The Adoption Tax Credit Can Help Offset Expenses. But Many Don’t Know About It

More than 100,000 children are adopted in the United States each year. Bringing a new child into your family can be expensive. The adoption tax credit can help offset these expenses and might encourage more adoptions. But many people don’t know about it.

Today’s WatchBlog post looks at our new report on the adoption tax credit and the resources available to parents.

Image

Adopting can be expensive. The tax credit can help.

Adoptions come with a lot of up-front costs that can add up to as much as $60,000.

To help offset these expenses, Congress created the adoption tax credit nearly 30 years ago. This past tax year, the credit was up to about $17,000 per child.

What can you claim under this tax credit?

Some of the adoption expenses that qualify for the tax credit include:

- Adoptions fees—such as background checks, home studies, attorney fees

- Court costs

- Travel expenses (including meals and lodging)

- Expenses related to the adoption of a foreign child

But not all adoption expenses can be claimed under the tax credit. Some of these include,

- Costs associated with adopting your spouse’s child (your stepchild)

- Carrying out a surrogate parent agreement

There are also different requirements on how much of the credit you can claim based on the adoption type. For instance, under a “special needs” adoption, taxpayers can claim the full credit amount regardless of whether any expenses were paid. The definition of special needs under the adoption tax credit is a child who cannot or should not return to their biological parents’ home and is unlikely to be adopted without assistance. Most public adoptions, particularly children in foster care, are considered a special needs adoption.

For all other types of adoptions, taxpayers may only claim qualified expenses.

Recently, there have been changes to the tax credit that will effect how parents can claim the credit. Starting next filing season, taxpayers will be able to receive up to $5,000 as a tax refund if the amount of their adoption credit is greater than their yearly tax bill. Prior to this change, for the last 12 tax years, the adoption tax credit had been nonrefundable, meaning it could only be applied to tax liabilities and no amount of the credit could be claimed as a cash refund.

What do some parents get wrong about the tax credit and how can IRS help?

Many parents may not know they are eligible for the adoption tax credit. Others who do know may inaccurately claim the credit or be unprepared to answer IRS’s questions if audited.

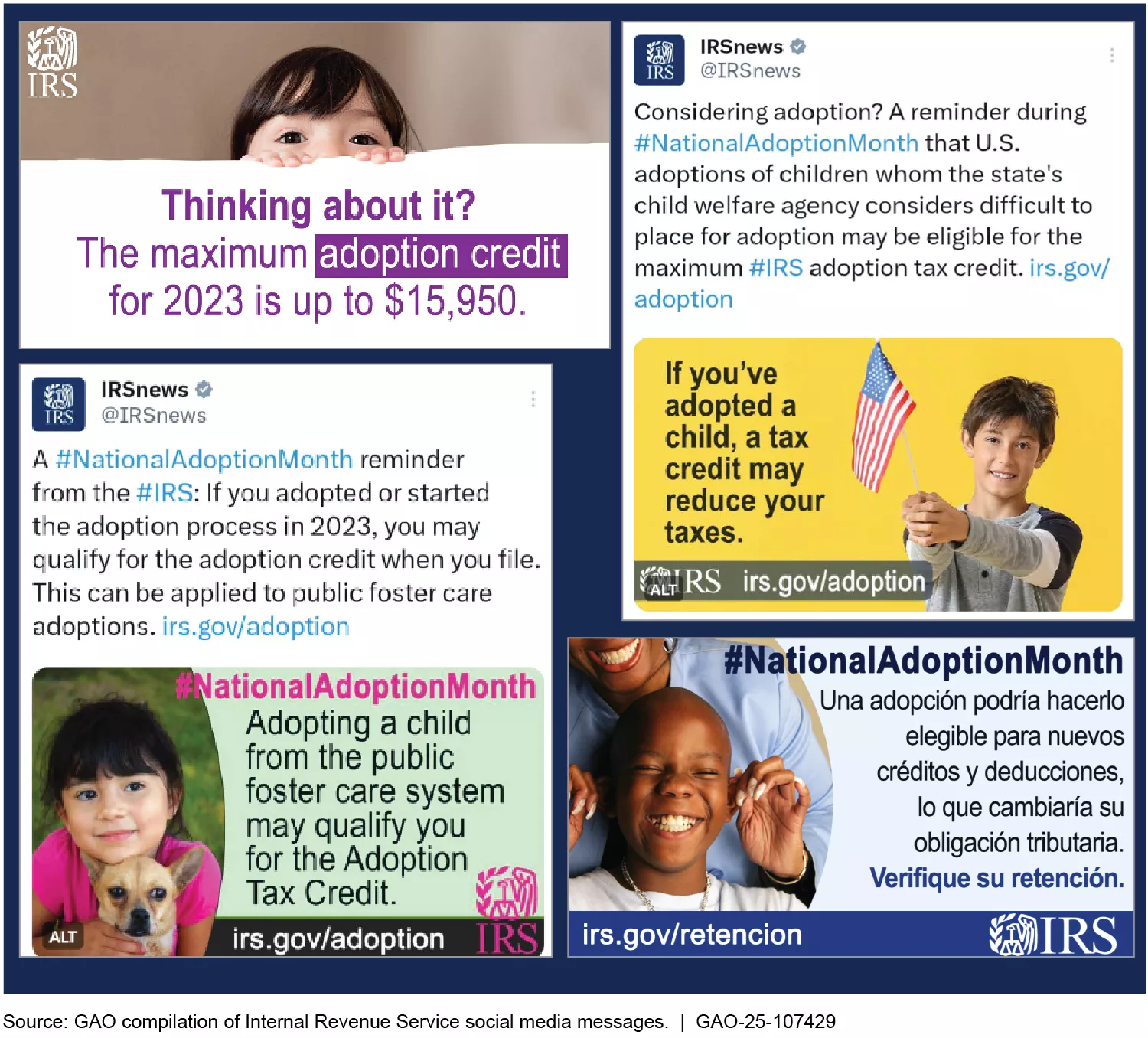

The IRS provides information to help on its website, social media, newsletters, Adoption Tax Credit Form 8839 instructions, and more.

But we found that IRS doesn’t consistently share this information with key partners like state adoption and foster care agencies. As a result, families that rely on these agencies for information throughout the adoption process may not learn about the tax credit or how to properly claim it.

Examples of Internal Revenue Service (IRS) Social Media Outreach for the Adoption Tax Credit for Filing Season 2024

Image

Additionally, IRS’s information is not always clear and consistent. For example, we found instructions that provided conflicting information for parents. This confusion may result in some parents missing out on thousands of dollars of tax credit. It could also result in taxpayers claiming a credit that they are ineligible for or claim an inaccurate amount. Others may be audited—a costly and time-consuming process—and eventually be responsible for unexpected tax bills.

We recommended that the IRS could help those interested in claiming the adoption tax credit by developing a comprehensive educational outreach plan. As part of this effort, we recommended that IRS take steps like working with stakeholders to better understand parents’ needs and questions. This could help more parents understand and claim the tax credit they qualify for.

For more on the adoption tax credit, check out our new report.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.

- Got a comment, question? Email us at blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.