Government Performance: Confronting High Risks and Fiscal Challenges Is Crucial to a More Effective and Sustainable Government

Fast Facts

In his final testimony as head of GAO, Comptroller General Gene L. Dodaro discussed High Risk areas and fiscal health challenges facing the nation. The testimony was before the Subcommittee on Border Management, Federal Workforce and Regulatory Affairs.

This testimony is based primarily on the following reports:

The Nation's Fiscal Health: Strategy Needed as Debt Levels Accelerate

We've made many recommendations that can help inform a strategy to address these pressing issues and improve government.

The U.S. Capitol building with the text next to it that says "GAO Testimony to Congress."

Highlights

What GAO Found

GAO’s High-Risk List identifies 38 areas across the federal government that are seriously vulnerable to fraud, waste, abuse, and mismanagement or that are in need of transformation. Addressing these high-risk issues will save hundreds of billions of dollars, improve service to the public, and increase government performance and accountability. Conversely, left unaddressed, these issues will impede the government’s ability to effectively serve the nation.

GAO’s 2025 High-Risk update added a new area on federal disaster assistance. Natural disasters have become costlier and more frequent, which has strained the Federal Emergency Management Agency. Further, the federal approach to disaster recovery is fragmented across more than 30 federal entities, making it harder for survivors and communities to navigate federal programs. GAO recommended Congress reform the federal approach to disaster recovery.

Other high-risk areas also need special attention, including:

- Expediting the pace of cybersecurity and critical infrastructure protections. While improvements have been made and efforts continue, the government is still not operating at a pace commensurate with the evolving, grave cybersecurity threats to the nation's security, economy, and well-being. GAO has made 4,441 related recommendations since 2010. While 3,848 have been implemented or closed, 593 have not been fully implemented. Also, greater federal efforts are needed to better understand the status of private sector technological developments with cybersecurity implications—such as artificial intelligence—and to continue to enhance public and private sector coordination.

- Addressing the government’s human capital challenges. The government faces long-standing challenges in strategically managing its workforce. Skills gaps are prevalent across many parts of the federal government and can impair the government’s ability to cost-effectively serve the public and achieve results. Agencies experience skills gaps when they have an insufficient number of staff or individuals without the appropriate skills or abilities to successfully perform their work. GAO has recommended agencies address skills gaps by improving workforce planning, training, and recruitment and retention efforts.

- Restructuring the U.S. Postal Service (USPS). For years USPS has faced unsustainable financial challenges, declining mail volumes, significant capital needs (such as vehicle replacement), and an outdated business model that struggles to align costs with changing mail use. There is a fundamental tension between the level of service Congress expects and what revenue USPS can reasonably be expected to generate. Congress needs to establish what services it wants USPS to provide and negotiate a balanced funding arrangement.

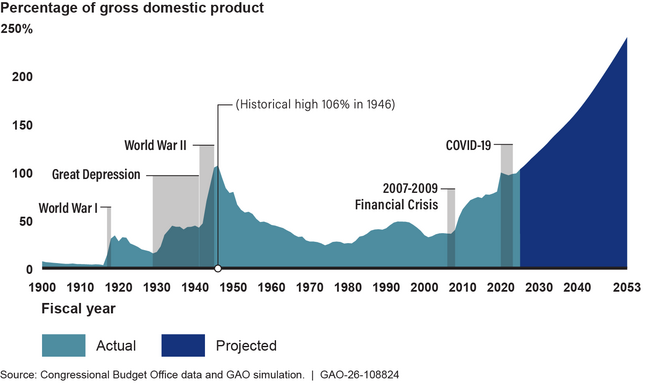

GAO has also found that the federal government is on an unsustainable fiscal path. Debt held by the public as a share of gross domestic product (GDP) is projected to hit its historical high in fiscal year 2027 and grow at a faster rate than GDP over the long term. Perpetually rising debt as a share of GDP has many implications for the economy, American households, and individuals. Risks include slower economic growth and increased chances of a fiscal crisis.

Debt Held by the Public Projected to Grow Faster than GDP

GAO has recommended that Congress develop a strategy to place the government on a more sustainable fiscal path. The strategy should, among other things, incorporate fiscal rules and targets to help manage debt and address financing gaps for Social Security and Medicare Hospital Insurance. Both programs are supported by trust funds that are projected to be depleted by 2033.

A strategy would also include efforts to improve fiscal responsibility by reducing improper payments and fraud; improving tax compliance and addressing tax expenditures; rightsizing the government’s property holdings; and pursuing other efficiencies. GAO recommendations on high-risk areas and its work on fragmentation, overlap, and duplication could help inform the strategy.

- Reducing improper payments and fraud. Since fiscal year 2003, cumulative improper payment estimates reported by executive branch agencies have totaled about $2.8 trillion. This includes $162 billion for fiscal year 2024. With respect to fraud, GAO estimates that the federal government loses between $233 billion and $521 billion annually, based on data from fiscal years 2018 through 2022. GAO has recommended many actions Congress and the executive branch could take to address improper payments and fraud risks. These include enhancing identity verification through data sharing, restoring fraud-related reporting requirements for agencies, and developing fraud estimates for highly vulnerable programs.

- Implementing a complete inventory of federal programs. A comprehensive inventory of programs—with related funding and performance information—would be a critical tool to help decision-makers better identify and manage fragmentation, overlap, and duplication. While important progress has been made, the federal government has not yet fully developed such an inventory. GAO has recommended the Office of Management and Budget articulate plans on how and when it will complete a comprehensive inventory.

Why GAO Did This Study

The federal government is one of the world’s largest and most complex entities, spending trillions of dollars across a broad array of programs and operations. The size, scope, and complexity of the federal government create inherent risks that need to be recognized and managed properly.

Since 1990, GAO has used its High-Risk Series to help Congress focus on high-risk issues that need immediate and sustained attention. Efforts to address high-risk issues have resulted in more than $811 billion in financial benefits. Progress on high-risk areas has also resulted in many other beneï¬ts, such as improved public safety, security, and service delivery. But progress across areas has varied.

The fiscal condition of the federal government also presents risks and challenges that must be confronted. Nearly every year this century, the government has spent more than it collected in revenue. To finance these deficits the government has had to borrow by issuing debt. The federal government’s level of debt and the annual amount of interest it pays on the debt are quickly approaching unprecedented levels relative to the size of the economy.

This statement focuses on (1) high-risk areas needing significant attention and (2) fiscal challenges facing the nation. It also highlights actions that Congress and the administration can take to address these risks and challenges.

This statement is based primarily on reports published from February 2025 through December 2025, with selected updates.

For more information, contact: Jeff Arkin at arkinj@gao.gov or Jessica Lucas-Judy at lucasjudyj@gao.gov.