Fraud and Improper Payments: Data Quality and a Skilled Workforce Are Essential for Unlocking the Benefits of Artificial Intelligence

Fast Facts

The federal government loses $233 billion–$521 billion annually to fraud, based on data from 2018-2022. We testified about AI and other tools the government can use to combat fraud.

Federal agencies have existing tools to combat fraud and other improper payments. Our prior work offered recommendations on improving and using these tools.

AI-enabled tools could also help by sifting through large volumes of data to find anomalous patterns or relationships. But they require error-free, unadulterated data. This can be hard to come by for some federal programs. And it requires a skilled workforce, another area where we have found gaps.

Highlights

What GAO Found

The federal government has many existing tools and resources to help agencies combat fraud and improper payments. GAO has recommended improvements in these areas. For example, Congress could make permanent the Social Security Administration's authority to share its full death data with the Department of the Treasury's Do Not Pay system.

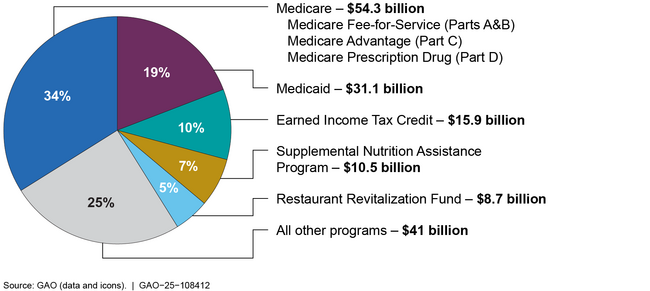

Programs Reporting the Largest Percentage of Estimated Improper Payments in Fiscal Year 2024

Note: See full report for details of payment estimates.

Artificial intelligence (AI) and other innovative technologies have the potential to enhance efforts to combat fraud and improper payments. However, these tools require high-quality data. Introducing insufficient, unrelated, or bad data will make an AI model less reliable. A system that produces errors will also erode trust in the use of AI to detect fraud. GAO's AI Accountability Framework for Federal Agencies and Other Entities includes key practices for ensuring data are high-quality, reliable, and appropriate for the intended purpose. Another potential step, which GAO recommended in 2022, is to establish a permanent analytics center of excellence focused on fraud and improper payments. Should such a center be realized, it is likely that an AI-based tool would be a key component.

An AI-ready workforce is another essential requirement if the federal government is to use this tool in the fight against fraud and improper payments. For decades, however, GAO has identified mission-critical gaps in federal workforce skills and expertise in science, technology, engineering, and mathematics. More specifically, there is a severe shortage of federal staff with AI expertise. GAO has reported that improvements may be hampered by uncompetitive compensation and the lengthy federal hiring process.

Why GAO Did This Study

GAO has reported that fraud and improper payments are estimated to have cost taxpayers trillions of dollars. These issues also impact the integrity of federal programs and erode public trust. Improper payments are payments that should not have been made or that were made in the wrong amount. Fraud involves obtaining something of value through willful misrepresentation.

The advancement of AI presents both opportunities and challenges for combatting fraud and improper payments in the federal government. This testimony describes 1) actions Congress and agencies can take to combat fraud and improper payments without the use of AI, 2) opportunities and challenges for using AI to combat fraud and improper payments, and 3) workforce challenges in the use of AI in the federal government.

For more information, contact Sterling Thomas at ThomasS2@gao.gov.