Adoption Tax Credit: IRS Needs a Comprehensive Educational Outreach Plan

Fast Facts

Adopting a child can be expensive, but many taxpayers can claim a credit for adoption on their taxes. In some cases, taxpayers can get the full credit even if they didn’t pay that much in qualified expenses.

We found that IRS’s messages about the credit are not clear or consistent. Also, IRS doesn’t reach out to key adoption stakeholders, such as state adoption agencies, with the relevant information.

Confusion about eligibility could mean that taxpayers are not getting the full benefit of this credit. We recommended that IRS develop an educational outreach plan to help ensure that people know about the credit and claim it appropriately.

Highlights

What GAO Found

The Internal Revenue Service (IRS) does not have an educational plan to help ensure that its outreach and communication efforts for the adoption tax credit are effective. In 2011, GAO recommended that IRS should include relevant adoption stakeholders and clarify its documentation requirements for the credit. GAO also reported IRS audited a high percentage of returns that claimed the credit. In 2012, in response to GAO's recommendation, IRS took some steps to improve its adoption tax credit communications strategy. However, IRS does not currently have a comprehensive educational outreach plan to engage with adoption stakeholders and provide clear, consistent information to taxpayers.

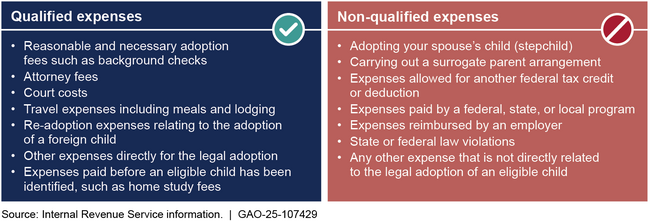

Examples of Qualified and Non-qualified Adoption Expenses

Note: See figure 3 in GAO-25-107429 for more information on certain expenses.

IRS has developed adoption tax credit materials but has not consistently provided the information to key adoption stakeholders, such as state agencies. Some stakeholders told GAO that having these materials would help them in assisting adoptive families. Additionally, some of these materials did not provide clear, consistent messages on how to accurately claim the credit. Also, IRS's list of approved documentation taxpayers should retain when claiming the credit is not easily accessible. As a result, taxpayers may (1) not know they are eligible for the credit, (2) inaccurately claim the credit, or (3) be unprepared if audited.

GAO also found that the percentage of returns claiming the adoption credit were generally audited at the same rate as all individual tax returns for tax years 2012 through 2021. However, among adoption credits audited during this time, 41 percent were adjusted by IRS. The average increase to the credit was approximately $6,000 and the average decrease was approximately $7,000. IRS officials could not easily provide an explanation for these changes.

An educational outreach plan for the adoption tax credit would help IRS ensure that adoptive families know about the credit, their eligibility, and other requirements. Such a plan is particularly important in light of changes to the credit that were enacted in July 2025. Improved education and guidance, along with more engagement with adoption stakeholders—such as the Department of Health and Human Services' Administration for Children and Families—could help taxpayers avoid costly mistakes in either failing to claim the credit or doing so inappropriately. Improved understanding of the credit could also save IRS resources by reducing the need for expensive audits.

Why GAO Did This Study

In the United States, over 100,000 children are adopted annually. More than half of adoptions are performed through the public foster care system. Individuals can pay thousands of dollars in expenses to adopt a child. In 1996, the adoption tax credit was established and encourages adoptions by offsetting related costs.

GAO was asked to review IRS's administration of the adoption tax credit. This report examines (1) IRS's outreach to educate individuals on the availability and requirements to claim the adoption tax credit, and (2) the frequency and results of audits IRS conducted on the adoption tax credit for tax years 2012 through 2021.

GAO reviewed IRS's education efforts on the adoption credit and interviewed relevant officials. GAO also interviewed a nongeneralizable sample of seven adoption stakeholders, including state adoption and foster care agencies and nongovernmental organizations, including those that provide tax and legal assistance for adoptive families. Lastly, GAO reviewed the results of adoption tax credit audits for tax years 2012 through 2021, the most current data available.

Recommendations

GAO is recommending that IRS develop a comprehensive educational outreach plan for the adoption tax credit, including identifying key stakeholders and developing clear, consistent messaging. IRS concurred with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should direct the Acting Chief of Communications and Liaison and the Chief Taxpayer Experience Officer to develop a comprehensive educational outreach plan for the adoption tax credit that aligns with our Leading Practices for Consumer Education Planning, including identifying key stakeholders and developing clear, consistent messaging. (Recommendation 1) |

In September 2025, IRS officials stated that they are drafting a comprehensive educational outreach plan for the adoption tax credit. Officials expected to complete the plan by November 2025 in advance of the 2026 filing season. An educational outreach plan for the adoption tax credit would help IRS ensure that adoptive families know about the credit, their eligibility, and other requirements, as well as help taxpayers avoid costly mistakes in either failing to claim the credit or doing so inappropriately. Such a plan is particularly important in light of changes to the credit that were enacted in July 2025.

|