Tax Filing: 2021 Performance Underscores Need for IRS to Address Persistent Challenges

Fast Facts

IRS faced an unprecedented workload during the 2021 filing season. It began with a backlog of 8 million returns from the prior year. IRS reduced the backlog, but still had millions of new 2021 returns to process by year's end. Taxpayers faced refund delays due to an unprecedented volume of returns requiring manual review—most with similar tax credit errors.

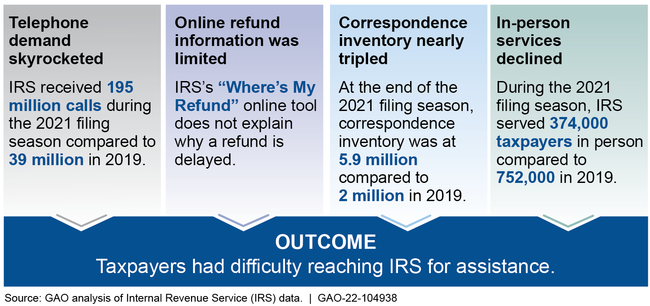

During the 2021 filing season, taxpayers also struggled to get help from IRS as:

- Telephone demand skyrocketed

- Online refund information was scant

- Correspondence nearly tripled

- In-person service declined

We recommended that IRS address these issues.

Highlights

What GAO Found

The Internal Revenue Service (IRS) experienced multiple challenges during the 2021 filing season as it struggled to respond to an unprecedented workload that included delivering COVID-19 relief. IRS began the filing season with a backlog of 8 million individual and business returns from the prior year that it processed alongside incoming returns. IRS reduced the backlog of prior year returns, but as of late December 2021, had about 10.5 million returns to process from 2021. Further, IRS suspended and reviewed 35 million returns with errors primarily due to new or modified tax credits. As a result, millions of taxpayers experienced long delays in receiving refunds. GAO found that some categories of errors occur each year; however, IRS does not assess the underlying causes of taxpayer errors on returns. Doing so could help reduce future errors, refund delays, and strains on IRS resources.

IRS has paid nearly $14 billion in refund interest in the last 7 fiscal years, with $3.3 billion paid in fiscal year 2021. Using IRS data, GAO identified some characteristics of refund interest payments, such as amended returns. However, IRS does not identify, monitor, and mitigate issues contributing to refund interest payments. Accordingly, IRS is missing an opportunity to reduce costs.

Challenges with IRS Customer Service during the 2021 Filing Season

IRS answered more phone calls than in prior years, but taxpayers had a difficult time reaching IRS due to high call volumes. IRS urged taxpayers to access its “Where's My Refund” online tool to get refund status information; yet this tool provides limited information on refund status and delays. IRS does not have plans to modernize “Where's My Refund,” although this could help IRS better serve taxpayers, lower call volume, and reduce costs. IRS's correspondence inventory was 5.9 million by the end of the filing season, and grew to more than 8 million by the start of 2022. IRS does not have a plan or estimates for reducing this backlog; doing so could help reduce demands on IRS. Finally, in-person service has significantly declined since 2015 and IRS has not fully considered alternatives for its current in-person service model. IRS's plans to improve the taxpayer experience—such as by expanding virtual services—may further contribute to the decline in in-person visits.

Why GAO Did This Study

During the annual tax filing season, generally from January to mid-April, IRS processes more than 150 million individual and business tax returns and provides telephone, correspondence, online, and in-person services to tens of millions of taxpayers. To accommodate new legislation and provide additional relief to taxpayers, IRS postponed the 2021 individual filing and payment deadline by 1 month to May 17, 2021.

GAO was asked to review IRS's performance during the 2021 filing season. This report assesses IRS's performance during the 2021 filing season on (1) processing individual and business income tax returns and (2) providing customer service to taxpayers.

GAO analyzed IRS documents and data on filing season performance, refund interest payments, hiring, and employee overtime. GAO also interviewed cognizant officials.

Recommendations

GAO is making six recommendations, including that IRS assess reasons for tax return errors and refund interest payments and take action to reduce them; modernize its “Where's My Refund” application; address its backlog of correspondence; and assess its in-person service model. IRS agreed with four recommendations and disagreed with two. IRS said its process for analyzing errors is robust and that the amount of interest paid is not a meaningful business measure. GAO believes that these recommendations remain warranted.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should develop a process to identify and analyze the underlying causes for taxpayer errors on returns and address them, as appropriate and feasible, with input from internal and external stakeholders. (Recommendation 1) |

IRS disagreed with this recommendation. In October 2022, IRS said it has a robust process for identifying taxpayer errors on returns, identifying probable causes, and proactively disseminating information through public and professional channels to prevent their continued occurrence. As we discussed in our report, for errors that occur frequently each year, such as those related to refundable credits, IRS said it did not have a process to identify and analyze their underlying causes. However, in October 2022, IRS said that it maintains a research program that addresses questions of taxpayer behavior and challenges they face in accurately complying with tax provisions, particularly refundable credits for individuals. IRS did not indicate how it uses these results to reduce taxpayer errors, particularly for recurring errors on the Earned Income Tax Credit and the Child Tax Credit that we highlighted in our report. Also, in April 2023, IRS released its Inflation Reduction Act Strategic Operating Plan, which includes initiatives to help taxpayers address errors quickly both before and after filling. If IRS uses results from the research program it maintains to identify and analyze underlying causes for frequently occurring taxpayer errors, and to address those errors, it could satisfy our recommendation. If IRS incorporates this or other data and analysis into its future efforts to help taxpayers quickly address errors both before and after filling, it could also address our recommendation. As of February 2026, it is unclear if IRS is continuing efforts on these initiatives. We will continue to follow-up with IRS on the status of its efforts.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should direct responsible IRS business units to regularly identify, monitor, and report on the primary reasons for individual and business-related refund interest payments and associated dollar amounts, and report this information, as appropriate, to IRS leadership, Treasury, and Congress. (Recommendation 2) |

IRS disagreed with this recommendation. As of December 2025, IRS maintains its position that interest is prescribed by statute, and it does not consider interest paid a reliable or meaningful business measure. We maintain that interest payments are an expense to the U.S. government, and monitoring them could help IRS and Congress know how, if at all, the expense could be reduced. To implement this recommendation, IRS needs to identify why it pays interest and share this information with IRS leadership, Treasury, and Congress, as appropriate.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should take steps to reduce the amount of refund interest paid for those cases within IRS's control. (Recommendation 3) |

IRS agreed to look for ways to reduce refund interest payments related to the return backlog resulting from the COVID-19 pandemic. This included hiring additional staff, redirecting existing resources, and utilizing automation to improve processing timeliness. As of April 2024, IRS reported it continued using direct hiring authority to help hire additional processing staff and that it had implemented scanning of paper returns. We support IRS's efforts to fully address its pandemic-related backlog and process returns and correspondence in a timely manner. However, processing returns and correspondence in a timely manner alone likely will not resolve the annual cost of refund interest payments, which have totaled $32.4 billion from fiscal years 2015 to 2024. In May 2025, IRS reported that it paid $5.3 billion in refund interest in fiscal year 2024. Further, refund interest payments can be due to both retroactive legislative benefits and delays in IRS processing times. As of December 2025, IRS has not reported additional actions taken to implement our recommendation. Without identifying, monitoring, and reporting on the primary reasons for refund interest payments, and associated dollar amounts (per recommendation 2), IRS is not in a position to ensure that any steps it takes in response to this recommendation directly affect any reduction in refund interest payments. We will continue to follow-up with IRS on the status of its efforts.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should work with Treasury to develop and implement a modernization plan for "Where's My Refund" that fully addresses taxpayer needs and requirements. (Recommendation 4) |

IRS agreed with this recommendation. In 2022 IRS conducted a study to determine taxpayer needs and feedback on the application. In March 2023, IRS approved a modernization plan to address taxpayer needs it identified in the study. IRS completed implementation of its plan in June 2024. For example, IRS integrated the "Where's My Refund" application into taxpayers' online accounts, updated the web interface and optimized its appearance on mobile devices, and introduced additional information for taxpayers whose returns are delayed due to processing errors or identity theft concerns. These improvements provide taxpayers with additional information, which can help reduce the need to call or write IRS for this information.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should estimate time frames for resolving IRS's correspondence backlog, monitor and update these estimates periodically, and communicate this information to taxpayers and stakeholders. (Recommendation 5) |

IRS agreed with the recommendation. Officials said IRS would continue with its efforts to manage its correspondence inventory and return it to normal levels. In March 2024, IRS launched a new web page, "Processing status for tax forms," on IRS.gov. This web page shows the receipt date (month and year) of the correspondence that IRS is currently processing. While the "Processing status of tax forms" web page shows approximately how long IRS is taking to begin processing correspondence after receiving it, it does not provide information on how long taxpayers can expect to wait for a response once IRS begins to process it. To fully implement this recommendation, IRS needs to clearly communicate estimated time frames for resolving correspondence so taxpayers know when to reasonably expect a response or refund. In January 2026, IRS officials reaffirmed their position that they do not intend to share this information with taxpayers and stakeholders. Without clear, timely information on IRS's processing time frames for addressing taxpayer correspondence, taxpayers may continue to call, write, or visit IRS in person to try to obtain this information. IRS will continue to struggle to meet demands for taxpayer customer service and in processing returns.

|

| Internal Revenue Service | The Commissioner of Internal Revenue and appropriate IRS stakeholders should develop and communicate a plan for providing in-person taxpayer services relative to IRS's plans for expanded virtual customer service options, and costs and benefits. (Recommendation 6) |

IRS agreed with this recommendation. In October 2022, IRS stated that it will develop and communicate a plan, while considering costs and benefits, to consider the expansion of in-person service in concert with virtual customer service options. IRS also stated that it developed a Taxpayer Assistance Hiring and Expansion Strategy to identify underserved areas of the country and to expand the Taxpayer Assistance Center footprint. For the 2023 filing season, IRS opened 5 new Taxpayer Assistance Centers -- one in Mississippi and four in Puerto Rico. In November 2023, IRS provided data to support its plans to expand in-person service offerings at new Taxpayer Assistance Centers, but IRS has not fully communicated how it will weigh the costs and benefits to ensure that it is meeting taxpayer needs in person. In November 2024, IRS officials stated that they were evaluating how to best weigh cost and benefits and are in the process of doing a cost-benefit analysis. They said they expect to have the analysis completed and a communications plan developed by mid-2025. In January 2026, IRS officials told us that the agency was reviewing this analysis and will develop a communication plan once the review is completed. Developing and communicating a plan for how IRS intends to provide in-person service to taxpayers will help IRS allocate its resources among its multiple taxpayer service channels and ensure that it is meeting taxpayer needs.

|