Higher Education: IRS and Education Could Better Address Risks Associated with Some For-Profit College Conversions

Fast Facts

A for-profit college can be converted into a nonprofit college if it's sold to a tax-exempt organization and the Education Department approves the conversion.

In about a third of cases we identified, college owners or officials held leadership roles in the college's tax-exempt buyer. If that is the case, they aren't allowed to use their influence to inflate the college's sale price or otherwise improperly benefit from the conversion.

But IRS staff didn't always follow guidance to assess the risks of improper benefit. Also, Education doesn't assess ongoing risks in its reviews. We recommended improvements in agency review processes.

Highlights

What GAO Found

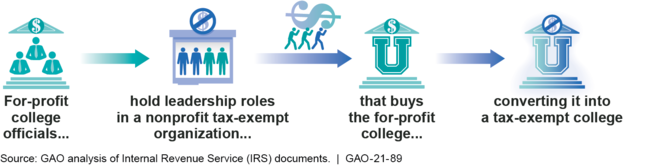

GAO identified 59 for-profit college conversions that occurred from January 2011 through August 2020, almost all of which involved the college's sale to a tax-exempt organization. In about one-third of the conversions, GAO found that former owners or other officials were insiders to the conversion—for example, by creating the tax-exempt organization that purchased the college or retaining the presidency of the college after its sale (see figure). While leadership continuity can benefit a college, insider involvement in a conversion poses a risk that insiders may improperly benefit—for example, by influencing the tax-exempt purchaser to pay more for the college than it is worth. Once a conversion has ended a college's for-profit ownership and transferred ownership to an organization the Internal Revenue Service (IRS) recognizes as tax-exempt, the college must seek Department of Education (Education) approval to participate in federal student aid programs as a nonprofit college. Since January 2011, Education has approved 35 colleges as nonprofit colleges and denied two; nine are under review and 13 closed prior to Education reaching a decision.

Figure: Example of a For-Profit College Conversion with Officials in Insider Roles

IRS guidance directs staff to closely scrutinize whether significant transactions with insiders reported by an applicant for tax-exempt status will exceed fair-market value and improperly benefit insiders. If an application contains insufficient information to make that assessment, guidance says that staff may need to request additional information. In two of 11 planned or final conversions involving insiders that were disclosed in an application, GAO found that IRS approved the application without certain information, such as the college's planned purchase price or an appraisal report estimating the college's value. Without such information, IRS staff could not assess whether the price was inflated to improperly benefit insiders, which would be grounds to deny the application. If IRS staff do not consistently apply guidance, they may miss indications of improper benefit.

Education has strengthened its reviews of for-profit college applications for nonprofit status, but it does not monitor newly converted colleges to assess ongoing risk of improper benefit. In two of three cases GAO reviewed in depth, college financial statements disclosed transactions with insiders that could indicate the risk of improper benefit. Education officials agreed that they could assess this risk through its audited financial statement review process and could develop procedures to do so. Until Education develops and implements such procedures for new conversions, potential improper benefit may go undetected.

Why GAO Did This Study

A for-profit college may convert to nonprofit status for a variety of reasons, such as wanting to align its status and mission. However, in some cases, former owners or other insiders could improperly benefit from the conversion, which is impermissible under the Internal Revenue Code and Higher Education Act of 1965, as amended.

GAO was asked to examine for-profit college conversions. This report reviews what is known about insider involvement in conversions and to what extent IRS and Education identify and respond to the risk of improper benefit. GAO identified converted for-profit colleges and reviewed their public IRS filings. GAO also examined IRS and Education processes for overseeing conversions, interviewed agency officials, and reviewed federal laws, regulations and agency guidance. GAO selected five case study colleges based on certain risk factors, obtained information from college officials, and reviewed their audited financial statements. In three cases, GAO also reviewed Education case files. Because of the focus on IRS and Education oversight, GAO did not audit any college in this review to determine whether its conversion improperly benefitted insiders.

Recommendations

GAO is making three recommendations, including that IRS assess and improve conversion application reviews and that Education develop and implement procedures to monitor newly converted colleges. IRS said it will assess its review process and will evaluate GAO's other recommendation, as discussed in the report. Education agreed with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should assess the agency's internal controls for reviewing for-profit college applications for tax-exempt status and improve the review process to ensure that staff appropriately apply agency guidance on assessing potential improper benefit to insiders. (Recommendation 1) |

In its initial response to this recommendation, IRS stated that it would assess its internal controls for reviewing applications for tax-exempt status from organizations with a for-profit history and make improvements to those controls, as appropriate. In October 2021, IRS concluded its assessment and determined that these controls--including technical support for staff conducting reviews, training materials and resource guides, and preapproved question lists that staff can pose to applicants, as needed--were sufficient. However, lRS also determined that due to the moderate to complex nature of for-profit conversions, such cases should be assigned to more experienced staff, and updated its case assignment guide to reflect that change. IRS also scheduled training for staff on issues related to for-profit conversions. With these actions, IRS has implemented this recommendation.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should collect information, for instance on the annual IRS filing tax-exempt organizations are required to submit, that would enable the agency to systematically identify tax-exempt colleges with a for-profit history for audit and other compliance activities. (Recommendation 2) |

In its initial response to this recommendation, IRS stated it would evaluate the benefits and burdens of collecting information about the for-profit history of tax-exempt organizations, including colleges, noting that it already asks tax-exempt organizations to report whether they have engaged in transactions with insiders. In October 2021, IRS completed its review and determined that, because the agency already asks applicants for tax-exempt status whether they have a for-profit history, it would be redundant and burdensome to ask already approved tax-exempt organizations to report similar information. As we noted in our report, some for-profit conversions involve approved tax-exempt organizations rather than applicants for tax-exempt status, and IRS does not collect information that would enable it to easily and systematically identify when such organizations are involved in a for-profit conversion, such as for-profit college conversion. As we also noted in our report, IRS initiated a compliance strategy to identify tax-exempt organizations involved in for-profit conversions due to concerns about for-profit college conversions. However, IRS did not identify any already approved tax-exempt organizations that purchased a for-profit college from insiders through its strategy. In October 2021, IRS stated that it had "successfully tested its ability to secure data based on [current] information sources and capabilities, indicating the current and on-going ability to collect and systemically utilize data to identify situations that go to GAO's stated concern regarding the increased risk of inurement related to transactions with insiders." In March 2025, IRS provided documentation from this compliance strategy using existing data through which it assessed whether selected tax-exempt organizations with a for-profit history were improperly benefitting insiders, and found relatively low levels of non-compliance. As a result, IRS determined that it collects sufficient information to assess the risk of improper benefit and reiterated that asking tax-exempt organizations to provide additional information about their for-profit history would be burdensome. For this strategy, however, IRS selected tax-exempt organizations for review that had previously been for-profit and had been granted tax-exempt status by IRS. IRS did not identify or select tax-exempt organizations that purchased for-profit entities, such as colleges, from insiders for this compliance strategy. This is the population of tax-exempt organizations we continue to believe IRS does not have the capability to easily identify. We continue to believe that IRS should collect additional information to enable it to systematically identify this group of tax-exempt organizations--organizations that the agency acknowledges pose a heightened risk of improper benefit--for oversight purposes.

|

| Department of Education | The Secretary of Education should develop and implement monitoring procedures for staff to review the audited financial statements of all newly converted nonprofit colleges for the risk of improper benefit. (Recommendation 3) |

In December 2020, Education agreed with this recommendation and stated that it would develop new financial analysis procedures to ensure that staff review audited financial statements submitted by newly converted colleges after Education's approval. Education also stated that it would include additional reporting requirements for newly converted colleges and would closely monitor newly converted nonprofit colleges for the risk of improper benefit. As of February 2022, Education updated its procedures reflecting these actions. First, Education updated its financial statement analysis procedures for both colleges with conversion applications under review and newly converted colleges for the first five full fiscal years after their approval. These procedures state that financial analysts must review such colleges' financial statements for improper benefit, complete a nonprofit conversion financial analysis checklist, and refer their initial analysis to Education's change in ownership workgroup for further analysis. Second, Education created additional financial, enrollment, and nonprofit reporting and monitoring requirements for converted colleges. Under these procedures, Education may require converted colleges to report IRS correspondence relating to the college's nonprofit status; any agreements with former owners; and any mergers, acquisitions, business expansions, or corporate restructuring; among other things. Education also shared copies of training materials provided to relevant staff regarding these new procedures. By taking these actions, Education is better positioned to identify and respond to risk of improper benefit at newly converted nonprofit colleges.

|