develop an inventory of its current workforce and related competency and staffing requirements, analyze its workforce to identify skills gaps, develop strategies to address them, and evaluate and adjust strategies as conditions change over time. As a result, IRS has taken an important step in coordinating previously fragmented efforts to address skills gaps at the agency.

|

| Department of the Treasury | The Secretary of the Treasury should issue clarifying guidance to IRS about the Integrated Talent Management system, including when the workforce planning and talent management modules will be deployed and available for IRS's use, the functions it will include, and how IRS's existing systems and processes within business divisions and program offices will be affected. (Recommendation 2) |

Treasury agreed with the recommendation. Treasury stated that it has taken actions to ensure that IRS and all Treasury bureaus have a clear understanding of when the ITM workforce planning module will be available and how it will be used. Treasury stated that they conducted a Workforce Planning offsite in May 2019 to (1) ensure a common understanding of the workforce planning process as it relates to ITM; 2) document the process in preparation of utilizing ITM; and 3) agree on how the agency will accomplish workforce planning in ITM. According to Treasury, goals 1 and 2 were achieved during the offsite and the workforce planning community continues to work on the third goal. Treasury expects to complete the discussion on how to accomplish workforce planning in ITM by the end of calendar year 2019. Treasury's Offices of the Chief Human Capital Officer and the Chief Information Officer are responsible for ensuring effective communication and training are completed as each ITM module is implemented. We continued to monitor Treasury's progress in implementing this recommendation. In October 2020, Treasury officials told us the agency has drafted the clarifying guidance to address this recommendation, and submitted it to its Chief Human Capital Officer for approval. According to the officials, the guidance includes a requirement to use the ITM Workforce Planning Module for strategic workforce planning forecasting, skills gap analysis, strategies, and risk assessments; and documents when the agency will provide a related desk guide and training on use of the module. We reviewed the ITM desk guide and training documents that Treasury had completed as of August 2021, and found they addressed the functions the system includes and how ITM affects IRS's workforce planning processes. As a result, Treasury has clarified guidance to IRS about the ITM system, and we closed this recommendation as implemented.

|

| Internal Revenue Service | The Commissioner of IRS should ensure the Human Capital Officer improves reporting for its workforce planning initiative in its bi-monthly HRstat information submissions to Treasury. The submissions should include the original implementation schedule, changes to the original schedule, delays in implementation and each of their causes, and IRS's strategy to address the causes of those delays. (Recommendation 3) |

IRS agreed with this recommendation and stated that they will include workforce planning in their bi-monthly HRstat information submissions to Treasury. IRS identified the Human Capital Officer as the responsible official for addressing this recommendation. In October 2020, we reviewed subsequent HRStat submissions to Treasury and found IRS included the status of the workforce planning initiative's implementation, including the original implementation schedule, changes to the original schedule, delays in implementation and their causes, and their strategy to address the causes of those delays. As a result, IRS and Treasury can take fuller advantage of a key opportunity to discuss and address workforce planning initiative delays at Human Capital Advisory Council meetings.

|

| Internal Revenue Service | The Commissioner of IRS should ensure the Human Capital Officer and Deputy Commissioner for Services and Enforcement report the results of efforts to close skills gaps among revenue agents, including lessons learned, that may help inform strategies for conducting skills gap assessment efforts for other mission critical occupations. (Recommendation 4) |

IRS agreed with this recommendation. In its recommendation status letter to us, IRS provided a timetable for implementation. By January 2021, IRS will initiate use of Integrated Talent Management's (ITM) capability to enable workforce planning and analytics and by December 2021, IRS will report the results of efforts to close skills gaps among revenue agents, including lessons learned on an annual basis over the next three fiscal years. In September 2023, IRS provided documentation and data showing that it had established strategies for conducting skills gaps assessments for nearly all mission critical occupations and had plans for mitigating skills gaps where found. Going forward, IRS will need to routinely conduct these skills gaps assessments as part of its larger effort to fully implement its workforce planning initiative.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of IRS should ensure the Human Capital Officer and Deputy Commissioner for Services and Enforcement collaborate to develop a work plan or other mechanism that prioritizes and schedules skills assessments for mission critical occupations at highest risk of skills gaps, such as those identified by Treasury or where key activities have been scaled back, for the purposes of developing a strategy to close the gaps. (Recommendation 5) |

IRS agreed with the recommendation. As of February 2020, IRS reported that it expects to fully implement this action by June 15, 2020. IRS reported that full implementation of related actions has been delayed due to limited resources. To date, the IRS Human Capital Officer has (1) identified mission critical occupations (MCOs), (2) collaborated with the Employment, Talent and Security (ETS) Division to develop an implementation schedule for the assessments, (3) obtained the Worklife Benefits and Performance Division and ETS Division Directors' approval of the implementation schedule, and (4) published and distributed the schedule. Going forward, the IRS Human Capital Office will coordinate with the Chief Financial Office and the Deputy Commissioner for Services and Enforcement in developing a work plan or other mechanism that prioritizes and schedules skills assessments for mission critical occupations. IRS will also validate its list of 22 positions established in coordination with Treasury. A work plan for addressing MCOs and skills gaps could help IRS identify and close skills gaps on a timely basis. Without such a plan, IRS risks continuing to scale back on mission-critical activities, adding to the existing fragmentation of its human capital planning efforts. In June 2020, IRS reported they established a repeatable, data-based methodology for validating and prioritizing the list of MCOs, including reduction of the list from 22 positions to 14 Occupational Series to align with current IRS human capital management functions. IRS briefed the results of the methodology to key IRS executives and stakeholder organizations for input/concurrence, and obtained IRS Human Capital Officer's approval on the priority MCO list. Based on that list, IRS developed a work plan and schedule for conducting priority skills assessments for 4 of 14 MCOs based on available resources. We reviewed the associated documents and believe IRS's actions address the recommendation. Going forward, it will be important that IRS apply the lessons learned from the four pilot skills assessments to the remaining ten they need to conduct.

|

| Internal Revenue Service | The Commissioner of IRS should direct the Human Capital Officer to measure the extent to which each of its activities for improving hiring capacity are effective in producing desired hiring capacity outcomes, including strategies used to mitigate hiring risks associated with Tax Cuts and Jobs Act implementation hiring. (Recommendation 6) |

According to IRS, its Human Capital Office agrees with the recommendation and evaluated the effectiveness of its hiring activities and strategies (e.g., contracts, Administrative Resource Center (ARC) services, Federal Executive Board, and Business-based HR teams) on its enterprise hiring capacity. IRS found that a number of its activities and strategies were not effective in helping the agency meet its hiring needs. In response, IRS developed a "Get-Well" strategy to address current and future IRS hiring requirements. The strategy was effective April 1, 2019. Aspects of this strategy included establishing deadlines for HCO to post all vacancies and issue certificates of eligible candidates to the selecting officials and providing weekly reports to notify Business Units of completed announcements and certificates. This proactive communication approach was designed to provide the HCO staff the opportunity for uninterrupted focus on production of hiring actions. According to IRS, the "Get-Well" strategy is the first step of many that HCO will implement to ensure the agency sustains a responsive program for the IRS's hiring needs. As IRS has measured the extent to which its hiring activities met its needs, identified problem areas, and has taken corrective action, we are closing this recommendation as implemented. Going forward, it will be important for IRS to identify and address problems with its hiring capacity that may emerge as the agency works to close skills gaps in mission critical occupations.

|

| Internal Revenue Service | The Commissioner of IRS should direct the Human Capital Officer and Chief Financial Officer to issue clarifying guidance on the current Exception Hiring Process, including clarifying areas where hiring limitations that were used in previous years are no longer applicable. (Recommendation 7) |

The Chief Financial Officer and the IRS Human Capital Officer agree with this recommendation. According to IRS, on March 8, 2019, they issued new guidance to the business units' Senior Executive Team streamlining the hiring approval process and discontinuing the FY 2011 Exception Hiring Process guidance. On July 10, 2019, the Chief Financial Officer, in partnership with IRS Human Capital Officer, issued Frequently Asked Questions to the business units to further clarify hiring and staffing levels and posted documents on our Corporate Budget website. With the discontinuation of the exception hiring process and the issuance of guidance on the new hiring process, we have closed this recommendation as implemented.

|