Paid Tax Return Preparers: IRS Efforts to Oversee Refundable Credits Help Protect Taxpayers but Additional Actions and Authority Are Needed

Fast Facts

IRS estimated that $26 billion in refundable tax credits were for the wrong amount or missing documentation in FY 2021. Millions of taxpayers claimed these credits and about half used a paid preparer to complete their returns.

IRS doesn't have the authority to establish professional requirements for all paid tax preparers, so it created a program to educate preparers who submit returns with tax credit errors. IRS's program aims to improve the accuracy of tax returns, but it can only reach a small fraction of paid preparers.

We made recommendations to help Congress and IRS strengthen this program and address issues with paid preparers.

Highlights

What GAO Found

The Internal Revenue Service (IRS) designed the Refundable Credits Return Preparer Strategy program to address improper payments associated with refundable tax credits and other benefits. This program includes tailored education and enforcement actions for paid preparers identified as having returns filed with a high probability of errors. The program aims to change the behavior of paid preparers and their clients and improve the accuracy of returns claiming these credits.

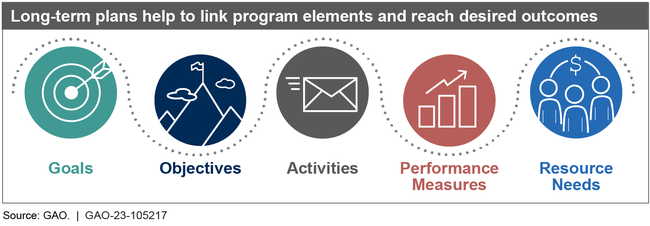

IRS has yet to develop a long-term plan that identifies and links long-term goals, objectives, activities, and performance measures for this program. Instead, program officials have focused on the operation of the program on a year-to-year basis. This includes ensuring preparers at risk of noncompliance are assigned to appropriate compliance actions. However, a long-term plan would provide a road map to help ensure that decisions align with program goals and inform budget requests and resource decisions. Without a long-term plan, program officials will continue to be limited in their ability to plan strategically.

IRS identified a need for an IRS-wide tax return preparer strategy that would ensure consistent treatment of all preparers across different compliance programs. However, progress on the IRS-wide strategy stalled. Thus, how the Refundable Credits Return Preparer Strategy program fits into a broader service-wide strategy remains unclear. IRS officials noted that the strategy cannot be finalized until the IRS-wide reorganization is completed. IRS received significant additional funding as part of the Inflation Reduction Act of 2022. The agency is developing a detailed spend plan for these funds. Officials reported that the IRS-wide strategy was still under consideration within IRS's reorganization. However, until the IRS reorganization is complete and the IRS-wide preparer strategy is implemented, IRS may be missing opportunities to capitalize on prior planning efforts.

While the Refundable Credits Return Preparer Strategy program helps encourage preparer compliance with due diligence requirements, the challenge with preparer accuracy is much broader. IRS data show the program can reach a small fraction—less than 2 percent in 2021—of preparers with education and enforcement activities. Further, tax preparers are not held to uniform standards because IRS lacks the authority to establish professional requirements for all types of preparers. This puts some taxpayers at risk of receiving insufficient or incompetent tax preparation services and potentially burdensome enforcement actions. Providing IRS with the authority to establish requirements for all paid preparers would allow IRS to target its resources more efficiently on noncompliant preparers.

Why GAO Did This Study

Millions of taxpayers claim refundable tax credits each year. About half of taxpayers use a paid preparer, according to the Department of the Treasury. However, these credits have complex eligibility rules that can be difficult to follow. This can result in errors and improper claims. For fiscal year 2021, IRS estimated that it paid $115 billion in refundable tax credits, but $26 billion were improperly paid.

GAO was asked to examine IRS's Refundable Credits Return Preparer Strategy program. This report assesses (1) the extent to which the program incorporates key elements of program design, and (2) how, if at all, IRS could broaden the effect of its strategy to reduce improper payments, among other objectives.

GAO reviewed IRS program data and documentation. GAO also interviewed IRS officials, paid preparers, and industry groups. Further, GAO compared IRS's efforts to guidance on key program elements from the Office of Management and Budget's Circular No. A-11 and IRS's Strategic Plan.

Recommendations

GAO is making six recommendations to IRS. They include IRS developing a long-term plan and finalizing the IRS-wide preparer strategy. GAO is also recommending that Congress grant IRS the authority to establish professional requirements for paid preparers. IRS agreed with five of the recommendations. IRS neither agreed nor disagreed with the recommendation to finalize the IRS-wide preparer strategy, stating that other reorganization efforts must be completed first.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should grant IRS the explicit authority to establish professional requirements for paid tax preparers. (Matter for Consideration 1) | Multiple bills have been introduced in the Congress that would authorize the Department of Treasury to regulate paid tax preparers and establish professional requirements, as GAO recommended in April 2014 and November 2022. However, as of February 2026, none of these bills have been enacted. GAO testified on October 1, 2015 on improper payments and the tax gap before Senate Finance and on December 10, 2015 on GAO recommendations before the Subcommittee on Regulatory Affairs and Federal Management, Committee on Homeland Security and Governmental Affairs, US Senate. Both hearings increased attention to GAO's matter to Congress that tax preparers be regulated. Paid preparer regulation and the establishment of professional requirements may increase the accuracy of tax returns and potentially reduce the tax gap. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should test preparer education and compliance treatments in the Refundable Credits Return Preparer Strategy program that use digital services and assess the results of any tests. Examples include warning letters and secure document uploads. (Recommendation 1) |

In response to the recommendation, IRS initiated the development of the Document Upload Tool as an option for preparers selected for correspondence due diligence visits to upload requested documentation. In 2025, IRS also updated its letter to preparers selected for a due diligence treatment to include a link and access code for preparers to submit documentation via the document upload tool. By providing this tool for preparers, IRS enhanced the program's effectiveness by improving preparers interactions with IRS.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should develop a performance measure for the Refundable Credits Return Preparer Strategy program to assess how its preparer treatments affect compliance with due diligence requirements over time. (Recommendation 2) |

IRS agreed with this recommendation. As of February 2024, IRS reported that it explored options to develop such a performance measure. IRS completed a preliminary analysis that track preparers who received a program treatment over the next five years. IRS reviewed the results of this analysis and included a performance measure in its fiscal year 2023 annual program report. This additional measure of preparer compliance over multiple years may provide more information about the program's progress and accomplishments on improving compliance, protecting taxpayers, and reducing the tax gap. Such a measure may also allow officials to more clearly communicate the benefit of the program to Congress, IRS management, and the public.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should define and document program elements of the Refundable Credits Return Preparer Strategy program, including its goals, objectives, activities, and performance measures. (Recommendation 3) |

IRS agreed with this recommendation. In response to this recommendation, IRS provided documentation of the program's defined goals, objectives, activities and performance measures. By fully defining these program elements, program officials will be able to more effectively communicate with stakeholders and IRA leadership and thereby increase the likelihood of achieving the goals and objectives of the program.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should develop a long-term plan for the Refundable Credits Return Preparer Strategy program, in coordination with stakeholders, which outlines the program's vision for the future, links program elements together, and clearly aligns to agency strategic goals. (Recommendation 4) |

IRS agreed with this recommendation. In response to this recommendation, IRS provided documentation in December 2024 of future goals for different areas of the program as well as a vision statement about integration with agency strategic efforts. This documentation, coupled with other program documentation, will help the Refundable Credits Return Preparer Strategy program more effectively advocate for its needs and resources, as well as plan more proactively and strategically in the future.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should implement a systematic method of tracking internal recommendations for the Refundable Credits Return Preparer Strategy program. (Recommendation 5) |

IRS agreed with this recommendation. In response, IRS developed a Preparer Treatment Delivery Tool (PTDT) to track the status of internal and external recommendations for the Refundable Credits Return Preparer Strategy Program. IRS started using the new tool in September 2023. This new systematic method of tracking recommendation status will better position program officials to ensure that important lessons learned from past work are considered and incorporated into planning efforts.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should finalize the Service-wide Return Preparer Strategy and identify the resources needed to implement it. (Recommendation 6) |

IRS agreed with this recommendation. IRS's April 2023 Strategic Operating Plan described initiatives that could help paid preparers improve the accuracy of returns they submit, such as by notifying preparers of potential issues, but did not contain additional information on agency-wide preparer compliance efforts. In April 2024, IRS provided a draft crosswalk of how the Service-wide Return Preparer Strategy aligned with the Strategic Operating Plan's objectives and initiatives. However, it was unclear how IRS planned to implement the Service-wide Return Preparer Strategy. For example, the first goal of the Service-wide Return Preparer Strategy was to develop a centralized compliance organization, but IRS decided not to implement that approach as of April 2024. Further, IRS had not documented the resources it needs to implement the preparer strategy. Executive Order [No. 14210, Feb. 14, 2025] directed IRS to conduct an agency reduction in force and reorganization. In June 2025, IRS stated that it is unknown what organizations or operations will remain as part of the IRS mission after the reduction in force and reorganization. As a result, IRS stated that it is impossible to implement this recommendation at this time. As of December 2025, IRS stated that there is no update on implementing this recommendation. However, GAO continues to believe that a service-wide strategy could help IRS determine the resources needed in relation to other programs that focus on paid preparer compliance. To fully implement this recommendation, IRS needs to capitalize on the planning efforts it already made and identify the remaining steps toward a more coordinated approach to paid preparer compliance and the resources needed to do so. Implementing a Service-wide Return Preparer Strategy could benefit taxpayers and their representatives by helping them prepare more accurate tax returns and could help IRS efficiently allocate resources across its paid preparer compliance activities.

|