Federal Home Loan Banks: Steps Have Been Taken to Promote Board Diversity, but Challenges Remain

Fast Facts

The Federal Home Loan Bank System comprises 11 government-sponsored banking cooperatives. Local financial institutions can join the Banks to borrow money so they can provide home loans and community credit.

In 2015, the Banks started reporting on diversity in their boards of directors. Since then, the overall share of female and minority directors increased.

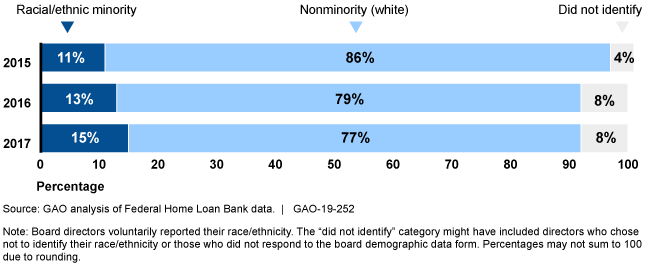

Individual directors voluntarily report their demographics. In 2017, 8% of directors didn't report their race or ethnicity, and it's unclear if they opted out or just forgot.

To better track diversity trends, the Banks should find ways to help collect more complete demographic data.

Share and Number of Minority and Nonminority Directors on Federal Home Loan Bank Boards, 2015-2017

Bar graph showing a growing percent of minorities on boards, but also 4-8% of directors either opting out or forgetting to report.

Highlights

What GAO Found

The Federal Housing Finance Agency (FHFA) has taken formal and informal steps to encourage board diversity at Federal Home Loan Banks (FHLBank) since 2015. For example, FHFA required FHLBanks to add board demographic data to their annual reports; clarified how banks can conduct outreach to diverse board candidates; and allowed some banks to add an independent director.

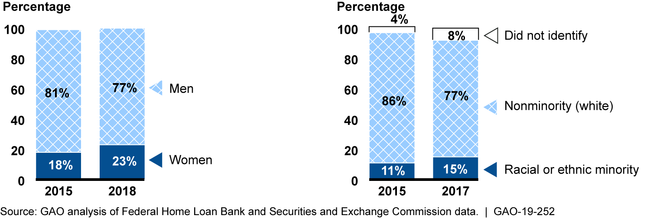

Since 2015, the share of women and minority directors on the boards of FHLBanks increased (see figure). The number of women directors increased from 34 in 2015 to 44 in October 2018, and the number of minority directors increased from 20 in 2015 to 30 in 2017, based on most recently available data. Trends for minority directors were less clear, because the banks' varying data collections processes did not always allow them to determine the extent to which directors opted out or forgot to answer data collection forms. FHFA stated that it planned to use board data to establish a baseline to analyze diversity trends. A review of the banks' data collection processes would help identify whether practices exist that could help improve the completeness of the data.

Share of Women and Minorities on Federal Home Loan Bank Boards, in Calendar Years 2015 and 2017, and as of October 2018

Note: Board directors voluntarily reported their race or ethnicity. The “did not identify” category might have included directors who opted out or forgot to provide the information. GAO completed gender information using other available data from 2018. Percentages may not sum to 100 due to rounding.

FHLBanks reported they continued to face some challenges to their efforts to promote board diversity, especially among member director seats. The challenges include (1) balancing the addition of new women or minority directors with retaining the institutional knowledge of existing directors; and (2) competing with other organizations for qualified female and minority board candidates. Despite reported challenges, FHLBanks have taken measures to promote board diversity, such as establishing a task force to promote board diversity through information sharing and training. Individually, the FHLBanks emphasized the importance of diversity in election materials, built pools of diverse candidates, and conducted outreach to industry and trade groups. They also took actions to increase diversity specifically among member directors, including filling interim board seats with women and minority candidates and encouraging directors to personally reach out to potential women and minority candidates.

Why GAO Did This Study

The FHLBank System consists of 11 regionally based banks cooperatively owned by member institutions. In 2018, each FHLBank had a board of 14–24 directors. Member directors are nominated from member institutions and independent directors from outside the system. Member institutions vote on all directors. At least two independent directors on a board must represent consumer or community interests. FHFA is the regulator of the FHLBanks.

GAO was asked to review FHLBanks' implementation of board diversity and inclusion matters. This report examines (1) steps FHFA took to encourage board diversity at FHLBanks; (2) trends in gender, race, and ethnicity on FHLBank boards; and (3) challenges FHLBanks face and practices they use to recruit and maintain diverse boards. GAO analyzed FHLBank data on board demographics, reviewed policies and regulations, and reviewed previous GAO work on diversity at FHLBanks and the financial services industry. GAO interviewed FHFA and FHLBank staff and a nongeneralizable sample of FHLBank board directors and external stakeholders knowledgeable about board diversity.

Recommendations

GAO recommends that FHFA, in consultation with FHLBanks, review data collection processes for board demographic information and communicate effective practices to banks. FHFA agreed with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Federal Housing Finance Agency | The Director of FHFA's Office of Minority and Women Inclusion, in consultation with FHLBanks, should conduct a review on each bank's processes for collecting gender and race/ethnicity data from boards of directors and communicate effective practices to FHLBanks. (Recommendation 1) |

To address our recommendation, FHFA's Office of Minority and Women Inclusion conducted a review of each FHLBank's practices for collecting gender and race/ethnicity data from boards of directors. Specifically, FHFA collected and reviewed responses from FHLBanks on the banks' data collection methods, policies, and procedures, including how banks handle and report information for board directors who do not self-identify their demographic information. As of April 2020, FHFA staff said that they have communicated the findings of this review to FHLBanks and planned to follow up with the banks. In addition, a new FHLBank board diversity charter states that the Chair/Vice Chair Sub-Committee on Board Diversity will identify and evaluate best practices for advancing board diversity and inclusion throughout the Federal Home Loan Bank System and leverage their leadership on the boards of directors of the FHLBanks to influence implementation of those practices, including regulatory guidance, which includes reporting data to FHFA on board diversity.

|