Fair Lending: CFPB Needs to Assess the Impact of Recent Changes to Its Fair Lending Activities

Fast Facts

The Consumer Financial Protection Bureau oversees and enforces federal fair lending laws that protect consumers from discrimination. In 2019, it completed a reorganization of its fair lending activities.

In the reorganization, CFPB didn't follow leading practices for organizational change. For example, it didn't plan its workforce changes strategically—contributing to a loss of fair lending expertise at CFPB.

Also, CFPB stopped reporting on fair lending performance goals and measures in 2019. This change could reduce transparency and make it harder to assess progress toward those goals.

We recommended assessing the impact of these changes.

Highlights

What GAO Found

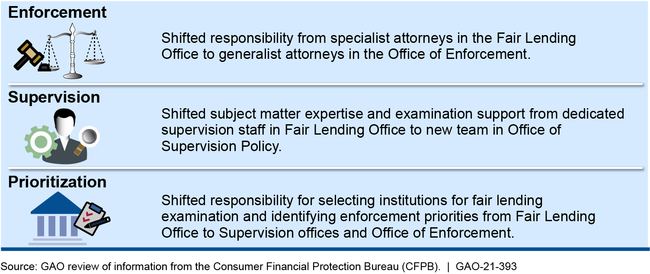

In January 2018, the Consumer Financial Protection Bureau (CFPB) announced a reorganization of its fair lending activities that moved its Office of Fair Lending and Equal Opportunity (Fair Lending Office) from the Supervision, Enforcement, and Fair Lending Division to the Office of the Director and reallocated certain of its responsibilities (see figure).

As CFPB planned and implemented the reorganization, it did not substantially incorporate key practices for agency reform efforts GAO identified in prior work—such as using employee input for planning or monitoring implementation progress and outcomes.

GAO identified challenges related to the reorganization (including loss of fair lending expertise and specialized data analysts) that may have contributed to a decline in enforcement activity in 2018. However, CFPB has not assessed how well the reorganization met its goals or how it affected fair lending supervision and enforcement efforts.

Collecting and analyzing information on reorganization outcomes would help CFPB determine the impact of the changes and identify actions needed to address any related challenges or unintended consequences.

Key Changes in Fair Lending Responsibilities under CFPB's 2018 Reorganization

As of February 2019, CFPB stopped reporting on performance goals and measures specific to fair lending supervision and enforcement—such as the number of completed examinations and the percentage of enforcement cases successfully resolved. Without these goals and measures, CFPB is limited in its ability to assess and communicate progress on its fair lending supervision and enforcement efforts, key components of CFPB's mission.

CFPB has used additional Home Mortgage Disclosure Act data that some lenders have had to report since 2018 to support supervisory and enforcement activities and fair lending analyses. CFPB incorporated these new loan-level data into efforts to identify and prioritize fair lending risks and support fair lending examinations. For example, the new data points improve CFPB's ability to compare how different institutions price loans, which helps its staff identify potentially discriminatory lending practices.

Why GAO Did This Study

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, CFPB is responsible for two federal fair lending laws that protect consumers from discrimination: the Equal Credit Opportunity Act and the Home Mortgage Disclosure Act. In January 2019, CFPB completed a reorganization of its fair lending activities.

GAO was asked to review issues related to CFPB's oversight and enforcement of fair lending laws. This report examines how CFPB has (1) managed the reorganization of its fair lending activities, (2) monitored and reported on its fair lending performance, and (3) used Home Mortgage Disclosure Act data to support its fair lending activities.

GAO reviewed CFPB documents related to its fair lending activities (such as strategic and performance reports, policies and procedures) and to the reorganization of its Fair Lending Office. GAO evaluated implementation of this reorganization against relevant key practices identified in GAO-18-427. GAO also interviewed CFPB staff.

Recommendations

GAO recommends that CFPB (1) collect and analyze information on the outcomes of its fair lending reorganization and (2) develop and implement performance goals and measures specific to its fair lending supervision and enforcement. CFPB agreed with both recommendations and said it was committed to implementing them.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Consumer Financial Protection Bureau | The Director of CFPB should collect and analyze information on the outcomes of its 2018–2019 fair lending reorganization and use that assessment to address any challenges or unintended consequences resulting from the change. (Recommendation 1) |

CFPB agreed with this recommendation and has stated its commitment to assessing the effects of the 2019 reorganization. In December 2021, CFPB said it was assessing the impacts of the reorganization and would address challenges or unintended consequences that resulted from that change. In June 2023, a CPFB official said that CFPB was continuing work on this assessment. This recommendation remains open pending further progress from CFPB toward completing this assessment.

|

| Consumer Financial Protection Bureau | The Director of CFPB should develop and implement performance goals and measures specific to its efforts to supervise and enforce fair lending laws. (Recommendation 2) |

In its April 2021 letter responding to the draft report, CFPB agreed with this recommendation and stated its commitment to implementing it. CFPB's Annual Performance Plan (APP) for fiscal year 2022, issued in February 2022, noted that going forward CFPB planned to report on a measure related to the number of fair lending supervision events opened during the year and a measure related to the percentage of fair lending enforcement cases that were successfully resolved. In February 2023, CFPB's FY23 APP reported actual numbers for these measures for fiscal year 2022 and set targets for these measures for fiscal years 2023 and 2024. Tracking and reporting on these measures will improve CFPB's ability to assess and communicate its progress on its fair lending supervision and enforcement efforts.

|