Federal Home Loan Banks: Efforts to Promote Workforce, Supplier, and Broker-Dealer Diversity

Fast Facts

We previously reported on diversity in board directors at Federal Home Loan Banks. Now we’re looking at their efforts to diversify their workforces and companies they do business with—such as targeted recruiting in colleges and professional organizations to build a pipeline of diverse employees.

In 2011–2017:

the share of women in senior management at these banks increased; minority representation was about the same

the share of women and minorities in the workforce overall was about the same and was higher than in senior management

In 2018, banks varied in their purchases of goods and services from minority- and women-owned companies.

Two hands in a handshake

Highlights

What GAO Found

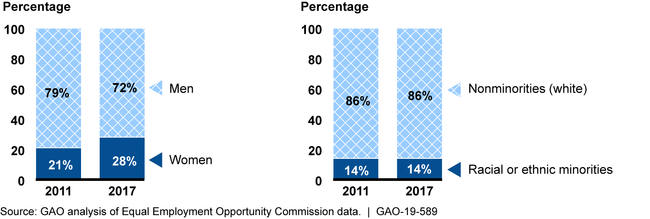

From 2011 to 2017, the share of women in senior management in Federal Home Loan Banks (FHLBank) increased from about 21 percent (35 individuals) to 28 percent (47 individuals). The share of minority senior management remained the same at about 14 percent (23 individuals). The overall share of women employees slightly decreased and minority employees slightly increased during this period, but gender and minority representation varied by individual bank. FHLBanks identified challenges to maintaining and increasing workforce diversity, such as limited hiring opportunities due to low turnover. FHLBanks have been taking steps to promote workforce diversity, such as outreach to organizations that represent women or minorities and incorporation of diversity and inclusion in incentive compensation goals or performance competencies.

Share of Women and Minorities in Senior Management in Federal Home Loan Banks, 2011 and 2017

Note: Federal Home Loan Bank staff said that banks classified senior management differently, and some cut or added positions between 2011 and 2017, which affected overall percentages.

In 2018, use of minority- and women-owned suppliers (for goods and services) and broker-dealers varied among individual FHLBanks. Overall, minority- and women-owned suppliers accounted for 8 percent and 13 percent of procurement expenditures, respectively. Minority- and women-owned broker-dealers accounted for about 3 percent and less than 1 percent of the debt issuance amount, respectively. FHLBanks and the Office of Finance (which issues debts on behalf of the banks) have been taking steps to increase diversity in these business activities, such as conducting outreach to diverse entities. However, external stakeholders said such suppliers and broker-dealers may continue to face some barriers—for example, capital requirements that limit participation by diverse broker-dealers, which generally have fewer resources.

In 2017, the Federal Housing Finance Agency (FHFA) started reviewing the diversity and inclusion efforts of FHLBanks in its annual bank examinations. In the 2017 and 2018 examinations, FHFA found the banks generally took steps to promote diversity and inclusion but also identified areas for improvement, such as improving goals for workforce and supplier diversity. In 2018, FHFA issued a manual and templates for reporting of quarterly and annual diversity data to help ensure consistent reporting of the data. FHFA also began using the quarterly data for ongoing monitoring of the banks' diversity and inclusion efforts.

Why GAO Did This Study

The FHLBank System consists of 11 regionally based banks that are cooperatively owned by member institutions (such as community banks and credit unions) and of the Office of Finance. The banks, which are regulated by FHFA, provide liquidity for their member institutions to use in support of housing finance and community lending.

GAO was asked to review FHLBanks' implementation of diversity and inclusion matters in workforce and business activities (including the use of suppliers and broker-dealers). This report examines (1) trends in gender, race, and ethnicity in FHLBank workforces, and challenges faced and practices used to maintain and increase a diverse workforce; (2) use of minority- and women-owned suppliers and broker-dealers in 2018, and challenges faced and practices used to increase and maintain their use; and (3) FHFA oversight of FHLBank diversity and inclusion efforts.

GAO analyzed FHLBank and Equal Employment Opportunity Commission data on the banks' workforce, suppliers, and broker-dealers. GAO also reviewed FHFA and FHLBank policies and regulations and previous GAO work on these issues. GAO interviewed FHFA and FHLBank staff and a nongeneralizable sample of external stakeholders knowledgeable about supplier and broker-dealer diversity.

For more information, contact Anna Maria Ortiz at (202) 512-8678 or ortiza@gao.gov.