Disaster Loan Program: SBA Should Include Key Issues in Its Review of How the Program Affects Underserved Communities

Fast Facts

The Small Business Administration's Disaster Loan Program helps homeowners, renters, and businesses recover from disasters that can cause billions of dollars in damage each year.

SBA has identified lending criteria—such as credit history—as one barrier to loan access in underserved communities, like those with high poverty rates. For 13 hurricanes in fiscal years 2018-2022, we found that SBA approved applicants from some underserved communities less often than other applicants.

SBA plans to review whether any of its current practices result in unequal access. But it doesn't plan to assess its lending criteria. Our recommendation addresses this.

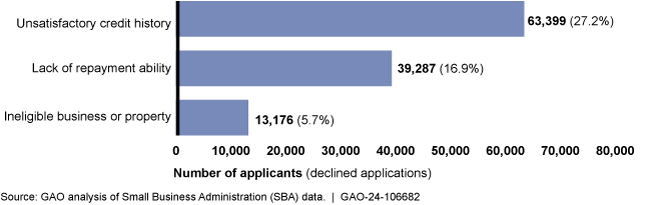

Top Reasons for SBA Declining Disaster Loan Applications from Survivors of 13 Hurricanes, FY 2018-2022

Highlights

What GAO Found

The Small Business Administration (SBA) has taken initial steps to improve access to the Disaster Loan Program for historically underserved communities (such as those with high poverty rates or high percentages of Black or African American, Asian, and Hispanic or Latino residents). In its 2022 Equity Action Plan, SBA identified its lending criteria, such as satisfactory credit score, as a barrier that underserved communities face in accessing the program. SBA plans to conduct a congressionally requested review to determine if any current practices provide unequal outcomes for certain underserved communities and, if so, develop recommendations to improve outcomes. However, SBA does not plan to assess its lending criteria as part of this review. Doing so would help it to better determine if changes to the criteria are needed to reduce unequal outcomes for historically underserved communities, consistent with Congress's direction.

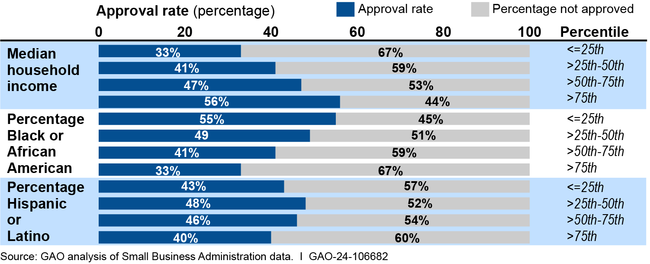

SBA declined about 40 percent of disaster loan applications for 13 hurricanes in fiscal years 2018–2022. Loan outcomes tended to be worse in communities with higher percentages of low-income and Black or African American individuals. Of the 312,916 applications SBA accepted in the first stage of its application review, SBA approved 42 percent and declined 38.6 percent. Applications were declined primarily due to insufficient credit score or lack of repayment ability. The average approval rate in communities with the lowest median household incomes was 23 percentage points lower than in communities with the highest median household incomes. The average approval rate in communities with the highest percentages of Black or African American residents was 22 percentage points lower than in communities with the lowest percentages of Black or African American residents. Results were similar for areas affected by four hurricanes in fiscal year 2017 and for Puerto Rico.

Disaster Loan Approval Rates by Socioeconomic and Demographic Characteristic in Communities Affected by 13 Hurricanes, Fiscal Years 2018–2022

Note: For each characteristic, GAO ordered the census tracts within the disaster areas from the lowest to the highest prevalence of that characteristic and divided the ordered distribution into four equal groups (quartiles). The tracts with the lowest prevalence of that characteristic fall into the lowest quartile (or <=25th percentile), while those with the highest prevalence fall into the highest quartile (or >75th percentile).

Why GAO Did This Study

Natural disasters cause billions of dollars of damage each year. Underserved communities with low levels of community resilience may be disproportionately affected. SBA's Disaster Loan Program assists homeowners, businesses, and others affected by natural and other disasters.

The Explanatory Statement to the Consolidated Appropriations Act, 2023 includes a provision for GAO to report on delivery of SBA disaster recovery support and how the needs of certain communities are addressed. This report examines (1) steps SBA has taken to improve equitable access to the Disaster Loan Program and (2) loan outcomes in and characteristics of communities in which program applicants and recipients are located.

GAO reviewed SBA policies and procedures and interviewed SBA officials. GAO also analyzed disaster loan application data for all 17 hurricanes in fiscal years 2017–2022 that caused at least $1 billion in damage. This included calculating loan outcomes and using census data to determine the demographic and socioeconomic characteristics of communities in which applicants were located. Because of the magnitude of the four fiscal year 2017 hurricanes and Puerto Rico's unique demographics, GAO analyzed those applications separately.

Recommendations

GAO recommends that SBA assess its lending criteria as part of its internal review of the Disaster Loan Program. SBA agreed, stating it would assess its lending criteria and evaluate any relevant gaps in loan outcomes.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Small Business Administration | The Administrator of SBA should ensure that the Associate Administrator of the Office of Capital Access includes in the scope of SBA's internal review of the Disaster Loan Program an assessment of its lending criteria for both businesses and homeowners and an analysis of the gaps in loan outcomes among program applicants, including those in underserved communities. (Recommendation 1) |

In May 2024, SBA stated that its Office of Capital Access (OCA) was conducting an internal assessment of disaster lending for the home and business disaster loan program, including an analysis of the gaps in loan outcomes among program applicants in underserved communities. To complete this internal assessment, SBA said that OCA had convened a Disaster Underserved Data Equity Project team of loan policy experts and data analysts to examine areas such as the following for the SBA disaster loan program: applications and approval rates by race/ethnicity, gender, veteran status, and criminal justice history. The agency expected to complete the project by the first quarter of fiscal year 2025. In that same May 2024 correspondence, SBA noted that additional context was needed to understand a key finding in the report that loan outcomes tend to be worse in communities with higher percentages of low-income or Black and African American individuals. The agency noted that in SBA's disaster loan program, disaster survivors across a broad spectrum of income levels and impacts from the event, including no property damages, were required to apply for an SBA loan in order to gain eligibility for a FEMA grant. It stated these applicants may likely prefer a quick decline decision on their SBA loan, so they may pursue the FEMA grant. We noted several places in the report that declination of an SBA disaster loan was necessary to be eligible for some FEMA grants. SBA also expressed concerned about the withdrawal codes analysis in the report, stating that SBA only withdraws an application if the data set is incomplete. For our analysis, we relied on the reasons for withdrawal outlined in SBA's Standard Operation Procedure for the Disaster Assistance Program. In May 2025, we asked SBA for the status of the internal review underway in May 2024. As of December 2025, we were awaiting information from SBA on the status of that internal review.

|