Financial Audit: Bureau of the Fiscal Service's FY 2022 Schedules of the General Fund

Fast Facts

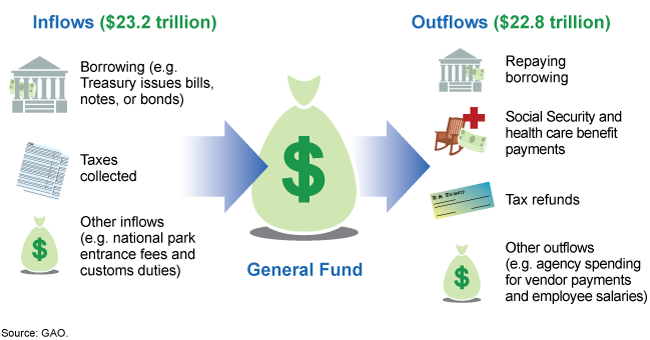

Treasury's Fiscal Service manages the General Fund, which finances daily and long-term government operations. In FY 2022, $23.2 trillion flowed into the General Fund and $22.8 trillion flowed out of it.

Fiscal Service continued to make progress in addressing the issues identified in our prior audits. However, we don't have enough information to give an opinion on the reliability of the FY 2022 Schedules because of issues that aren't expected to be resolved for several years, such as:

Modernizing Treasury's information systems

Getting agencies to cooperate in using Treasury's financial reporting system

Highlights

What GAO Found

Certain deficiencies in internal control over financial reporting resulted in scope limitations that

- prevented GAO from expressing an opinion on the Schedules of the General Fund as of and for the fiscal year ended September 30, 2022;

- prevented GAO from obtaining sufficient appropriate audit evidence to provide a basis for an opinion on the effectiveness of the Bureau of the Fiscal Service's internal control over financial reporting relevant to the Schedules of the General Fund as of September 30, 2022; and

- limited tests of compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements for fiscal year 2022.

The scope limitations and underlying control deficiencies related to Fiscal Service's inability to readily (1) identify and trace General Fund transactions to determine whether they were complete and properly recorded in the correct general ledger accounts and line items within the Schedules of the General Fund, which GAO determined to be a significant deficiency, and (2) provide sufficient appropriate audit evidence to support the account attributes assigned to active Treasury Account Symbols that determine how transactions are reported in the line items of the Schedules of the General Fund. As a result of these limitations, GAO cautions that amounts Fiscal Service reported in the Schedules of the General Fund and related notes may not be reliable.

In addition to the deficiencies that contributed to GAO's disclaimer of opinion on the Schedules of the General Fund, GAO found two other significant deficiencies in internal control related to (1) information systems controls (which includes information system control deficiencies that were reported in connection with the audits of the Department of the Treasury's consolidated financial statements and the Schedules of Federal Debt) and (2) management's monitoring of internal control over financial reporting.

GAO is making six new recommendations to improve Fiscal Service's internal control over financial reporting related to the Schedules of the General Fund. During fiscal year 2022, based on Fiscal Service's actions taken, GAO closed 14 of the 19 recommendations that remained open from GAO's previous audits and continued to make progress on remediating the remaining five recommendations that remain open as of September 30, 2022. Fiscal Service continued to express its commitment to remediating these deficiencies.

Why GAO Did This Study

The General Fund of the U.S. government is the reporting entity responsible for accounting for the cash activity of the U.S. government. The Secretary of the Treasury has delegated management of the General Fund to Fiscal Service. In fiscal year 2022, the General Fund reported $23.2 trillion of cash inflows, including debt issuances and tax collections, and $22.8 trillion of cash outflows, including debt repayments. It also reported a budget deficit of $1.4 trillion, which includes both cash and noncash activity.

GAO audits the consolidated financial statements of the U.S. government. Because of the significance of the General Fund to the government-wide financial statements, GAO audited the fiscal year 2022 Schedules of the General Fund to determine whether, in all material respects, (1) the Schedules of the General Fund are fairly presented and (2) Fiscal Service management maintained effective internal control over financial reporting relevant to the Schedules of the General Fund. Further, GAO tested compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedules of the General Fund.

Recommendations

GAO is making six recommendations to improve Fiscal Service's internal control over financial reporting relevant to the Schedules of the General Fund.

In commenting on a draft of this report, Fiscal Service concurred with the results of GAO's audit and stated that it will factor corrective actions into the audit remediation plan.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status Sort descending |

|---|---|---|

| Bureau of the Fiscal Service |

Priority Rec.

The Commissioner of Fiscal Service should design and implement policies and procedures to effectively monitor the fiscal agents. (Recommendation 6) |

In June 2023, Fiscal Service developed a corrective action plan to address the recommendation. As of February 2025, Fiscal Service reevaluated whether the corrective actions it previously developed would adequately address the deficiencies, and it halted progress, citing resource constraints. Fiscal Service had initially anticipated resolving this recommendation in fiscal year 2027; however, it is revising the remediation plan and has not determined whether a revised planned completion date is needed.

|

| Bureau of the Fiscal Service |

Priority Rec.

The Commissioner of Fiscal Service should develop (1) reporting criteria for CIHO and funds held outside of Treasury and (2) a methodology for full-CARS reporters to report CIHO to CARS. (Recommendation 1) |

As of February 2025, Fiscal Service concluded that (1) cash and other investments held outside of Treasury (CIHO) and funds held outside of Treasury (FHOT) represented the same type of transaction activity and (2) that CIHO activity reported in the Schedules of the General Fund resulted from entities not following the relevant Treasury Financial Manual (TFM) guidance for reporting FHOT activity, which resulted in CIHO being incorrectly reported in a different line item than FHOT activity. As a result, Fiscal Service reemphasized the TFM guidance to federal entities that were reporting CIHO on the Schedules of the General Fund that includes a methodology for full-CARS reporters to report CIHO to CARS. These actions address this recommendation.

|

| Bureau of the Fiscal Service |

Priority Rec.

The Commissioner of Fiscal Service should design and implement controls to identify and close TASs established during the annual fiscal year-end rollover process that do not subsequently have corresponding appropriations supporting the period of availability. (Recommendation 2) |

As of February 2025, Fiscal Service developed and implemented a process to validate legal authority for rollover Treasury Account Symbols (TAS) without legal authority based on federal entity outreach. Based on the results of this confirmation process, Fiscal Service suspended rollover TASs without legal authority and will require federal entity justification prior to use. Fiscal Service plans to administratively close the suspended TASs in CARS before the next annual fiscal year rollover process. These actions address this recommendation.

|

| Bureau of the Fiscal Service |

Priority Rec.

The Commissioner of Fiscal Service should develop and implement a mechanism to reasonably assure that postpayment voucher transactions recorded in the Schedules of the General Fund general ledgers are readily traceable to the cancellation schedules and the returned or canceled payments that are credited to federal entities. (Recommendation 3) |

As of February 2024, Fiscal Service traced various postpayment vouchers to the cancellation schedules to plan for a potential reconciliation process. As of February 2025, Fiscal Service is analyzing postpayment processes in place for fiscal year 2024 to plan for a manual or systematic process to trace (1) postpayment vouchers to the cancellation schedules and (2) the returned or canceled payments in the cancellation schedule to the Treasury Account Symbols and adjustment Business Event Type Codes of the original payment. Fiscal Service is currently documenting procedures for this process and is considering ways to automate the reconciliation. Fiscal Service anticipates resolving this recommendation in fiscal year 2025.

|

| Bureau of the Fiscal Service |

Priority Rec.

The Commissioner of Fiscal Service should enhance the methodology for classifying cash activity, sufficient to support accurate reporting of line items on the Schedules of the General Fund, to include all transaction types as well as adequate review procedures. (Recommendation 4) |

As of February 2025, Fiscal Service analyzed and evaluated its current cash classification process to identify possible enhancements to its methodology for proper reporting of the cash line items on the Schedules of the General Fund. Fiscal Service also began to document its rationale for manually classifying some cash transaction types to the Cash In or Cash Out line items. Additionally, Fiscal Service is considering a new presentation of its cash note disclosure to identify the cash transaction types that make up the Cash In and Cash Out line items. Fiscal Service anticipates resolving this recommendation in fiscal year 2026.

|

| Bureau of the Fiscal Service |

Priority Rec.

The Commissioner of Fiscal Service should enhance the design and implementation of the oversight policy and the FAAs to effectively monitor the financial agents. (Recommendation 5) |

As of February 2025, Fiscal Service updated its policy and executed new or amended Financial Agency Agreements for all 11 collection reporting programs with updated requirements for assessing internal control over financial reporting. Of the 11 collection reporting programs, seven provided Fiscal Service with System and Organization Control (also referred to as SOC-1) reports and bridge letters for fiscal year 2024, and the remaining four will provide these documents starting with fiscal year 2025. Fiscal Service anticipates resolving this recommendation in fiscal year 2026.

|