Puerto Rico: IRS Should Improve Oversight of Taxpayers Claiming Exemption from Federal Taxes

Fast Facts

In 2012, Puerto Rico enacted tax incentives to encourage relocation to and investment in Puerto Rico, including preferential tax rates on investment and export service income. Puerto Rico residents can also receive a federal income tax exemption if they meet certain requirements.

The overall effect on Puerto Rico’s economy of the incentives is difficult to isolate.

We found that, on average, incentive recipients were high-income and paid significantly less federal tax after moving to Puerto Rico.

We found weaknesses in IRS's oversight of the federal tax exemption and recommended ways to help IRS obtain relevant data and improve compliance.

The Capitol Building in San Juan, Puerto Rico

A large stone building with colonnades across the front and a large central dome on the roof. It stands against a bright blue sky, behind a row of palm trees punctuated by the U.S. and Puerto Rico flags.

Highlights

Para la versión de esta página en español, ver a GAO-26-108642.

What GAO Found

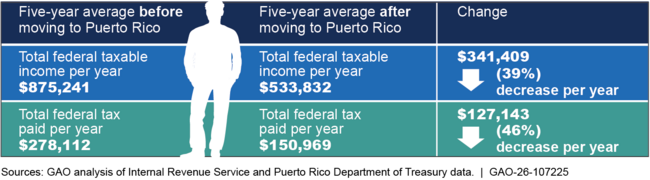

In 2021, the most current year for which GAO had complete data, there were approximately 2,200 recipients of the Puerto Rico resident investor tax incentive. GAO’s analysis found a significant decrease in the average federal taxable income and federal taxes paid by this population between the 5 years prior to and up to 5 years after moving to Puerto Rico (see figure). GAO’s analysis found that the decrease in federal tax revenue in aggregate could amount to hundreds of millions of dollars per year.

Figure: Average Total Federal Taxable Income and Total Federal Taxes Paid by Taxpayers Receiving the Puerto Rico Resident Investor Tax Incentive

Note: Dollar amounts are inflation-adjusted 2023 dollars.

Additionally, from 2012 through 2024, almost 4,000 taxpayers received Puerto Rico’s business export service tax incentive. The effect of the resident investor and business export service incentives on Puerto Rico’s economy is difficult to isolate as the evidence is mixed on the overall costs and benefits. This is, in part, due to recipients representing a small fraction of Puerto Rico’s population. Some economic studies undertaken for the Puerto Rico government suggest an increase in economic activity and employment related to the tax incentives while local perspectives and migration data suggest mixed results.

In 2021, the Internal Revenue Service (IRS) announced a compliance initiative, called a campaign, to address concerns that some recipients of Puerto Rico’s resident investor incentive may not be meeting their federal tax obligations. The campaign only recently began showing results, in part, due to the complexity of high-income and high-wealth audits, IRS not prioritizing the effort, and communication gaps between IRS and Puerto Rico. Until 2025, IRS was unable to obtain complete data on taxpayers claiming Puerto Rico’s resident investor incentive with Social Security numbers to help ensure compliance with federal tax laws. Further, IRS has no documented plan to routinely acquire the most current data from Puerto Rico going forward. Obtaining such data regularly would improve IRS’s ability to ensure compliance.

Additionally, IRS did not pursue referrals from Puerto Rico government officials who identified U.S. taxpayers whom officials could not confirm met Puerto Rico’s residency requirement. IRS also does not have a plan to prioritize any future referrals. GAO analyzed these referrals along with IRS data and identified taxpayers with indicators of potential noncompliance with federal tax law, which GAO shared with IRS. Establishing procedures to review cases of potential noncompliance identified by Puerto Rico government agencies could help IRS improve federal tax compliance.

Why GAO Did This Study

In 2012, Puerto Rico enacted the resident investor (Act 22) and export service business (Act 20) tax incentives to encourage relocation to and investment in Puerto Rico. Federal law generally exempts residents of Puerto Rico from federal income tax on income sourced from Puerto Rico. IRS is responsible for ensuring that taxpayers claiming Puerto Rico’s resident investor incentive are meeting their federal tax obligations.

GAO was asked to review the Puerto Rico resident investor and export service business tax incentives. This report (1) describes the population receiving tax incentives, (2) describes selected economic effects of these tax incentives on Puerto Rico’s economy, and (3) assesses IRS efforts to ensure compliance among U.S. persons relocating to Puerto Rico and claiming residency.

GAO analyzed IRS and Puerto Rico documentation and data and interviewed relevant officials. GAO also interviewed local officials, economic development firms, and stakeholder groups.

Recommendations

GAO is making three recommendations to IRS, including that it establish procedures to regularly obtain data on all taxpayers claiming Puerto Rico’s resident investor incentive and procedures to review cases of potential noncompliance referred to IRS by Puerto Rico government agencies. IRS agreed with all three of the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should establish procedures to regularly obtain from Hacienda current data on all recipients of the Puerto Rico resident investor incentive. These procedures could incorporate GAO's leading collaboration practices. (Recommendation 1) |

We will update the status of this recommendation when IRS provides its 180-day letter which is expected in June 2026.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should establish written procedures to review cases of potential noncompliance among recipients of the resident investor incentive that Puerto Rico government agencies identify and send to IRS. (Recommendation 2) |

We will update the status of this recommendation when IRS provides its 180-day letter which is expected in June 2026.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should take action to promote voluntary compliance, such as sending educational letters explaining key compliance requirements to taxpayers who are benefiting from Puerto Rico's resident investor incentive. (Recommendation 3) |

Implementing this recommendation would strengthen compliance and potentially generate millions of dollars in additional federal tax revenue. We will update the status of this recommendation when IRS provides its 180-day letter which is expected in June 2026.

|