Small Business Administration: Export Promotion Grant Program Should Better Ensure Compliance with Law and Help States Make Full Use of Funds

Fast Facts

The State Trade Expansion Program seeks to help U.S. small businesses export their products to other countries. The Small Business Administration awards the program's funds to state trade offices, which assist with activities like trade show attendance. It has given about $139 million in grants since FY 2011.

The program requires states to provide matching funds—including a portion in cash—and SBA must follow rules designed to spread funding among states.

We made 4 recommendations, including that SBA:

Develop a process to ensure compliance with matching fund requirements

Evaluate the challenges some states face in using all their grant funds

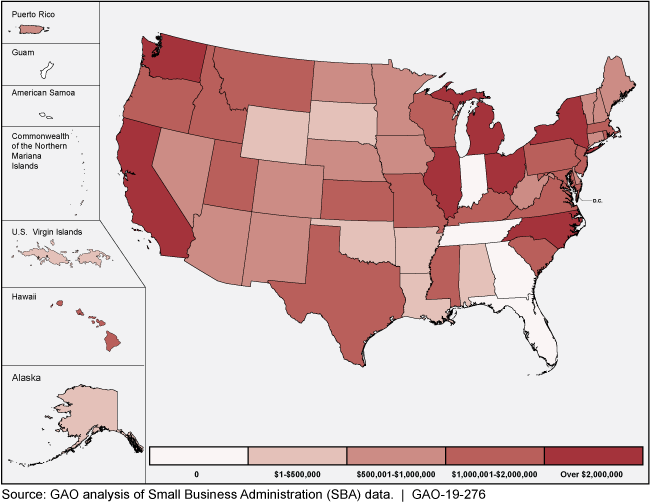

Total State Trade Expansion Program award amounts by state, fiscal years 2015-2017

Color-coded map showing the states and U.S. territories.

Highlights

What GAO Found

The Small Business Administration's (SBA) management of the State Trade Expansion Program (STEP) does not provide reasonable assurance of compliance with some legal requirements. Specifically, the Trade Facilitation and Trade Enforcement Act of 2015 (TFTEA) requirements for STEP include:

Proportional distribution requirement. SBA's Office of International Trade (OIT) must distribute grant funds so that the total amount awarded to the 10 states with the highest percentage of eligible small businesses does not exceed 40 percent of the program's appropriation that year.

Total match requirement. States must provide a 25 or 35 percent non-federal match to the federal grant amount.

Cash match requirement. A state's match cannot be less than 50 percent cash.

GAO found that, while OIT has a process to meet the distribution requirement, it does not have a process for documenting that states have met the total match requirement before grant closeout, and does not have a process to determine whether states are meeting the cash match requirement. Without such processes, SBA cannot be reasonably assured that states are contributing per the law's requirements.

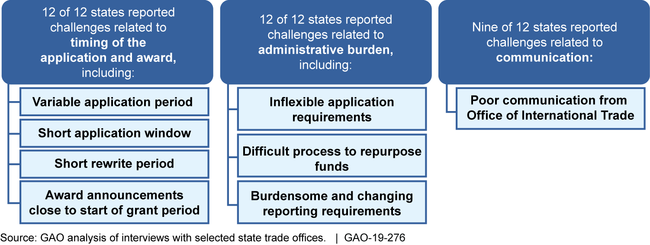

GAO found that, while OIT has made changes to STEP in response to states' feedback, officials from states with low grant use described ongoing challenges with the program that affect their ability to fully use funds. These challenges include compressed application and award timelines, administrative burden, and poor communication. SBA has not adequately assessed risks to the program, including the risk to achieving program goals posed by some states' low grant fund use rates. Without such an assessment, OIT's ability to support U.S. exporters may be diminished. Further, SBA has not effectively facilitated sharing best practices among states. By doing this, SBA could help states make full use of funds to achieve the program's goals.

Twelve States with Low STEP Grant Fund Use Rates Reported Challenges

Why GAO Did This Study

Congress established STEP in 2010 to increase small business exports. Through STEP, SBA has awarded about $139 million in grants to state trade offices, which in turn facilitate small business export activities, including participation in trade missions and attendance at trade shows. Congress reauthorized STEP in 2016. GAO was asked to review SBA's management of the program.

This report examines the extent to which (1) SBA's STEP grants management process provides reasonable assurance of compliance with selected requirements of applicable law, and (2) SBA has taken steps to address challenges states report in using grant funds to achieve program goals. GAO reviewed the program's authorizing legislation and federal and agency guidance on grants management, analyzed SBA program data, and interviewed SBA officials. GAO also conducted semi-structured interviews with a non-generalizable sample of 12 of the 40 states that received STEP grants in fiscal year 2015, the most recent year for which complete data were available. GAO selected these states on the basis of their low grant fund use rates.

Recommendations

GAO is recommending that SBA develop processes to ensure compliance with legal grant matching fund requirements, take steps to assess risks to program goals from low grant fund use rates, and enhance the sharing of best practices among states receiving the grant. SBA concurred with all of the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Small Business Administration |

Priority Rec.

The SBA Administrator should establish a process that ensures documentation of states' compliance with the total match requirement before grant closeout. (Recommendation 1) |

In March 2019, GAO reported challenges with the Small Business Administration's (SBA) State Trade Expansion Program (STEP), a program intended to help states develop their small business' export capacities. The program had not established procedures that provided reasonable assurance of state grantees meeting certain legal requirements. Specifically, the program did not have processes in place to ensure that each state grantee had met the total match requirement before the grant was closed. Per this requirement, grantees must provide either 25 or 35 percent of the federal grant amount in state-sourced matching funds. SBA concurred with GAO's recommendation. As of January 2023, as a result of GAO's recommendation, SBA had designed new checks for use during quarterly grant spending reviews and had established a mechanism to determine whether the total match requirement had been met at the end of each grant's lifecycle. Agency officials provided GAO their new STEP Program Closeout Process Checklist, which should better ensure the match was met before grant closure. According to SBA officials, as a result of GAO's recommendation, this process is in place and is being implemented in the review and closure of STEP grants from 2020 and 2021. SBA's implementation of these measures will provide a reasonable assurance that state grantees are meeting the legal requirements of the program and providing all the appropriate funding.

|

| Small Business Administration |

Priority Rec.

The SBA Administrator should develop a process to determine states' compliance with the cash match requirement. (Recommendation 2) |

In March 2019, GAO reported challenges with the Small Business Administration's (SBA) State Trade Expansion Program (STEP), a program intended to help states develop their small business' export capacities. The program had not established procedures that provided reasonable assurance of state grantees meeting certain legal requirements. Specifically, the program did not have processes in place to ensure that each state grantee had met the cash match requirement before the grant was closed. Per this requirement, grantees must ensure that half of their state-sourced matching funds are provided in cash. SBA concurred with GAO's recommendation. As of January 2023, as a result of GAO's recommendation, SBA had designed new cash match checks during quarterly grant spending reviews and had established a mechanism to determine whether the cash match requirement had been met at the end of each grant's lifecycle. Agency officials provided GAO their new STEP Program Closeout Process Checklist, which should better ensure the match was met before grant closure. According to SBA officials, these measures are being implemented in the review and closure of STEP grants from 2020 and 2021. SBA's implementation of these measures will provide a reasonable assurance that state grantees are meeting the legal requirements of the program and providing funding in the appropriate form.

|

| Small Business Administration | The SBA Administrator should assess the risk to achieving program goals posed by some states' low grant fund use rates. Assessing this risk could include examining the challenges that states reported related to the program's application and award processes, administrative burden, and communication. (Recommendation 3) |

In March 2019, GAO reported challenges with the Small Business Administration's (SBA) State Trade Expansion Program (STEP) had prevented some grantees from fully utilizing available grant funds to support small business exporters. State recipients of the grant described fund utilization challenges related to (1) timing of the application and award processes, (2) administrative burden, and (3) communication. GAO recommended that SBA assess the risk to achieving program goals posed by some states' low grant fund use rates, and noted that assessing this risk could include examining the challenges that states reported related to the program's application and award processes, administrative burden, and communication. SBA concurred with GAO's recommendation. As of March 2020, SBA noted that it had assessed the risks to achieving program goals associated with low fund utilization, and had taken took a variety of measures to increase fund utilization by states and territories. These measures included (1) releasing the grant application earlier to allow more time for states to complete the application; (2) reducing application and grantee reporting requirements, and (3) facilitating communication by instituting orientation sessions for new state grantees and initiating monthly calls with grantees. In addition, in August 2019, SBA determined to allow states some additional flexibility in the use of grant funds in order to help to reach the program's goal of 100 percent utilization of funds. SBA's implementation of these measures in pursuit of the goal of full utilization of funds can result in more funds being used to support U.S. small business exports.

|

| Small Business Administration | The SBA Administrator should enhance collection and sharing of best practices among states that receive STEP grant funds. (Recommendation 4) |

In March 2019, GAO reported challenges with the Small Business Administration's (SBA) State Trade Expansion Program (STEP), including a lack of an effective process for sharing best practices among grantees. Although sharing detailed information with all participating states about the approaches that some grantees used to successfully achieve STEP's goals could encourage all grant recipients to improve the effectiveness of their programs, SBA had no systematic process to share best practices with states struggling to use their STEP funds. GAO recommended that SBA enhance collection and sharing of best practices among states that receive STEP grant funds. SBA concurred with GAO's recommendation. As of March 2020, SBA reported that it had conducted surveys of STEP grantees that excelled at (1) return on investment, and; (2) providing assistance to more eligible small business concerns. The practices used by the top states in these categories were reported in the fiscal year 2019 STEP Annual Report to Congress, and best practices were also presented at a conference for states in July 2019. SBA reported that collection and reporting on best practices will be a consistent part of all publicly available STEP annual reports to Congress going forward. Communicating information about best practices can strengthen grantees' ability to use the funds to help as many exporting small businesses as possible, leading to a fuller realization of the program's goals.

|