Public Service Loan Forgiveness: Education Needs to Provide Better Information for the Loan Servicer and Borrowers

Highlights

What GAO Found

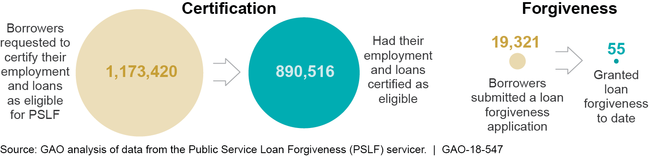

As of April 2018, over a million borrowers had taken steps to pursue Public Loan Service Forgiveness (PSLF) from the Department of Education (Education), but few borrowers have been granted loan forgiveness to date. The PSLF program, established by statute in 2007, forgives borrowers' federal student loans after they make at least 10 years of qualifying payments while working for certain public service employers and meeting other requirements. Over 890,000 borrowers have passed a first step towards potentially qualifying for PSLF by voluntarily having their employment and loans certified as eligible for PSLF as of April 2018, according to data from Education's PSLF loan servicer. While borrowers first became eligible to apply for loan forgiveness in September 2017, few applicants had met all requirements as of April 2018, with 55 borrowers having received loan forgiveness (see figure). Education has used various outreach methods to inform borrowers about PSLF, but the large number of denied borrowers suggests that many are still confused by the program requirements. A recently enacted law requires Education to conduct additional outreach to help borrowers understand how to meet program requirements.

PSLF Certification Requests and Forgiveness Applications, as of April 2018

Education does not provide key information to the PSLF servicer and borrowers.

- Guidance and instructions: Education provides piecemeal guidance and instructions to the PSLF servicer it contracts with to process certification requests and loan forgiveness applications. This information is fragmented across the servicing contract, contract updates, and hundreds of emails. As a result, PSLF servicer officials said their staff are sometimes unaware of important policy clarifications. Education officials said they plan to create a comprehensive PSLF servicing manual but have no timeline for doing so.

- Qualifying employers: Education has not provided the PSLF servicer and borrowers with a definitive source of information for determining which employers qualify a borrower for loan forgiveness, making it difficult for the servicer to determine whether certain employers qualify and for borrowers to make informed employment decisions.

- Qualifying loan payments: Education does not ensure the PSLF servicer receives consistent information on borrowers' prior loan payments from the eight other federal loan servicers, which could increase the risk of miscounting qualifying payments. Borrowers also lack sufficiently detailed information to easily identify potential payment counting errors that could affect their eligibility for loan forgiveness.

These weaknesses are contrary to federal internal control standards for using and communicating quality information, creating uncertainty for borrowers and raising the risk some may be improperly granted or denied loan forgiveness.

Why GAO Did This Study

Starting in September 2017, the first borrowers became eligible and began applying to have their loans forgiven through the PSLF program. GAO was asked to review the PSLF program.

This report examines the (1) number of borrowers pursuing PSLF and the extent to which Education has conducted outreach to increase borrower awareness of program eligibility requirements, and (2) extent to which Education has provided key information to the PSLF servicer and borrowers. GAO analyzed data from the PSLF servicer on employment and loan certifications and loan forgiveness applications as of April 2018; reviewed Education's guidance and instructions for the PSLF servicer; assessed the information used by Education and the PSLF servicer and communicated to borrowers against federal internal control standards; and interviewed officials from Education and the four largest loan servicers, including the PSLF servicer.

Recommendations

GAO recommends that Education (1) develop a timeline for issuing a comprehensive guidance and instructions document for the PSLF servicer, (2) provide the PSLF servicer and borrowers with additional information about qualifying employers, (3) standardize payment information other loan servicers provide to the PSLF servicer, and (4) ensure borrowers receive sufficiently detailed information to help identify potential payment counting errors. Education agreed with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of Federal Student Aid | The Chief Operating Officer of the Office of Federal Student Aid should develop a timeline for issuing a comprehensive guidance and instructions document for PSLF servicing. This could involve developing a new servicing manual or expanding upon the PSLF servicer's existing processing handbook. (Recommendation 1) |

Education agreed with this recommendation, and in March 2020 it released its first PSLF Servicing Guide. This guide, which was provided to the servicer, is intended as a reference source that reflects overall requirements and servicing standards for the PSLF program. Education officials said they plan to release updated versions of the PSLF Servicing Guide in the future to reflect relevant changes to the program. These efforts to implement our recommendation and keeping the new servicing guide up to date will help improve the administration of the PSLF program by providing the servicer with a central, authoritative source of relevant guidance and instructions.

|

| Office of Federal Student Aid |

Priority Rec.

The Chief Operating Officer of the Office of Federal Student Aid should provide additional information to the PSLF servicer and borrowers to enhance their ability to determine which employers qualify for PSLF. This could involve Education developing an authoritative list of qualifying employers or improving the PSLF servicer's existing database, and making this information available to borrowers. (Recommendation 2) |

Education agreed with this recommendation, and in June 2020 the agency introduced an Employer Eligibility Database to the PSLF Help Tool, an online tool to help borrowers better understand the PSLF eligibility requirements. Education launched an updated version of this tool in November 2020 which allows borrowers to search for an employer using an Employer Identification Number (EIN) and determine if it is a qualifying employer for PSLF. The Employer Eligibility Database is populated using available federal data from sources such as the Census Bureau, IRS, and Department of Labor, and contained almost 1.5 million eligible employers as of August 2020. Education officials said they plan to expand this database over time through periodic updates from the federal data sources and as more borrowers submit documentation for employers that were not previously in the database. These efforts to implement our recommendation will help streamline the eligibility determination process for the PSLF servicer and provide borrowers with the information they need to reliably determine whether they are on the right path towards loan forgiveness.

|

| Office of Federal Student Aid | The Chief Operating Officer of the Office of Federal Student Aid should standardize the information the PSLF servicer receives from other loan servicers to ensure the PSLF servicer obtains more consistent and accurate payment information for borrowers pursuing PSLF. (Recommendation 3) |

Education agreed with this recommendation, and in 2020 Education provided documentation of efforts it had implemented to standardize the PSLF loan payment data exchanged between servicers. For example, Education reached agreements with the loan servicers to standardize terminology, address missing and conflicting payment information, and correct other issues identified by the PSLF servicer. As a result of these efforts, the PSLF servicer has indicated that it is now able to process the basic payment history details provided from borrowers' prior loan servicer. This will improve the PSLF servicer's ability to accurately determine qualifying payment counts for borrowers transferring from other servicers.

|

| Office of Federal Student Aid | The Chief Operating Officer of the Office of Federal Student Aid should ensure that borrowers receive sufficiently detailed information from the PSLF servicer to be able to identify any errors in the servicer's counts of qualifying payments, including information on whether or not each payment qualified toward forgiveness. (Recommendation 4) |

Education agreed with this recommendation, and has since taken multiple steps to provide borrowers with detailed information on counts of qualifying payments. All borrowers that have previously submitted a PSLF application or employment certification form can now access detailed payment information by logging into their accounts on the PSLF servicer's online portal. There they can view a list of each of their prior loan payments and see which of these qualified towards loan forgiveness as well as a reason why any payments did not qualify, for example because the payment was not received on time or because the borrower was not enrolled in a qualifying repayment plan. In August 2020, the department also began sending a letter with similarly detailed information to borrowers upon request if they had a question or dispute regarding the number of qualifying payments they had made. By implementing this recommendation to provide borrowers detailed information on prior payments, Education has made it easier for borrowers to detect potential erroneous payment counts that could ultimately affect their eligibility for loan forgiveness.

|