Restaurant Revitalization Fund: Opportunities Exist to Improve Oversight

Fast Facts

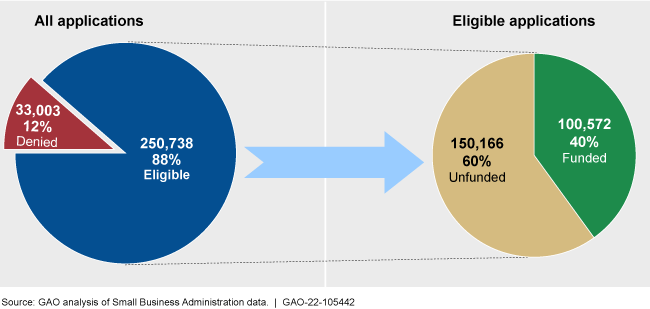

In March 2021, Congress appropriated $28.6 billion to the Small Business Administration to help the food service industry weather the COVID-19 pandemic. About 40% of eligible applicants received awards from the resulting Restaurant Revitalization Fund before it was depleted.

SBA took steps to detect fraudulent or ineligible applications. For instance, it prevented over 30,000 suspicious applications from receiving awards. But it flagged 4,000 award recipients for suspected fraud and isn't taking timely action to address them. We recommended that SBA do so.

Number of Restaurant Revitalization Fund Applications by Eligibility and Funding Status

Highlights

What GAO Found

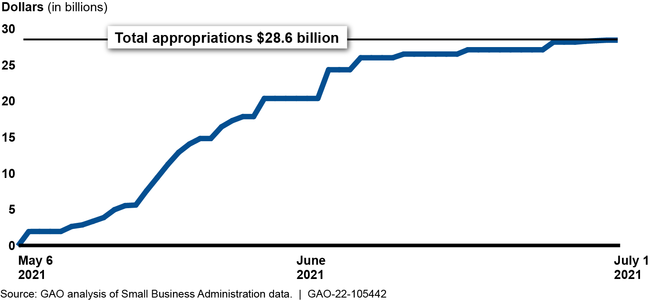

The Restaurant Revitalization Fund was established in March 2021 to support eligible entities suffering revenue losses from the COVID-19 pandemic. The Small Business Administration (SBA) began accepting applications and awarding funds in May 2021. SBA stopped accepting applications in July 2021 with the program oversubscribed and almost all its funds disbursed.

Restaurant Revitalization Fund Award Disbursements, May 3–July 1, 2021

Just over 100,000 businesses received funding (40 percent of eligible applicants). The median award was about $126,000. Most recipients (72 percent) reported they were owned by women, veterans, or members of socially and economically disadvantaged groups. About 43 percent had 2019 revenue of $500,000 or less.

SBA emphasized pre-award controls to detect fraudulent or ineligible applications but has not assessed their effectiveness. While SBA prevented over 30,000 suspicious applications from receiving awards, GAO identified systemic control weaknesses. For example, SBA considered applications made through external vendors to be low-risk, but over 4,000 recipients who applied through such a channel have been flagged for suspected fraud or ineligibility, including an alleged fraudster who received $8 million. Assessing controls and addressing deficiencies would help SBA better ensure program integrity.

SBA requires recipients to report annually on fund use, but has taken limited steps to enforce reporting requirements and identify fraudulent or ineligible awards. The first reports were due in December 2021, but 32 percent were overdue as of June 2022. And SBA has not proactively used data analytics or information from enforcement entities to identify potentially fraudulent award recipients. SBA does not immediately investigate all potentially fraudulent awards, and instead waits for recipients to submit final reports (which might not be until April 30, 2023). Taking additional steps to identify and address potentially fraudulent awards in a timely manner could help SBA recover funds.

Why GAO Did This Study

In 2020 and 2021, restaurants, bars, and other food service businesses experienced substantial revenue loss and unemployment resulting from the COVID-19 pandemic. In March 2021, Congress appropriated $28.6 billion to SBA for a Restaurant Revitalization Fund to assist the industry.

The CARES Act includes a provision for GAO to monitor federal efforts to respond to the COVID-19 pandemic. Among its objectives, this report examines recipient characteristics, SBA's internal controls and fraud risk management practices, and SBA's efforts to monitor recipients.

GAO reviewed SBA documentation, analyzed SBA data on the program's applicants and recipients, and interviewed SBA officials and representatives of industry associations.

Recommendations

GAO makes seven recommendations to SBA, including to assess pre-award controls and address deficiencies, strengthen post-award reporting, take additional steps to identify fraudulent or ineligible awards, and develop and implement a plan to address potentially fraudulent award recipients in a timely manner. SBA agreed or partially agreed with two recommendations. SBA disagreed with five recommendations, including to assess pre-award controls and implement a plan to address fraudulent or ineligible awards. GAO maintains that all of the recommendations are valid, as discussed in this report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Small Business Administration | The Associate Administrator for the Office of Capital Access should conduct and document an assessment of the RRF pre-award controls and address or mitigate deficiencies. (Recommendation 1) |

In March 2025, SBA provided GAO with a report summarizing assessments of the RRF pre-award controls that the agency conducted in 2022-2024. The report also included recommendations on how to mitigate these weaknesses in future programs. However, the report only reviewed systemic control weaknesses and did not assess weaknesses in the individual controls (those applying to specific types of applicants). This recommendation will remain open until SBA provides documentation that it has also assessed weaknesses in individual pre-award controls.

|

| Small Business Administration | The Associate Administrator for the Office of Capital Access should assess how the design of RRF pre-award controls may have adversely affected applicants from U.S. territories, and identify and document steps to mitigate this issue for future programs. (Recommendation 2) |

In January 2023, SBA stated that it would offer to participate in a government-wide dialogue to address systemic weaknesses related to IRS and territories' tax validation systems. In April 2024, SBA officials said they maintained this position and opposed using taxpayer funds to conduct such an assessment because the challenges with IRS and territory tax transcript processing are government-wide in nature and well-documented. In March 2025, SBA stated that it was planning to submit information to GAO that would demonstrate that it has addressed the recommendation. This recommendation will remain open until SBA (1) assesses how the design of RRF pre-award controls may have adversely affected applicants from U.S. territories, and (2) documents steps to mitigate this issue for future programs.

|

| Small Business Administration | The Associate Administrator for the Office of Capital Access should develop and implement policies and procedures for addressing RRF recipients who do not meet annual reporting requirements. (Recommendation 3) |

In July 2023, SBA sent a final letter to recipients urging them to submit their annual reports. In September 2023, SBA provided documentation of steps taken to communicate with recipients who had not met reporting requirements, as well as documentation of procedures for recovering funds for recipients who do not comply with the reporting requirement. In March 2024, SBA officials said about 10 percent of recipients had not submitted a post-award report (which had been due by April 30, 2023). SBA officials said that they are planning to send letters to the overdue recipients requesting they return their awards. In April 2024, SBA officials said that the letters would be dispersed after they complete a system update that would allow recipients to remit their awards. According to SBA's post-award recovery procedures, SBA will refer recipients that fail to submit post-award reports to the Office of General Counsel who will determine if it should be referred to the Department of Justice. In March 2025, SBA said that about nine percent of recipients still had not completed a post-award report. Officials said they were considering requesting noncompliant recipients return their awards but were awaiting guidance from the new administration. This recommendation will remain open until SBA provides evidence of implementing the recovery procedures.

|

| Small Business Administration | The Associate Administrator for the Office of Capital Access should enhance RRF post-award reporting procedures by adding requirements for recipients to report their operating status. (Recommendation 4) |

We are closing this recommendation as no longer valid because, as of March 2025, SBA had not updated its post-award reporting procedures to collect information on operating status and over 90 percent of RRF recipients had submitted their post-award reports. While SBA initially agreed with this recommendation and stated it was exploring ways to add operating status to the post-award report, the agency did not update reporting requirements by the time final reports were due in April 2023. In March 2025, officials said they were reviewing operating status as part of the manual post-award reviews for a subset of recipients. However, officials said that it would not be cost effective for SBA to go back and collect operating status information at this time, particularly in light of the agency's limited resources. We agree that this recommendation is no longer valid because the RRF program operations and recipient reporting are mostly complete, with only post-award reviews remaining. We plan to continue monitoring SBA's findings on operating status from its RRF post-award reviews and lessons learned for future programs as part of our follow up for the remaining recommendations.

|

| Small Business Administration |

Priority Rec.

The Associate Administrator for the Office of Capital Access should develop and implement data analytics across RRF awards as a means to detect potentially fraudulent award recipients. (Recommendation 5) |

In response to our recommendation, SBA's Office of Financial Program Operations worked with the Office of the Chief Data Officer to conduct data analytics for the RRF program. Specifically, SBA cross-checked RRF recipient identifiers (such as address, tax identification numbers, and phone numbers) against recipients that had been flagged for fraud or identity theft in RRF and other SBA pandemic programs (Paycheck Protection Program and Economic Injury Disaster Loans). In June 2023, SBA provided GAO with the results of this analysis, which found almost 8,000 RRF awards were related to other awards flagged for identity theft or fraud. SBA said it will manually review the awards identified through the data analytics.

|

| Small Business Administration |

Priority Rec.

The Associate Administrator for the Office of Capital Access should develop, document, and implement procedures to use enforcement data on suspected fraud in other SBA programs, such as PPP, to identify potential fraud in RRF recipients. (Recommendation 6) |

In response to our recommendation, in April 2024, SBA provided us with documentation that it uses enforcement data from a variety of sources--including the Department of Justice and Office of Inspector General--to identify and flag potentially fraudulent RRF awards. SBA officials said that its Fraud Team regularly receives reports on potential fraud from a variety of sources, including the Office of Inspector General and DOJ. The Team uses the information to flag matching RRF awards in its system so that the awards are added to the post-award review sample. In addition, SBA runs cross-program analysis to identify all RRF awards with associated PPP loans that have been flagged because of enforcement activity. These cross-program analytics are run monthly, with identified RRF awards added to the post-award review sample.

|

| Small Business Administration |

Priority Rec.

The Associate Administrator for the Office of Capital Access should develop and implement a plan to respond to potentially fraudulent and ineligible RRF awards in a prompt and consistent manner. This plan should include coordinating with the OIG to align efforts to address fraud. (Recommendation 7) |

A July 2023 SBA Office of Inspector General (OIG) report similarly found that SBA had not prioritized reviewing awards flagged for fraud, specifically noting that some awards flagged in May 2021 had not yet been reviewed over two years later. The OIG recommended that SBA prioritize reviewing these flagged awards and SBA agreed with the recommendation. In September 2023, SBA officials also told us they would prioritize reviewing awards flagged for potential fraud and provide us with documentation of their actions in response to the OIG's recommendation. As of April 2024, SBA officials said that they had prioritized reviewing flagged RRF awards and that they had conducted initial reviews of all flagged awards for which recipients had submitted post-award reports. In addition, SBA provided us with its post-award review and recovery plans. However, these plans do not include procedures prioritizing the review of potentially fraudulent awards or procedures for referring suspicious activity to its OIG with information that will be useful to the OIG. Furthermore, SBA officials said they had not closed the OIG's related recommendation and were targeting a July 2024 date. In March 2025, SBA described analysis that they conduct on a monthly basis to identify and prioritize potentially fraudulent awards. This recommendation will remain open until SBA provides us with documentation of its procedures for prioritizing flagged awards and evidence of implementing these procedures.

|