Ginnie Mae: Risk Management and Staffing-Related Challenges Need to Be Addressed

Fast Facts

Ginnie Mae, a government-owned corporation, is a major player in the housing finance market. It has grown to guarantee over $2 trillion worth of mortgage-backed securities—which encourages investors to provide capital for mortgage loans with a promise that they'll receive payments even if the borrowers default.

Ginnie Mae's growth has raised concerns. We examined how it manages risks; its staffing issues such as heavy reliance on contractors and limited budget for in-house staff; and how its oversight differs from other entities with similar functions.

Our recommendations help address these concerns and improve oversight of Ginnie Mae.

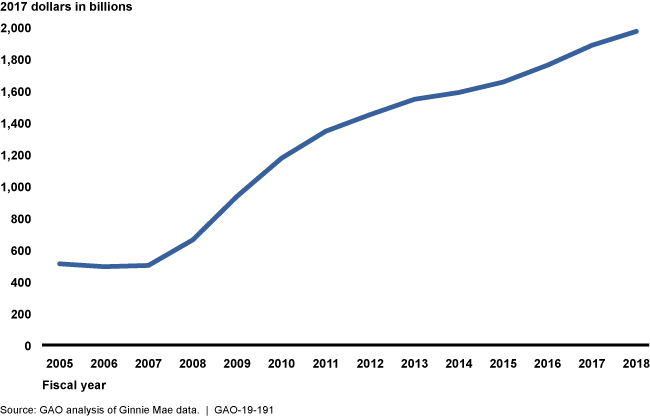

The unpaid principal on the mortgages backing Ginnie Mae's securities, which is a measure of Ginnie Mae's potential fiscal risk

Line chart showing growth from around $500 billion in 2005 to around $2 trillion in 2018

Highlights

What GAO Found

The amount of mortgage-backed securities (MBS) that the Government National Mortgage Association (Ginnie Mae) guaranteed rose from $500 billion to $2 trillion in fiscal years 2007–2018—exposing it to a greater risk of loss. From 2011 to 2018, the majority of institutions issuing Ginnie Mae-guaranteed MBS (issuers) shifted from banks to nonbanks, such as mortgage lenders. Unlike banks, nonbank issuers generally are not consistently subject to comprehensive federal safety and soundness standards.

Since GAO's 2011 report, Ginnie Mae increased minimum financial requirements for MBS issuers and developed new tools to monitor them. However, it has limited flexibility under law to raise the fee charged to guarantee single-family MBS in response to changes in risks. Ginnie Mae also has not assessed if the current fee would provide it with sufficient capital reserves to withstand losses under various scenarios, which would be consistent with federal internal control and risk-management standards. Such an analysis would provide Ginnie Mae with information necessary to help ensure the fee is set appropriately and inform Congress whether Ginnie Mae needs greater flexibility to adjust the fee.

As GAO reported in 2011, Ginnie Mae still faces contracting and staffing challenges. It continues to rely heavily on contractors (because it has authority to use certain fee revenue to fund contractors but not its own in-house staff). However, it has not routinely analyzed if using its own in-house staff instead of contractors for certain functions would be more efficient. Such analyses could help inform Ginnie Mae and Congress about the optimal mix of contractors and staff and potential need for greater budget flexibility. Ginnie Mae also still faces challenges recruiting and retaining staff, in part due to its lower pay scale relative to some of its competitors. But it has not exhausted all options under its current authority to revise its pay scale to mitigate these challenges or evaluated the costs and benefits of other options. Such actions could help inform Ginnie Mae about how it could use current authorities to address these challenges and provide Congress with the information needed to consider providing Ginnie Mae with additional pay flexibility.

The Department of Housing and Urban Development (HUD) oversees and sets general policies that govern Ginnie Mae's operations. However, GAO previously reported that HUD's management challenges limit the effectiveness of its oversight of Ginne Mae and its other programs. In light of these challenges and Ginnie Mae's increasing risks, GAO reviewed the oversight structures of three similar financial entities and found that certain alternative structures used by these entities, such as boards of directors, offer potential oversight benefits that could be considered as part of any future reform proposals for Ginnie Mae. As GAO previously reported, if Congress considers legislation to reform the federal role in housing finance, such reforms would need to be comprehensive and consider all relevant federal entities, including Ginnie Mae. As part of such reforms, it also would be important to ensure that Ginnie Mae is adequately overseen and its risks effectively managed.

Why GAO Did This Study

Ginnie Mae, a government corporation within HUD, plays a significant role in the secondary mortgage market. Institutions issue MBS (backed by federally insured or guaranteed mortgages). Ginnie Mae guarantees MBS investors timely payments of principal and interest on the MBS if issuers cannot make such payments. In 2011, GAO identified challenges related to Ginnie Mae's issuer oversight, staffing, and contracting.

GAO was asked to re-examine these issues. This report reviews Ginnie Mae's (1) MBS volume, issuers, and risks; (2) oversight of issuers and related risks; (3) staff levels and contractor use; and (4) oversight structure compared to selected entities to identify areas for potential reforms. GAO analyzed data on MBS volume, reviewed Ginnie Mae policies and procedures, reviewed oversight structures of three similar financial entities, and interviewed agency officials.

Recommendations

GAO makes four recommendations to Ginnie Mae, including that it evaluate its issuer guaranty fee, contractor use, and alternative compensation structures. GAO also makes recommendations to Congress to consider requiring Ginnie Mae to report on its evaluations of (1) the adequacy of its issuer guaranty fee, (2) its reliance on contractors and use of certain fee revenue to hire in-house staff, and (3) use of greater flexibility to set staff compensation; and (4) to consider possible reforms to Ginnie Mae's oversight structure. Ginnie Mae concurred with GAO's recommendations.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider requiring Ginnie Mae to evaluate the adequacy of its current guaranty fee for single-family mortgage-backed securities and report to Congress with recommendations, if any, on revising the fee, such as by adopting standards under which the fee should be determined. (Matter for Consideration 1) | As of February 2025, Congress has not passed specific legislation, but in its FY 2022 budget, Congress directed Ginnie Mae to take specific action in its explanatory statement. Specifically, it directed HUD to work with GAO to address all open items related recommendations in the GAO-19-191 report. In its FY 2021 congressional budget justification, Ginnie Mae stated that the single-family guarantee fee of six basis points, and the restrictions upon it, were set in statute and date to 1987. Ginnie Mae planned to request that a range be established for guaranty fee for single-family mortgage-backed securities rather than a set amount. Ginnie Mae stated once the statutory authority was provided, an administrative process to adjust the guaranty fee could be made. Between 2021 to 2022, Ginnie Mae implemented a model to periodically evaluate the extent to which the guaranty fee for single-family MBS provides the agency with sufficient reserves to cover potential losses under different economic scenarios. However, as of February 2025, Ginnie Mae has not requested a change to its statutory authority. We will continue to monitor the status of this matter. | |

| Congress should consider requiring Ginnie Mae to evaluate its reliance on contractors and report to Congress on how it would use fee revenue available to hire contractors to also hire in-house staff. (Matter for Consideration 2) | While Congress has not passed specific legislation, it has directed Ginnie Mae to take specific action in its explanatory statement. More specifically, the explanatory statement directed HUD in its FY 2022 budget request to make recommendations for increasing its internal capacity for oversight of core functions and contracts. Ginnie Mae responded in its FY 2022 budget justifications of steps it planned to take as a result, including conducting an analysis. As of February 2023, Ginnie Mae had completed its evaluation on its reliance of contractors and planned to report its findings to Congress. | |

| Congress should consider requiring Ginnie Mae to provide a report on how it would use greater flexibility or broader authority to set the compensation of its in-house staff. (Matter for Consideration 3) | While Congress has not passed specific legislation, it has directed Ginnie Mae to take specific action in its explanatory statement. More specifically, the explanatory statement directed Ginnie Mae in its FY 2022 budget to work with GAO to address all open items related recommendations in GAO-19-191 report. In its FY 2022 budget justifications, Ginnie Mae outlined its plans to work with HUD, OMB and OPM to explore the use of Critical pay authority. As of March 2023, Ginnie Mae had identified positions to use the critical pay authority and planned to explore other authorities and develop a committee to review human capital issues. | |

| Congress should consider reforms to Ginnie Mae's oversight structure that can help address its increasing risks. (Matter for Consideration 4) | As of February 2025, Congress has not enacted legislation that contains reforms to Ginnie Mae's oversight structure that can help address its increasing risks. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Government National Mortgage Association (Ginnie Mae) |

Priority Rec.

The Chief Risk Officer of Ginnie Mae should periodically conduct an actuarial or similar analysis that includes a stress test to evaluate the extent to which the current level of the guaranty fee for single-family MBS provides Ginnie Mae with sufficient reserves to cover potential losses under different economic scenarios. (Recommendation 1) |

As of March 2022, Ginnie Mae has implemented this recommendation. More specifically, Ginnie Mae has implemented a model to periodically evaluate the extent to which the guaranty fee for single-family MBS provides the agency with sufficient reserves to cover potential losses under different economic scenarios. In 2021, Ginnie Mae developed a model to estimate the necessary guaranty fee to cover losses under different economic scenarios. Ginnie Mae found its reserves were adequate to cover estimated losses under the scenarios and committed to conduct the evaluation at least annually. In early 2022, Ginnie Mae completed its second evaluation of its guaranty fee after updating and recalibrating its model. Ginnie Mae found it was well positioned to withstand foreseeable market stress at the current guaranty fee and capital reserves levels under different economic scenarios. Ginnie Mae officials told us that they plan to continue to further enhance the model and conduct the guaranty fee evaluation semi-annually and eventually quarterly, depending on competing demands. By conducting such an analyses, Ginnie Mae is now better positioned to understand its ability to absorb losses and, in turn, whether its guaranty fee is set at an appropriate level

|

| Government National Mortgage Association (Ginnie Mae) |

Priority Rec.

The Senior Vice President of Ginnie Mae's Office of Management Operations should analyze the costs of using contractors for its operations and develop a plan to determine the optimal mix of contractor or in-house staff for operations. (Recommendation 2) |

As of February 2023, Ginnie Mae (HUD) has implemented this recommendation. More specifically Ginnie Mae provided the completed analysis of the optimal mix of contractors or in-house staff for operations, which contained three recommendations. The report recommended that (1) Ginnie Mae consider where some contracts could be shifted to include more in-house staff; (2) Ginnie Mae review its organizational structure and also develop a plan to periodically review its contract mix; and (3) Ginnie Mae implement changes to its compensation structure to assist in hiring and retention. Ginnie Mae officials provided an example of how they have begun to identify areas where they can hire internal staff rather than contractors. More specifically, officials outlined steps to develop a workflow tool to manage compliance exams and the creation of new position that has been filled to oversee issuer compliance. Officials also outlined future plans to create a new division in fiscal years 2023 and 2024 with additional staff to support this function. Moreover, Ginnie Mae officials stated they plan to establish procedures and a regular cadence for assessing its contract mix in light of evolving business changes and anticipated modernization efforts at Ginnie Mae. By conducting this analysis and developing a plan on ways to address its reliance on contractor, Ginnie Mae has taken steps to assess its operating posture in the future.

|

| Government National Mortgage Association (Ginnie Mae) |

Priority Rec.

The Senior Vice President of Ginnie Mae's Office of Management Operations should assess its contract administration options to determine the most efficient and effective use of funds. (Recommendation 3) |

As of March 2023, Ginnie Mae has implemented this recommendation. Ginnie Mae completed its review of benefits and costs of its contract administration options. More specifically, the analysis considered three alternatives to how contracts are administered and provided cost and benefits of each alternative. According to officials, Ginnie Mae will continue to use both the General Service Administration (GSA) and HUD's contracting office for contract administration and is not pursuing one of the alternatives presented in the report. Ginnie Mae officials told us that based on its review of its mix of contractors and in-house staff for operations, it sought to make some organizational level changes. First, it sought and received approval from HUD to make the Chief Operating Officer position a career position rather than a political appointment. Officials stated this change could ensure continuity of operations through administrative changes and provide dedicated focus on contracting given Ginnie Mae's large reliance on contractors. Second, Ginnie Mae officials told us they are seeking approval to hire a Chief Acquisition Officer to ensure that Ginnie Mae can directly oversee its ongoing contracting needs in addition the support it receives from HUD's procurement office. Lastly, Ginnie Mae plans to periodically assess its contract administrations options to determine if it is the most efficient and effective use of funds. By completing its review of its contract administration options and plans for continual review going forward, Ginnie Mae has begun to take steps to determine the most efficient and effective use of funds.

|

| Government National Mortgage Association (Ginnie Mae) |

Priority Rec.

The Chief Financial Officer of Ginnie Mae and Senior Vice President of Ginnie Mae's Office of Management Operations should finalize efforts to assess the costs and benefits of options to revise its compensation structure within current authority and submit proposals, if warranted, to HUD for review and consideration. (Recommendation 4) |

Ginnie Mae (HUD) implemented this recommendation. As of March 2023, Ginnie Mae has implemented its alternative pay option (known as Critical Position Pay) and identified mission critical occupations to begin utilizing the critical pay authority. Additionally, according to officials, Ginnie Mae's Office of the President is working with its Office of General Counsel to assess Ginnie Mae's ability to establish a special pay authority, that may provide a more long-term and sustainable approach in addressing recruitment and retention. In addition, Ginnie Mae plans to stand up a committee to ensure they are making decisions on compensation and human capital using all of the information available. By implementing its alternative pay option, Ginnie Mae is beginning to follow through on its efforts to reform its compensation structure.

|