Tobacco Taxes: Federal Revenue Implications of Tax Rate Differences and Drawback Refunds

Fast Facts

Pipe tobacco and some large cigars are taxed at lower rates than cigarettes, roll-your-own tobacco, and small cigars. As a result, the federal government is not collecting the revenue it would if taxes were the same for these smoking tobacco products. For example, the government could raise at least an additional $1.5 billion over 5 years if tax rates for pipe tobacco and roll-your-own tobacco were equal.

As smoking rates have declined, revenue from tobacco taxes has also decreased. With consumers choosing more e-cigarettes and oral nicotine pouches—neither of which is federally taxed—this revenue could decline further.

Highlights

What GAO Found

After the enactment of the Children’s Health Insurance Program Reauthorization Act (CHIPRA) of 2009, large tax rate differences among similar smoking tobacco products led to market shifts among these products. Specifically, CHIPRA increased tax rate differences between roll-your-own and pipe tobacco and between small cigars and some large cigars, creating opportunities for tax avoidance and leading manufacturers and consumers to substitute lower-taxed tobacco products for higher-taxed ones. These trends have continued, and the generally lower-taxed products—pipe tobacco and large cigars—have remained the top products in their respective markets.

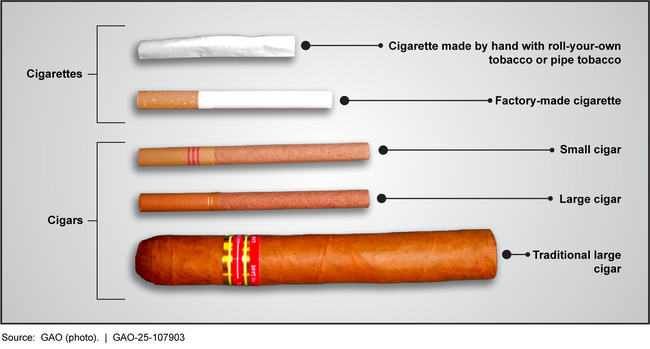

Examples of Cigarette and Cigar products

Federal revenue from tobacco excise taxes has decreased from about $14 billion in fiscal year 2014 to $9 billion in fiscal year 2024 as sales of smoking tobacco products have declined. In addition, the extent to which the increased use of e-cigarettes and oral nicotine pouches has affected the market for traditional smoking tobacco products is unknown.

Federal revenue would likely increase if Congress were to increase the tax rate for pipe tobacco to match the current rate for roll-your-own tobacco. GAO estimated that if the tax rate for pipe tobacco were the same as the roll-your-own tobacco rate, the federal government could collect at least $1.5 billion dollars in additional revenue for both products from fiscal year 2025 through fiscal year 2029.

Similarly, federal revenue would likely increase if the minimum tax rate for large cigars were the same as the small cigar rate. However, a precise estimate is challenging to determine because of limited information about the retail prices of large cigars and consumer response to increased taxes.

Further, companies have filed more drawback claims since the Trade Facilitation and Trade Enforcement Act of 2015 modernized and generally expanded eligibility for the drawback program, according to CBP officials. Drawbacks are refunds of up to 99 percent of duties, taxes, or fees paid on imports and may be requested by companies that export similar, qualifying goods. CBP refunded a total of $312 million in federal taxes through drawbacks for smoking tobacco products from fiscal year 2019 through fiscal year 2024. Since fiscal year 2020, companies have requested increasing amounts of drawback refunds for these products. In fiscal year 2024, these drawback refund requests totaled approximately $392 million.

Why GAO Did This Study

By increasing gaps in the tax rates for smoking tobacco products that are similar to each other, CHIPRA created opportunities for tax avoidance through the substitution of lower-taxed tobacco products for higher-taxed ones. Specifically, CHIPRA increased the federal excise tax rate on small cigarettes and set equivalent rates on roll-your-own tobacco and small cigars, which can be close substitutes for factory-made cigarettes. Although CHIPRA also increased the federal excise tax rates for pipe tobacco and large cigars, the tax rates for cigarettes, roll-your-own tobacco, and small cigars are generally higher.

In 2012, 2014, and 2019, GAO reported that sales of lower-taxed pipe tobacco and large cigars saw immediate and significant growth following CHIPRA. In addition, GAO estimated the amount of revenue lost by the federal government because of these market shifts.

As part of GAO’s work on duplication, overlap, fragmentation, cost savings, and revenue enhancement in response to a provision in statute, GAO examined, among other things, (1) how much additional revenue the federal government could collect if tobacco tax rate disparities were eliminated and (2) how much revenue the federal government refunds to companies through qualified drawback claims for taxes paid on tobacco imports that are later exported or destroyed.

GAO analyzed sales and revenue data about smoking tobacco products from the Department of the Treasury and Customs and Border Protection (CBP), interviewed industry experts and agency officials, and summarized literature about these products and alternatives. GAO also modeled the effects on revenue of equalizing the tax rates for pipe tobacco and roll-your-own tobacco and establishing a minimum tax rate for large cigars equal to the small cigar tax rate. In addition, GAO analyzed CBP data about drawback refunds requested and finalized for smoking tobacco products.

Recommendations

In 2012, GAO recommended that Congress consider equalizing tax rates on roll-your-own tobacco and pipe tobacco and, in consultation with the Department of the Treasury, consider options for reducing tax avoidance related to the different tax rates for small and large cigars. As of July 2025, Congress had not passed legislation to reduce or eliminate tax differentials between smoking tobacco products.