Tax Enforcement: IRS Could Better Manage Alternative Dispute Resolution Programs to Maximize Benefits [Reissued with revisions on Jun. 7, 2023]

Fast Facts

This Fast Facts has been updated to correct a reference to the percentage of decline in program use.

The IRS's alternative dispute resolution programs—which use an IRS mediator to resolve tax disputes between taxpayers and the agency—may be faster and less costly than its traditional appeals process.

But the use of these programs fell by 65% between FYs 2013-2022, and the IRS doesn't have enough data to understand why. For instance, the IRS doesn't collect data on how often it rejects taxpayers' requests to use these programs. It also doesn't collect data on the results of using some of these programs—such as the actual time and costs involved.

We recommended that the IRS improve data collection and monitoring for these programs.

Revised June 7, 2023 to correct page 10. The corrected section should read: ‘From fiscal years 2013 through 2022, data from the Appeals Centralized Database System (ACDS) show that use of ADR programs fell by 65 percent.’

Highlights

What GAO Found

The Internal Revenue Service (IRS) offers six alternative dispute resolution (ADR) programs providing mediation to expedite resolution and avoid lengthy traditional appeals and litigation processes. ADR can potentially benefit both IRS and taxpayers by reducing the time and costs to resolve disputes while increasing certainty for taxpayers in meeting their tax obligations.

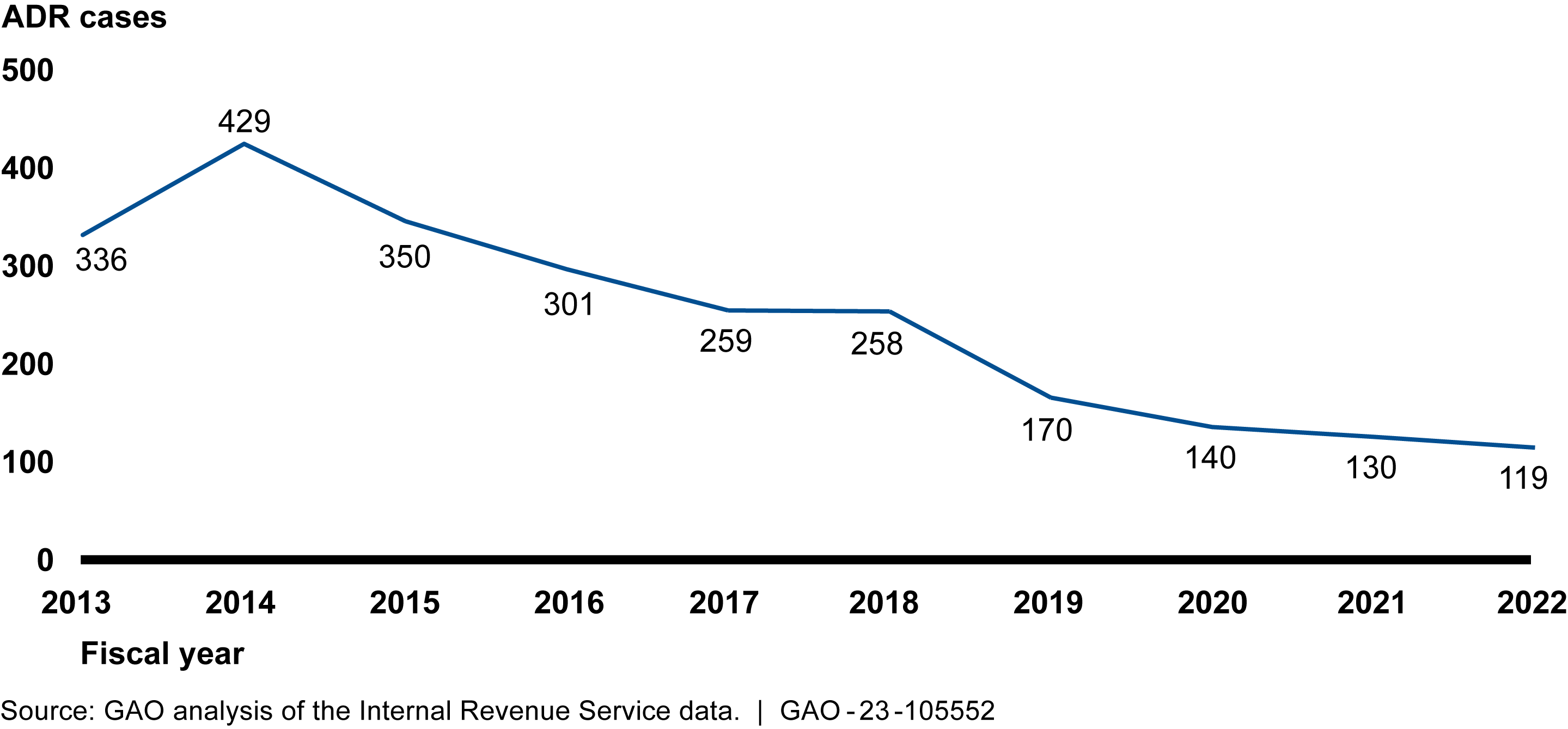

From fiscal year 2013 to 2022, IRS used ADR programs to resolve disputes in less than half of one percent of all cases reviewed by its Independent Office of Appeals, which is responsible for tracking and implementing all IRS ADR programs. During that period, use of ADR fell by 65 percent. Beyond these data on ADR usage, IRS does not have the data necessary to manage the ADR programs, such as data on taxpayer requests to use ADR; IRS' acceptance or rejection of those requests; and the results from using ADR, including rate of resolution, time, and costs. Although IRS does not know definitively why ADR usage has declined, potential reasons include that taxpayers do not perceive the benefits of using ADR, according to IRS officials.

Alternative Dispute Resolution (ADR) Cases Closed Annually, Fiscal Years 2013 to 2022

IRS is missing opportunities to use several management practices for its ADR programs to help increase taxpayers' willingness to use ADR as well as maximize the programs' benefits. IRS does not have clear and measurable objectives for its ADR programs that contribute to achieving IRS's strategic goals and objectives, such as its ability to resolve disputes over specific tax issues and reduce the investment of time and money to do so. IRS does not analyze data to assess whether ADR is achieving benefits such as resolving disputes over specific tax issues and reducing the investment of time and money to do so. IRS has not regularly monitored the taxpayer experience with ADR to address problems in real-time. Absent this information, IRS cannot assess how to improve taxpayers' willingness to use ADR as well as their experience in resolving tax disputes. In addition, IRS cannot take action on these missed opportunities to maximize ADR benefits because IRS has not established specific responsibilities and related tasks for consistently managing all elements of the ADR programs.

Why GAO Did This Study

IRS's ADR programs are intended to resolve disputes over taxes owed and to be paid between IRS enforcement staff and taxpayers more quickly and at lower cost than using the IRS appeals process or litigation. The National Taxpayer Advocate has reported that the use of ADR programs has steadily declined, while resolving disputes through the IRS appeals process is taking longer.

GAO was asked to review how IRS manages its ADR programs. This report describes IRS's ADR programs and evaluates ADR data as well as IRS's management of its ADR programs. GAO reviewed IRS ADR procedures, guidance and data; interviewed IRS and other government agency officials; and held focus groups with taxpayer representatives.

Reissued with revisions on Jun. 7, 2023

Revised June 7, 2023 to correct page 10. The corrected section should read: ‘From fiscal years 2013 through 2022, data from the Appeals Centralized Database System (ACDS) show that use of ADR programs fell by 65 percent.’Recommendations

GAO is making eight recommendations to improve how IRS manages its ADR programs, including that IRS should improve its ADR data collection, establish clear program objectives, analyze data to better achieve ADR's benefits, monitor taxpayers' experience to assess ways to improve it, and establish responsibilities and tasks for managing ADR programs. IRS generally agreed with the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should collect consistent, reliable data on what happens to taxpayer requests to use ADR as well as the results of each ADR program, such as resolutions achieved for the time and costs invested. (Recommendation 1) |

IRS generally agreed with the recommendation, tying its agreement to developing a data collection system known as Enterprise Case Management System (ECM). IRS said that as ECM implementation progresses, the IRS Independent Office of Appeals would coordinate with IRS business operating divisions (BOD) to consider what data should be collected to track taxpayer requests for ADR and the resolution of such requests. In May 2025, officials said that ECM is scheduled to come online in 2026 (June 2026 according to IRS documents). They said ECM is expected to improve IRS's ability to track and analyze all aspects of ADR programs, including personnel hours. We informed IRS that we would need documentation that IRS is collecting consistent, reliable data on what happens to taxpayer requests to use ADR as well as the ADR results. Until ECM comes online, IRS officials described actions to collect data on ADR usage and results as part of an effort to reinvigorate ADR usage after years of decline. In March 2024, IRS established the Appeals ADR Program Management Office (PMO) intended to centrally coordinate and manage change efforts and maintain a more robust ADR program across IRS. IRS officials said that IRS may be taking steps to track data on the denials of taxpayers' requests to use ADR. In May 2025, IRS officials said they had recently begun to collect data on Fast Track program requests and denials handled by the BODs. Officials said that IRS already had data to track requests and denials for ADR that originate in Appeals. IRS provided a sample data report, but it did not clearly break out and report the number of denials and other types of outcomes for taxpayers' ADR requests. If managed effectively, ADR programs can help taxpayers and IRS avoid or shorten the appeals process to resolve disputes without time-consuming, costly litigation. We will continue to monitor progress and periodically update this status as IRS documents its actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should establish objectives for ADR programs in clear, measurable terms. (Recommendation 2) |

IRS generally agreed with the recommendation but, in commenting on our report, focused on the existing limited, general statements about ADR programs' objectives that we found often lacked measurable terms and did not cover all the ADR programs. IRS later provided documentation that it agreed to consider necessary action. In February 2024, IRS officials said they were drafting objectives for ADR programs as well as the related measures to track progress as part of establishing the Appeals ADR Program Management Office (PMO). In May 2025, IRS officials provided the PMO charter that, rather than stating the desired, measurable results of ADR programs, stated objectives generally limited to the PMO's purposes and tasks in terms that were not clearly measurable. For example, the charter stated PMO objectives to establish continuity of oversight and administration of ADR programs, develop robust data collection and analysis methodologies for ADR, and communicate the availability of ADR to taxpayers. The charter stated two goals that could be measurable, specifically to facilitate certainty and case resolutions at an earlier stage in the audit/collections process, and to increase usage of ADR as a time-efficient and cost-effective means of resolving cases. However, the charter had no measures to align with them. Also in May 2025, IRS officials again referred to the Internal Revenue Manual (IRM) as already stating ADR programs' objectives and provided an example IRM ADR program section. As we reported, the IRM and other ADR program documents were not always consistent and clear about ADR programs' objectives in measurable terms. The example IRM section that IRS provided demonstrated a finding in our report -- that is, the IRM did not directly state a program's objectives, but instead asserted its benefits achieved. IRS provided no measures to assess the program's actual performance. As we reported, management should define objectives clearly in specific and measurable terms. Having clear program objectives that are stated in measurable terms can help IRS identify, analyze, and respond to risks to ADR programs and assess program performance. If managed effectively, ADR programs can help taxpayers and IRS avoid or shorten the appeals process to resolve disputes without time-consuming, costly litigation. We will update this status after we receive documentation on specific actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should link the ADR program objectives to the IRS strategic goals and objectives that the programs support. (Recommendation 3) |

IRS generally agreed with the recommendation and referred to IRS's April 2023 Inflation Reduction Act Strategic Operating Plan. IRS said its Independent Office of Appeals would coordinate with the IRS business operating divisions and the IRS Transformation and Strategy Office to consider how the objectives of the ADR program align with IRS's related strategic objective in the Plan. Without clear objectives for ADR programs (per recommendation 2), IRS cannot link them to the Plan's objective. IRS provided documents in May 2025 that indicated its intent to link ADR program objectives to the Plan's strategic objective to quickly resolve taxpayer issues when they arise, and the Plan's specific initiative to expand tax certainty and issue resolution programs. Having ADR program objectives clearly linked to strategic objectives as described in the Plan could provide the foundation for reinvigorating ADR programs. If managed effectively, ADR programs can help taxpayers and IRS avoid or shorten the appeals process to resolve disputes without time-consuming, costly litigation. We will update this status after we receive documentation of any actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should regularly analyze data on the use and results of ADR to make real-time decisions to improve performance, as appropriate. (Recommendation 4) |

IRS generally agreed with the recommendation but tied its agreement to developing a data collection system known as Enterprise Case Management System (ECM), which is slated for implementation by June 2026 (see recommendation 1). IRS said that the IRS Independent Office of Appeals would coordinate with the IRS business operating divisions to consider how data can be collected in ECM and how data analytics can be used to draw conclusions about the use and results of ADR. In the interim, IRS officials described efforts to analyze existing ADR data. In May 2025, they said the Appeals ADR Program Management Office (PMO) analyzes existing data monthly to make ongoing data-driven program decisions. Officials provided an example where IRS data indicated that the use of the Small Business/Self-Employed division's (SB/SE) Fast Track Settlement (FTS) program was not increasing as much as desired. IRS began developing training for SB/SE staff and planning to implement a SB/SE pilot in which the PMO is to contact taxpayers directly to offer FTS. The pilot is to help ensure taxpayers are aware of the FTS option and gauge how such information impacts decision making. IRS's ongoing efforts to reinvigorate and improve management of ADR could benefit from regular analysis of data on the use and results of ADR. We will continue to monitor progress and periodically update this status as IRS provides documentation on any actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should regularly monitor ADR program operations with a focus on soliciting and using taxpayer feedback on the quality of their experiences with ADR. (Recommendation 5) |

IRS generally agreed with the recommendation and referred to existing Independent Office of Appeals efforts to survey taxpayers on their ADR experience. IRS officials said the Independent Office of Appeals would coordinate with the IRS business operating divisions to consider potential further efforts to solicit taxpayer feedback on ADR programs. In May 2025, officials said that IRS had begun administering post-ADR customer satisfaction taxpayer surveys, but that the Department of Treasury terminated the survey contract in April 2025. IRS said it was trying to use the data that had been collected and seeking alternative ways to continue to obtain taxpayer feedback through surveys. Officials also referred to ongoing outreach to practitioners through IRS's participation in speaking events and classes where it solicits and obtains feedback from practitioners and the taxpayers they represent. Officials also referred to the Appeals ADR Program Management Office's email mailbox where taxpayers and practitioners can convey their experiences and suggest ADR improvements. However, IRS provided no information on feedback results or how IRS planned to analyze and use any of these data as taxpayer feedback on their experiences with ADR. According to IRS documentation, IRS plans to implement this recommendation by June 2026. IRS's ongoing efforts to reinvigorate and improve management of ADR could benefit from taxpayer feedback on their ADR experiences. If managed effectively, ADR programs can help taxpayers and IRS avoid or shorten the appeals process to resolve disputes without time-consuming, costly litigation. We will update this status after we receive documentation on actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should establish a neutral IRS resource to communicate with taxpayers to answer questions about IRS's Fast Track programs. (Recommendation 6) |

IRS agreed to consider establishing a separate neutral mechanism to address taxpayer questions about the ADR programs, noting that IRS's website and publications describe the programs and that independent Appeals staff are available to answer taxpayers' questions. Our report acknowledged that taxpayers used the IRS resources as well as asked IRS enforcement staff about how ADR worked but pointed out that some taxpayers still had questions. In February 2024, officials described creating an Appeals ADR Program Management Office (PMO) to provide a neutral resource for taxpayers. In May 2025, IRS provided documentation showing completed actions to implement the recommendation. IRS provided the charter that established the PMO, which stated that the PMO is to serve as a neutral party to communicate with taxpayers about ADR, including Fast Track programs. IRS also provided documentation that in January 2025, IRS announced it had established an PMO email mailbox to publicize its availability for Fast Track programs and ADR in general so that taxpayers could communicate with PMO staff about ADR. Furthermore, in June 2025, IRS published an Internal Revenue Manual section that states the PMO's responsibility to be a central, neutral point of contact for internal and external ADR program inquiries. As a result of taking these actions as we recommended, a neutral source to answer questions can help taxpayers make informed decisions about whether to use ADR. With such access to an independent IRS party that is not a disputant, taxpayers may be more likely to receive clear answers to their questions and make informed decisions about whether to use ADR, and Fast Track in particular. In turn, taxpayers may be more likely to use ADR. Such steps to more effectively manage ADR programs can help taxpayers and IRS avoid or shorten the appeals process to resolve disputes without time-consuming, costly litigation.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should conduct periodic evaluations of the ADR programs to identify actions needed to improve their performance in achieving objectives. (Recommendation 7) |

IRS agreed with the recommendation and said the Chief, IRS Independent Office of Appeals would coordinate with the IRS business operating divisions to establish and implement a process for conducting periodic reviews of ADR programs. In February 2024, officials described development of a planned Appeals ADR Program Management Office (PMO) to be responsible for conducting periodic evaluations of ADR programs to identify actions needed to improve their performance in achieving objectives. As of July 2025, IRS had provided no documentation on the regular schedule for such periodic evaluations or plans to conduct them, to include data to be collected and analysis methods. In May 2025, IRS officials provided documentation that the PMO had been established. In June 2025, IRS published Internal Revenue Manual guidance to state the PMO's responsibility to conduct periodic evaluations of the ADR programs to identify actions needed to improve their performance in achieving objectives. Furthermore, officials said that actions on this recommendation are partially dependent on progress with implementing a data collection system known as Enterprise Case Management System (ECM), as discussed in recommendation 1. Actions on this recommendation also depend on IRS establishing objectives for ADR programs in clear, measurable terms (see recommendation 2). Doing periodic evaluations of the ADR programs can help IRS identify actions needed to improve performance. If managed effectively, ADR programs can help taxpayers and IRS avoid or shorten the appeals process to resolve disputes without time-consuming, costly litigation. We will update this status after we receive documents on any actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should establish clear responsibility and related tasks for managing ADR programs, including the practices in the above recommendations, to help ensure that the programs maximize the benefits of using ADR. (Recommendation 8) |

IRS agreed with the recommendation and said it would clarify roles and responsibilities for managing ADR programs, noting that jurisdiction over the ADR programs is shared among Appeals and the IRS business operating divisions (BOD). In February 2024, IRS officials described development of an Appeals ADR Program Management Office (PMO) to be staffed with a manager given clear responsibility for tasks related to managing ADR programs. In May 2025, IRS provided documentation showing completed actions to implement the recommendation. Specifically, the PMO's charter identified its responsibilities for centralized management of ADR programs in coordinating with the BODs, including collecting consistent and reliable information regarding ADR requests, denials, timing, and case resolutions; and ensuring alignment of ADR programs with IRS's strategic goals and objectives. Furthermore, in June 2025, IRS published Internal Revenue Manual guidance that states the PMO's responsibilities to be a central, neutral point of contact for internal and external ADR program inquiries; conduct periodic evaluations of the ADR programs to identify actions needed to improve their performance in achieving objectives; and compile and interpret feedback to improve customer satisfaction with ADR programs. IRS's ongoing efforts to reinvigorate ADR will benefit by establishing such clear responsibility and related tasks for managing ADR programs as we recommended. Such steps to more effectively manage ADR programs can help taxpayers and IRS avoid or shorten the appeals process to resolve disputes without time-consuming, costly litigation.

|