Large Bank Supervision: OCC Could Better Address Risk of Regulatory Capture

Fast Facts

“Regulatory capture” is when regulators act in the interest of the industry they’re regulating, rather than in service of the public good. This can be a significant problem in banking regulation, where regulators may be swayed by future job offerings and more.

We looked at ways to reduce the risk of regulatory capture at the Office of the Comptroller of the Currency—which supervises the nation's largest banks—and found weaknesses. For example, when OCC selects a team to examine a bank, it does not have a policy to check data that could indicate conflicts of interest.

We made 9 recommendations to improve OCC's approach to regulatory capture.

Seal of the Office of the Comptroller of the Currency

Highlights

What GAO Found

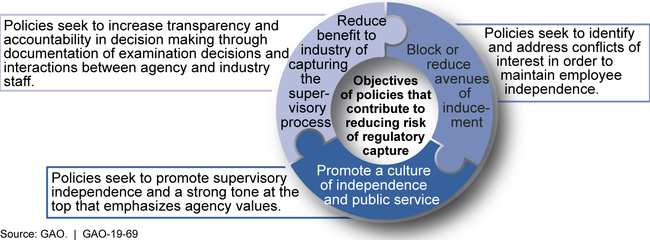

Banking regulators such as the Office of the Comptroller of the Currency (OCC) can implement policies to address the risk of regulatory capture. The objectives of these policies include reducing the benefit to industry of capturing the supervisory process, reducing avenues of inducement offered by regulated banks, and promoting a culture that values independence (see figure).

Framework for Reducing Risk and Minimizing Consequences of Regulatory Capture

OCC has some policies that encourage transparency and accountability in its large bank supervision processes; however, weaknesses in documentation requirements may make large bank supervision more vulnerable to regulatory capture. For example, examination teams are not required to document internal deliberations or communications with banks that lead to consequential decisions for a bank, such as supervisory or enforcement actions. Further, examination teams are required to delete drafts of key documents that memorialize reviews that are part of the supervisory process. Maintaining a complete and transparent record of decision making and important communication with banks could improve OCC's ability to mitigate capture-based decisions.

OCC also has some policies to mitigate conflicts of interest, but implementation is hindered by issues related to collection and use of data and lack of program assessments. For example, when staffing a bank examination team, OCC does not have a policy to verify that employees do not have active conflicts of interest by checking employee data. OCC also does not periodically assess the implementation of its ethics program, including policies and procedures intended to help the agency meet ethics laws and regulations. Improving data collection and assessing policies, controls, and guidance that identify and address conflicts of interest could help OCC ensure that its ethics program is operating effectively.

OCC leadership has taken some steps to demonstrate support for supervisory independence, but its approach to mitigating regulatory capture is narrow. For example, OCC only considers two factors when assessing the risk of capture: the tone of its media coverage and the extent to which examination staff rotate among banks. OCC does not analyze other relevant factors, such as employee movement to and from industry or its supervision practices, which can impact this risk. Without expanding its approach to addressing the risk of regulatory capture, OCC may be missing opportunities to identify other ways in which this enterprise-wide risk may affect the agency.

Why GAO Did This Study

OCC supervises over 1,300 financial institutions, with assets under supervision totaling $12 trillion. Weakness in supervision by federal regulators was among many factors that contributed to the 2007–2009 financial crisis, and some analyses have identified regulatory capture as one potential cause. Regulatory capture refers to a regulator acting in the interest of the regulated industry rather than in the public interest.

GAO was asked to review regulatory capture in financial regulation. This report examines the extent to which OCC (1) has policies that encourage transparency and accountability in the large bank supervision process, (2) has policies that address employees' conflicts of interest that could threaten their independence, and (3) promotes an agency-wide focus on supervisory independence and mitigating the risk of capture. GAO reviewed OCC policies, analyzed examination workpapers, and interviewed supervisory staff. GAO also analyzed conflict-of-interest data, as well as OCC's enterprise risk management framework.

Recommendations

GAO is making nine recommendations to OCC related to managing the risk of regulatory capture, including improving the documentation of its supervision process, checking for conflicts of interest, periodically assessing the ethics program, and expanding its approach to addressing the risk of capture across the agency, among others. OCC agreed with one recommendation, disagreed with five, and neither agreed nor disagreed with three. GAO maintains that the recommendations are valid.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of the Comptroller of the Currency | The Senior Deputy Comptroller for Large Bank Supervision should revise Large Bank Supervisions policy to require documentation of examination teams internal deliberations that lead to consequential decisions for the bank, such as the decision whether to issue a Matter Requiring Attention, among others. (Recommendation 1) |

In October 2022, officials from the Office of the Comptroller of the Currency notified us and provided evidence that Large Bank Supervision (LBS) updated the template examiners use to document examination conclusions. The template now requires examiners to document why a proposed Matter Requiring Attention or potential violation found during the examination did not make it into the final supervisory letter sent to the bank, which could include information from internal deliberations or other documents. In addition, in June 2023, OCC cited that its FY 2023 Quality Assurance plan includes several internal reviews that evaluate LBS adherence to documentation and communication requirements. By requiring documentation of these justifications and establishing a review process to ensure adherence to this requirement, this response will allow for consistent document internal deliberations that lead to significant decisions for the bank and improve transparency in its decision-making process, decreasing the risk of regulatory capture.

|

| Office of the Comptroller of the Currency | The Senior Deputy Comptroller for Large Bank Supervision should revise Large Bank Supervisions policy to require that bank examination teams retain drafts of key documents, including the conclusion memorandum and supervisory letter, that record the supervisory review process. (Recommendation 2) |

In October 2022, officials from the Office of the Comptroller of the Currency (OCC) notified us and provided evidence that Large Bank Supervision (LBS) updated its minimum documentation standards to provide greater detail on documentation expectations for each examination team member and for specific types of supervisory actions. LBS also updated the template examiners use to document examination conclusions. The template now requires examiners to document why a proposed Matter Requiring Attention or potential violation found during the examination did not make it into the final supervisory letter sent to the bank, which could include information about prior decisions made by examiners and management. Additionally, in June 2023, OCC cited that its FY 2023 Quality Assurance plan includes several internal reviews that evaluate LBS adherence to documentation and communication requirements. By updating minimum documentation standards, requiring documentation of why violations were not reported, and establishing a review process to ensure adherence to these requirements, OCC will be better positioned to review prior decisions and improve transparency in its decision-making process, decreasing the risk of regulatory capture.

|

| Office of the Comptroller of the Currency | The Senior Deputy Comptroller for Large Bank Supervision should revise Large Bank Supervisions policy to require documentation of communications with banks, including those between executive and senior management and banks, that inform supervisory decisions. (Recommendation 3) |

In October 2022, officials from the Office of the Comptroller of the Currency (OCC) notified us and provided evidence that Large Bank Supervision (LBS) updated its minimum documentation standards to provide greater detail on documentation expectations for each examination team member and for specific types of supervisory actions. LBS also updated the template examiners use to document examination conclusions. The template now requires examiners to document why a proposed Matter Requiring Attention or potential violation found during the examination did not make it into the final supervisory letter sent to the bank, which could include information from communications between banks and examination teams or management that influenced such a decision. Additionally, in June 2023, OCC cited that its FY 2023 Quality Assurance plan includes several internal reviews that evaluate LBS adherence to documentation and communication requirements. By updating minimum documentation standards, requiring documentation of why violations were not reported, and establishing a review process to ensure adherence to these requirements, OCC will be better positioned to review prior decisions and improve transparency in its decision-making process, decreasing the risk of regulatory capture.

|

| Office of the Comptroller of the Currency | The Senior Deputy Comptroller for Large Bank Supervision should systematically track and monitor Large Bank Supervisions use of informal recommendations. (Recommendation 4) |

In October 2022, the Office of the Comptroller of the Currency (OCC) continued to disagree with our recommendation and stated that internal guidance is clear that informal recommendations do not require any action by bank management or follow-up by examiners. They also noted that internal quality assurance activities have determined that examination teams that provided recommendations to banks clearly communicated them as enhancements to acceptable practices per guidance and did not identify misused recommendations by teams. However, we maintain that tracking and monitoring the use of informal recommendations could increase transparency of the supervisory process, which could help Large Bank Supervision mitigate the risk of regulatory capture.

|

| Office of the Comptroller of the Currency | The Chief Counsel should require that staff who review and record employees conflict-of-interest information (1) consistently record explanations of changes to scopes of recusals and (2) record waivers of Treasurys supplemental standards separately from recusals. (Recommendation 5) |

In response to GAO's recommendation, in August 2020, OCC clarified and defined options for identifying recusals, and stated that staff now recorded waivers separately from recusals. According to OCC, it has designed an electronic ethics management system that, among other things, separately documents waivers and recusals, and allows for supervisors to check on the status of employees' financial disclosure filings and ethics recusals. This electronic system facilitates the consistent recording of information and requires the user to access a drop down menu with options to label an issue (e.g., bank securities) when adding a recusal during a review of a financial disclosure report, and another drop down menu to label the topic of an ethics inquiry (e.g., a type of waiver). In closing out an ethics inquiry, an ethics official may add a recusal, where the same drop down menu for the recusal issue that appears on the financial disclosure form appears when adding a recusal as part of closing out an ethics inquiry. This response will allow OCC to determine whether ethics officials are granting recusals in accordance with agency guidance, and provide OCC with greater assurance that its staff are following ethics laws, regulations, and guidance, all of which decrease the risk of regulatory capture.

|

| Office of the Comptroller of the Currency | The Chief Counsel should develop a policy for Large Bank Supervision (1) to check employees active conflicts of interests during the staffing process for examinations and other supervisory activities and (2) to document the results of this check. (Recommendation 6) |

OCC disagreed with this recommendation. OCC noted in its December 2018 response letter to the report that they believed such a policy would shift the responsibility for ensuring compliance with recusal requirements from employees to those responsible for staffing. We maintain that this recommendation does not aim to alleviate the personal responsibility all employees have to comply with recusal requirements. Rather, our recommendation aims to strengthen the due diligence of those responsible for staffing by requiring an independent, preliminary check of active conflicts of interest. As of October 2024, OCC officials reported that the project to add employee recusal data to its staffing process has been delayed. We will continue to monitor the OCC's progress in addressing this recommendation.

|

| Office of the Comptroller of the Currency | The Chief Counsel should (1) revise OCCs instructions for conducting examination workpaper reviews to ensure that they are complete and (2) communicate the revised instructions to employees. (Recommendation 7) |

In response to GAO's recommendation, OCC has revised its instructions for conducting examination workpaper reviews and communicated the revised instructions to employees. OCC notes that in June 2019 it added a new function to its Ethics Management System that automated the pre-exit process, including the workpaper review process. In December 2019, OCC issued an Ethics Bulletin on the agency's workpaper review process. The bulletin addresses GAO's concerns: It (1) provides for workpaper reviews that are either required or requested; (2) details the examination workpaper review process; (3) provides the timeframe for completing workpaper reviews; (4) states the goal of a workpaper review and the specific questions asked in such a review; (5) specifies actions supervisors should take following negative findings; and (6) describes the workpaper review process for senior management.

|

| Office of the Comptroller of the Currency | The Chief Counsel should (1) conduct a periodic self-assessment of OCCs ethics program, including evaluating the implementation of its associated controls, policies, and guidance; (2) document the results; and (3) take action based on this assessment, as appropriate. (Recommendation 8) |

In response to GAO's recommendation, OCC legal counsel has conducted a self-assessment of the ethics program, and documented the results. The assessment states actions OCC is to take as it updates its ethics program. In December 2018, OCC completed a self-evaluation of its ethics program, based on Office of Government Ethics guidance. The assessment used information from several sources, such as the Operating Policies and Procedures for the OCC Ethics Program, the Ethics webpage provided on the OCC intranet, and the OCC Senior Counsel for Ethics. This assessment evaluated status and implementation of OCC's ethic program controls, policies, and guidance. Each recommendation in the assessment overviews the results of the assessment pertaining to that recommendation, and the actions OCC is to take to address that recommendation.

|

| Office of the Comptroller of the Currency | The Chief Risk Officer should expand OCCs approach to addressing the risk of regulatory capture, including (1) revising its risk appetite statement to address risk areas other than reputational risk and (2) identifying additional factors to analyze when assessing the risk of regulatory capture. (Recommendation 9) |

In response to our recommendation, in November 2019, OCC revised its Enterprise Risk Appetite Statement to address regulatory capture in 5 of the 9 risk areas identified. These include not only reputational risk, but also supervision risk, human capital risk, and operational risk, which we identified in our report, along with legal risk. In August 2020, OCC also added post-employment ethics issues as a factor to analyze when assessing the risk of regulatory capture, one of the factors we recommended that OCC consider in its risk assessment. With this additional factor and updates to the risk appetite statement, OCC will more fully understand how its actions may affect the risk of regulatory capture more broadly and identify additional ways to mitigate the risk.

|