Fraud Risk Management: 2018-2022 Data Show Federal Government Loses an Estimated $233 Billion to $521 Billion Annually to Fraud, Based on Various Risk Environments

Fast Facts

No area of the federal government is immune to fraud. We estimated that the federal government could lose between $233 billion and $521 billion annually to fraud.

Given the scope of this problem, a government-wide approach is required to address it. The Office of Management and Budget, working with agencies and the oversight community, should develop guidance to improve fraud-related data—providing a more uniform approach to what data is collected and how.

Also, Treasury should identify methods to expand government-wide estimates of fraud—prioritizing higher-risk program areas.

Our 3 recommendations address these and other issues.

Highlights

What GAO Found

GAO estimated total direct annual financial losses to the government from fraud to be between $233 billion and $521 billion, based on data from fiscal years 2018 through 2022. The range reflects the different risk environments during this period. Ninety percent of the estimated fraud losses fell in this range.

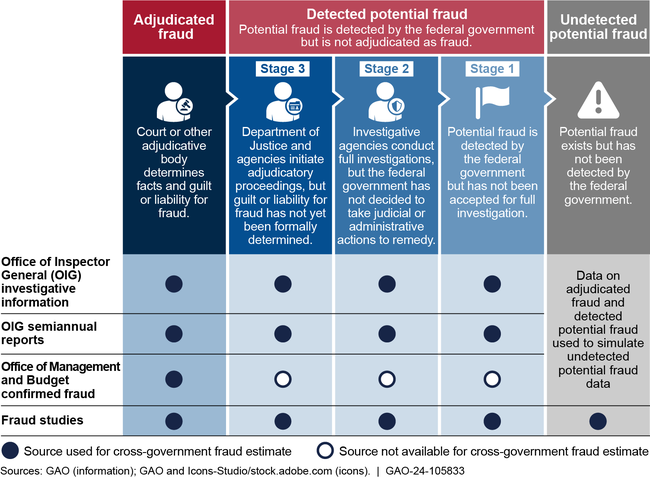

GAO collected data from three key sources to develop the estimate: investigative data, such as the number of cases sent for prosecution and the dollar value of closed cases; Office of Inspector General (OIG) semiannual report information; and confirmed fraud data reported to the Office of Management and Budget (OMB) by agencies. GAO organized these data around three fraud categories—adjudicated, detected potential, and undetected potential. Model design and validation were also informed by 46 fraud studies. OIG and other knowledgeable officials agreed with these categories and subcategories.

Categories of Fraud-Related Data Used in GAO's Estimate

GAO's approach is sensitive to the assumptions made about fraud and accounts for data uncertainty and limitations. GAO used a well-established probabilistic method for estimating a range of outcomes under different assumptions and scenarios where there is uncertainty. The estimate does not include fraud loss associated with federal revenue or fraud against federal programs that occurs at the state, local, or tribal level unless federal authorities investigated and reported it. GAO's estimate is in line with other estimates of fraud losses from the United Kingdom and Association of Certified Fraud Examiners, among others.

As a first of its kind government-wide estimate of federal dollars lost to fraud, there are known uncertainties associated with the model and underlying data important to interpreting the results. These include caveats related to

- applying the estimate to agencies or programs. GAO's model was developed to estimate government-wide federal fraud. The fraud estimate's range represents 3 to 7 percent of average federal obligations. These percentages should not be applied at the agency or program level. While every federal program and operation is at risk of fraud, the level of risk can vary substantially. Controls, growth or shrinkage of budget, and the emergence of new fraud schemes are some reasons the risk level can vary;

- drawing conclusions about pandemic fraud. GAO's estimate is based on data from fiscal years 2018 through 2022. The data include time periods and programs with and without pandemic-related spending. Therefore, the estimate includes, but is not limited to, pandemic-related spending fraud. While the upper range of the estimate is associated with higher-risk environments, it is not possible to break out a subset of our government-wide estimate to describe pandemic program fraud;

- comparing with improper payment estimates. GAO's estimate is not comparable to improper payment estimates. Improper payment estimates are based on a subset of federal programs, using a methodology not designed to identify fraud. GAO has also consistently reported that the federal government does not know the full extent of improper payments and has long recommended that agencies improve their improper payment reporting. In contrast, GAO's fraud estimate includes all federal programs and operations and is based on fraud-related data. With these differences in scope and data, the upper end of GAO's estimated fraud range exceeded annual improper payment estimates; and

- assuming the estimate is predictive. GAO's estimate is not based on a predictive model. Factors such as the amount of emergency spending, the effectiveness of federal fraud risk management, and the nature of new fraud threats could substantially impact the scale of future fraud.

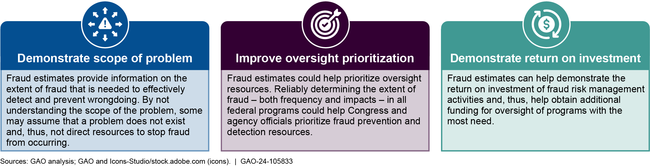

GAO has previously issued Matters for Congressional Consideration and recommendations to improve agencies' program integrity, including fraud risk management. Fraud estimation provides opportunities to improve fraud risk management, according to OIG and agency officials. For example, estimates can demonstrate the scope of the problem, improve oversight prioritization, and help determine the return on investment from fraud risk management activities. While it is not possible to eliminate fraud, with a better understanding of the costs, agencies will be better positioned to manage the risk.

How Fraud Estimates Can Improve Fraud Risk Management

OIG and agency officials noted challenges in producing fraud estimates, such as limited available fraud-related data and use of varying terms and definitions of fraud for recording data. These data gaps and variability result in information that cannot be readily compared or consolidated to determine the extent of fraud across the federal government. Guidance for collecting and reporting fraud-related data is currently limited to OIG semiannual reports and confirmed fraud reported by agencies to OMB, which are not designed to support fraud estimation. With guidance targeted to the purpose of fraud estimation, agencies and OIGs would be better positioned to collect and report data on potential and adjudicated fraud in support of estimation efforts.

OIG and agency officials also noted the utility of agency or program-level estimates compared with government-wide estimates. They further noted the need for expertise and data-analytics capacity to produce estimates. GAO previously reported that agencies identified limitations in expertise, data, and tools as a significant challenge for their fraud risk management efforts. These challenges could also impact agencies' ability to develop effective fraud estimates at a program or agency level. The Department of the Treasury's Office of Payment Integrity (OPI) supports agencies facing such challenges. OPI's resources are dedicated to preventing and detecting improper payments through a variety of data-matching and data-analytics services. Therefore, OPI is well positioned—with the expertise, data, and analytic tools—to evaluate and advance methods that the federal government can take to estimate fraud in support of fraud risk management.

Why GAO Did This Study

All federal programs and operations are at risk of fraud. Therefore, agencies need robust processes in place to prevent, detect, and respond to fraud. While the government obligated almost $40 trillion from fiscal years 2018 through 2022, no reliable estimates of fraud losses affecting the federal government previously existed.

As part of GAO's work on managing fraud risks, this report (1) estimates the range of total direct annual financial losses from fraud based on 2018-2022 data and (2) identifies opportunities and challenges in fraud estimation to support fraud risk management.

GAO estimated the range of total direct annual financial losses from fraud based on 2018-2022 data using a Monte Carlo simulation model. GAO identified opportunities and challenges through interviews and data collection focused on 12 agencies representing about 90 percent of federal obligations.

Recommendations

GAO is making two recommendations to OMB—one in collaboration with the Council of the Inspectors General on Integrity and Efficiency (CIGIE) and the other with agency input to improve the availability of fraud-related data. GAO is also making a recommendation to the Department of the Treasury to expand government-wide fraud estimation, in consultation with OMB. OMB generally agreed with the recommendations but disagreed with the estimate. GAO believes the estimate is sound, as discussed in the report. CIGIE stated it would work with OMB to consider how OIGs might improve fraud-related data. Treasury agreed with the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of Management and Budget |

Priority Rec.

The Director of the Office of Management and Budget, in collaboration with the Council of the Inspectors General on Integrity and Efficiency, should develop guidance on the collection of Office of Inspector General (OIG) data to support fraud estimation. The guidance should (1) identify and establish consistent data elements and terminology for use across OIGs; (2) include a timeline for implementation and key milestones; and (3) leverage existing data systems and processes, as appropriate. (Recommendation 1) |

In response to our recommendations, OMB acknowledged the need for improved data collection and reporting at the agency and program levels. OMB also informed us that it had been in touch with CIGIE to determine appropriate next steps regarding our recommendations. As of March 2025, OMB did not have an update on the status of this recommendation. To fully implement these recommendations, OMB will need to work with the oversight community to develop a plan--with timelines for implementation--for collecting consistent fraud-related data.

|

| Office of Management and Budget |

Priority Rec.

The Director of the Office of Management and Budget, with input from executive branch agencies, should develop guidance on the collection of executive agency data to support fraud estimation. The guidance should (1) identify and establish consistent data elements and terminology for use across agencies; (2) include a timeline for implementation and key milestones; and (3) leverage existing data systems and processes, as appropriate. (Recommendation 2) |

In response to our recommendations, OMB acknowledged the need for improved data collection and reporting at the agency and program levels. As of March 2025, OMB did not have an update on the status of this recommendation. To fully implement these recommendations, OMB will need to work with agencies to develop a plan--with timelines for implementation--for collecting consistent fraud-related data.

|

| Department of the Treasury |

Priority Rec.

The Secretary of the Treasury, in consultation with the Office of Management and Budget, should establish an effort to evaluate and identify methods to expand government-wide fraud estimation to support fraud risk management. This effort should (1) initially prioritize program areas at increased risk of fraud; (2) be responsive to changes in the availability or quality of data; and (3) leverage data-analytics capabilities, such as within the Office of Payment Integrity, which includes the Do Not Pay program. (Recommendation 3) |

Treasury indicated that it concurred with our recommendation that it establish an effort to evaluate and identify methods to expand government-wide fraud estimation to support fraud risk management. With more targeted estimates, agencies would be better positioned to leverage this information to strategically manage fraud risk. In May 2025, Treasury officials provided an update to GAO and stated that they were exploring fraud estimation approaches to address the recommendation. We will continue to monitor Treasury's progress with this effort.

|