Small Business Administration: Export Promotion Grant Program Should Better Ensure Compliance with Law and Help States Make Full Use of Funds

Fast Facts

The State Trade Expansion Program seeks to help U.S. small businesses export their products to other countries. The Small Business Administration awards the program's funds to state trade offices, which assist with activities like trade show attendance. It has given about $139 million in grants since FY 2011.

The program requires states to provide matching funds and SBA must follow rules designed to spread funding among states.

In the report on which this testimony is based, we recommended, among other things, that SBA

Develop a process to ensure matching fund requirements are met

Evaluate the challenges states face in using their grants

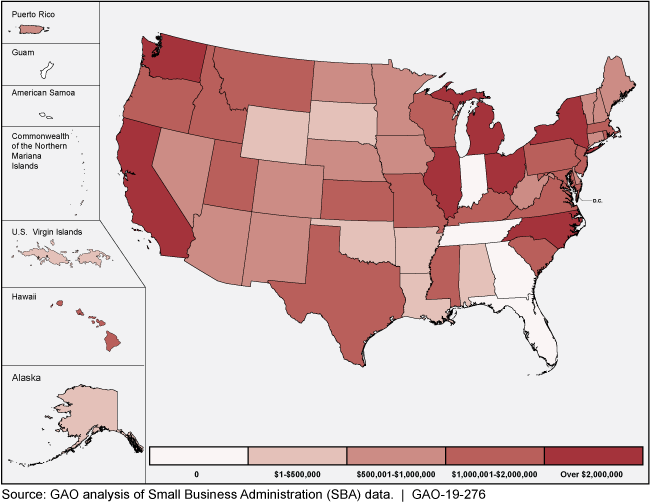

Total State Trade Expansion Program award amounts by state, fiscal years 2015-2017

Color-coded map showing the states and U.S. territories.

Highlights

What GAO Found

The Small Business Administration's (SBA) management of the State Trade Expansion Program (STEP) does not provide reasonable assurance of compliance with some legal requirements. Specifically, the Trade Facilitation and Trade Enforcement Act of 2015 (TFTEA) requirements for STEP include:

Proportional distribution requirement. SBA's Office of International Trade (OIT) must distribute grant funds so that the total amount awarded to the 10 states with the highest percentage of eligible small businesses does not exceed 40 percent of the program's appropriation that year.

Total match requirement. States must provide a 25 or 35 percent non-federal match to the federal grant amount.

Cash match requirement. A state's match cannot be less than 50 percent cash.

GAO found that, while OIT has a process to meet the distribution requirement, it does not have a process for documenting that states have met the total match requirement before grant closeout, and does not have a process to determine whether states are meeting the cash match requirement. Without such processes, SBA cannot be reasonably assured that states are contributing per the law's requirements.

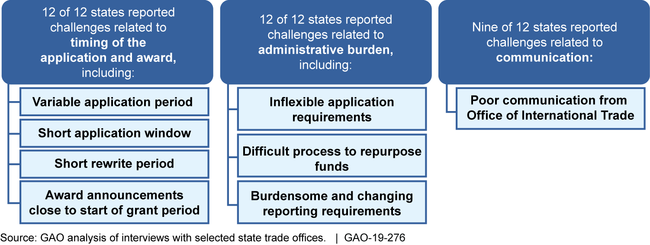

GAO found that, while OIT has made changes to STEP in response to states' feedback, officials from states with low grant use described ongoing challenges with the program that affect their ability to fully use funds. These challenges include compressed application and award timelines, administrative burden, and poor communication. SBA has not adequately assessed risks to the program, including the risk to achieving program goals posed by some states' low grant fund use rates. Without such an assessment, OIT's ability to support U.S. exporters may be diminished. Further, SBA has not effectively facilitated sharing best practices among states. By doing this, SBA could help states make full use of funds to achieve the program's goals.

Twelve States with Low STEP Grant Fund Use Rates Reported Challenges

Why GAO Did This Study

This testimony summarizes the information contained in GAO's March 2019 report, entitled Small Business Administration: Export Promotion Grant Program Should Better Ensure Compliance with Law and Help States Make Full Use of Funds (GAO-19-276).

For more information, contact Kimberly Gianopoulos at (202) 512-8612 or gianopoulosk@gao.gov.