COVID-19 Relief: Treasury Could Improve Compliance Procedures and Guidance for State and Local Fiscal Recovery Funds

Fast Facts

Treasury awarded billions of dollars to state and local governments to help cover COVID-19 costs.

But thousands of those recipients missed deadlines for reporting how they spent funds. And over 1,000 of them never submitted a report. Treasury issued notices and reached out via newsletters, webinars, and more. But reporting was still inconsistent.

Treasury can recoup money from recipients that don’t comply with reporting requirements, but it’s unclear when it will do so.

Highlights

What GAO Found

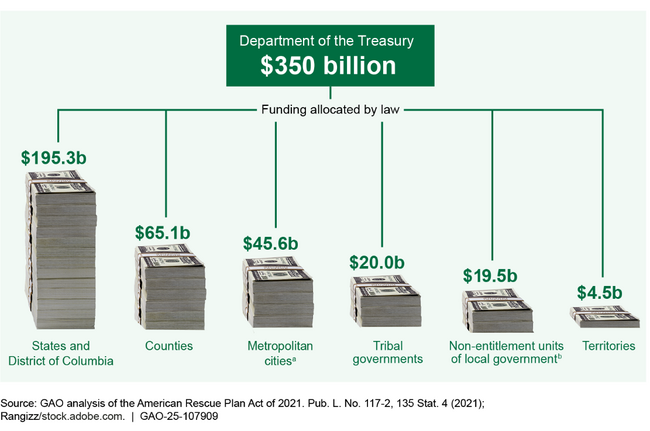

The Coronavirus State and Local Fiscal Recovery Funds (SLFRF) program, established under the American Rescue Plan Act of 2021, provided $350 billion to tribal governments, states, the District of Columbia, U.S. territories, and more than 30,000 local governments to cover a broad range of costs stemming from the health and economic effects of the COVID-19 pandemic. The Department of the Treasury is responsible for overseeing and monitoring recipients’ funds.

Allocations of Coronavirus State and Local Fiscal Recovery Funds by Recipient Type

aA metropolitan city is defined as the central city within a metropolitan area (i.e., a standard metropolitan statistical area as established by the Office of Management and Budget) or any other city within a metropolitan area that has a population of 50,000 or more. 42 U.S.C. §§ 803(g)(4), 5302(a)(4). A metropolitan city includes cities that relinquish or defer their status as a metropolitan city for purposes of receiving allocations under section 5306 of Title 42, United States Code, for fiscal year 2021.

bNon-entitlement units of local government (NEU) are local governments typically serving populations of less than 50,000. 42 U.S.C. §§ 803(g)(5), 5302(a)(5). NEUs include cities, villages, towns, townships, or other types of local governments.

To ensure state and local recipients use their awards for allowable purposes, Treasury developed reporting requirements for recipients to detail their uses of funds. Since 2022, Treasury has required recipients to submit project and expenditure (P&E) reports to provide information on how they used their awards, including obligations and spending amounts.

Over 1,000 SLFRF recipients—primarily smaller local governments—had never submitted a P&E report, as of January 2025. Individual awards for these recipients ranged from less than $1,000 to a high of $7.8 million. Additionally, thousands of SLFRF recipients did not report consistently across reporting cycles between 2022 and 2024. For example, recipients submitted reports for one reporting cycle, but not for subsequent cycles.

To ensure compliance with the requirements, Treasury has issued notices of noncompliance and conducted targeted outreach to those recipients that have not submitted reports. However, reporting has remained inconsistent, with thousands of recipients failing to submit a P&E report for multiple reporting cycles.

Treasury’s procedures allow Treasury to initiate recoupment with recipients that do not comply with reporting requirements, but the procedures do not require it based on specific timing or circumstances. Treasury has initiated recoupment with 988 recipients—accounting for about $139 million in collective awards—that had never submitted a report, as of January 2025. Of those, 339 recipients subsequently submitted a report between January and March 2025 for the first time since reporting began in January 2022. However, Treasury has not initiated recoupment with the thousands of other recipients that have not complied with the reporting requirements.

Developing procedures to document the timing and circumstances for recoupment would position Treasury to consistently take appropriate and timely action for recipients that do not meet reporting requirements and provide consistent oversight of the use of taxpayer funds. In addition, communicating to recipients through guidance the circumstances in which Treasury will initiate recoupment may increase recipients’ compliance with reporting requirements.

Why GAO Did This Study

Overall, SLFRF allocated $350 billion to tribal governments, states, the District of Columbia, local governments, and U.S. territories to help cover a broad range of costs stemming from the health and economic effects of the COVID-19 pandemic.

The CARES Act includes a provision for GAO to monitor the use of federal funds to respond to the COVID-19 pandemic. This report addresses the reporting requirements that SLFRF recipients are to meet and the extent to which Treasury ensures compliance with these reporting requirements.

To conduct this work, GAO reviewed laws and regulations governing the SLFRF program and Treasury SLFRF program guidance, policies, and procedures for meeting reporting requirements. To identify SLFRF recipients’ compliance with reporting requirements in 2022-2024, GAO analyzed Treasury’s P&E report data for each of those 3 years. GAO excluded tribal governments and U.S. territories from the review. To describe Treasury’s actions for SLFRF recipients that do not submit required reports, GAO reviewed notices Treasury sent to recipients and interviewed Treasury officials.

Recommendations

GAO recommends that Treasury develop and document, in Treasury’s internal procedures and guidance for recipients, the timing and circumstances under which it will initiate recoupment for recipients that have not met SLFRF reporting requirements. Treasury generally agreed with the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury should develop and document, in Treasury's internal procedures and guidance for recipients, the timing and circumstances under which Treasury will initiate recoupment of awards for recipients that have not met SLFRF reporting requirements. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|