Department of Defense: Actions Needed to Improve Accounting of Intradepartmental Transactions

Fast Facts

When the Department of Defense prepares its financial statements each year, transactions that occur between two DOD components (like Army and Navy) must be eliminated from the department-wide statements. For years, auditors have found that the DOD cannot adequately account for between-component transactions—including in its most recent audits for FY2019 and FY2020.

The DOD has a long-term plan to address this longstanding auditor-identified weakness, but doesn't have a clear overall strategy for the short term. Our 5 recommendations include that the DOD develop a strategy to identify short-term solutions and update applicable guidance.

Highlights

What GAO Found

The Department of Defense (DOD) has a long-standing material weakness related to intradepartmental transactions. Intradepartmental transactions occur when trading partners within the same department engage in business activities—such as the Department of the Army as a seller and the Department of the Navy as a buyer within DOD. As part of the standard process of preparing department-wide financial statements, intradepartmental transaction amounts are eliminated to avoid overstating accounts for DOD. For the fourth quarter of fiscal year 2019, DOD eliminated approximately $451 billion of net intradepartmental activity. Auditors continue to report a material weakness related to DOD's processes for recording and reconciling intradepartmental transaction amounts that are necessary to eliminate the transactions and prepare reliable consolidated financial statements.

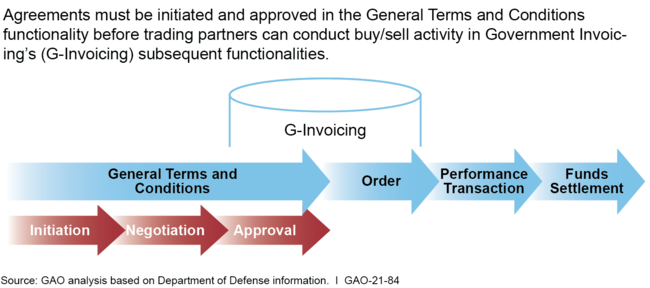

DOD has identified implementation of the Government Invoicing (G-Invoicing) system as its long-term solution to account for and support its intradepartmental activities. In fiscal year 2020, DOD issued a policy requiring all DOD components to use G-Invoicing's General Terms and Conditions (GT&C) functionality for initiating and approving GT&C agreements—a necessary step for using subsequent G-Invoicing functionalities (see figure). GAO found the use of this functionality varied among selected DOD components because of issues such as inconsistency in DOD policies and numerous changes to G-Invoicing system specifications. If DOD components do not implement the GT&C functionality, there is an increased risk of delay in full implementation of G-Invoicing to help remediate the intradepartmental eliminations material weakness.

General Terms and Conditions Agreement Process in Government Invoicing

Although DOD has identified G-Invoicing as its long-term solution, GAO found that DOD has not implemented an overall department-wide strategy to address its intradepartmental eliminations material weakness in the short term. Further, GAO found that while DOD issued a department-wide policy in May 2019 with new requirements for reconciling intradepartmental transactions, the Defense Finance and Accounting Service and selected DOD components have not updated their policies or implemented several of the new requirements. Without a short-term strategy that includes identifying the causes of issues and consistently implementing department-wide policies across DOD, DOD's efforts to resolve differences in intradepartmental transaction amounts—including its efforts in the long term—will likely be inefficient and ineffective.

Why GAO Did This Study

Since 1995, GAO has designated DOD financial management as high risk because of pervasive weaknesses in its financial management systems, controls, and reporting. DOD's long-standing intradepartmental eliminations material weakness reflects DOD's inability to adequately record and reconcile its intradepartmental transactions, and has affected DOD's ability to prepare auditable financial statements.

GAO was asked to evaluate DOD's process for performing intradepartmental eliminations. This report examines the extent to which DOD has (1) identified and taken steps to address issues related to intradepartmental eliminations and (2) established and implemented policies and procedures related to intradepartmental eliminations.

GAO interviewed DOD officials about intradepartmental eliminations processes and reviewed DOD policies and procedures to identify the extent to which procedures have been implemented to record and reconcile intradepartmental transactions.

Recommendations

GAO is making five recommendations to DOD, including that DOD should (1) take actions to ensure that its components follow its policy for using G-Invoicing's GT&C functionality and (2) develop short-term solutions that address causes for trading partner differences before G-Invoicing is fully implemented. DOD agreed with all five recommendations and cited actions to address them.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Defense | The Under Secretary of Defense (Comptroller) should take actions to help ensure that all DOD components follow its policy requiring the use of G-Invoicing's GT&C functionality to initiate and approve GT&C agreements. (Recommendation 1) |

DOD concurred with this recommendation. In response to our recommendation, in March 2021, OUSD (Comptroller) developed a General Terms and Conditions (GT&C) Executive Dashboard tool within the Advana platform to track component usage of the GT&C module. OUSD (Comptroller) also continues to monitor GT&C activity in Treasury's Government Invoicing (G-Invoicing) system by reviewing, analyzing, and comparing individual component's detail GT&C metrics, and briefs DOD executives and component leaders monthly on the results of the GT&C statistics. By taking these measures, OUSD (Comptroller) enhanced its ability to help ensure that all DOD components are using the GT&C module, which, in turn, will facilitate full implementation of G-Invoicing and help remediate the intragovernmental eliminations deficiency.

|

| Department of Defense | The Under Secretary of Defense (Comptroller), in conjunction with the Under Secretary of Defense (Acquisition & Sustainment), should update all applicable guidance, such as DOD Instruction 4000.19, to reflect the use of G-Invoicing and its GT&C functionality for initiating and approving GT&C agreements. (Recommendation 2) |

The Department of Defense (DOD) concurred with this recommendation. In response to our recommendation, DOD issued two memorandums regarding G-invoicing implementation, and updated three policy documents requiring DOD to follow Department of the Treasury guidance for initiation and approval of General Terms and Conditions (GT&C) agreements. If fully adhered to, these memorandums and policy updates should improve the consistency of DOD components' use of GT&C module, which in turn will improve DOD's accounting for intradepartmental activity. Over time, this may reduce the amount of unresolved intradepartmental differences, improving the overall reliability of DOD's consolidated financial information.

|

| Department of Defense |

Priority Rec.

The Under Secretary of Defense (Comptroller) should develop a strategy to identify short-term solutions that can be implemented in advance of the full implementation of G-Invoicing to address the intradepartmental eliminations material weakness. Such solutions should include documented procedures to (1) identify the causes for intradepartmental differences, (2) monitor the results of action plans prepared by components, and (3) measure whether implemented action plans are effective in addressing the causes for intradepartmental differences. (Recommendation 3) |

The Department of Defense (DOD) concurred with this recommendation and stated that to address the intradepartmental eliminations material weakness, the Office of Under Secretary of Defense (OUSD) (Comptroller) (1) established the Trading Partners Elimination working group to identify and develop procedure to reduce interdepartmental differences; (2) will request components provide an action plan for reducing intradepartmental differences; and (3) will develop a dash-boarding tool to track the status of reconciliations and eliminations. In April 2022, DOD updated its corrective action plan which included actions for analyzing on a quarterly basis the "Journal Voucher (JV) Action Plans" database in Advana and assess if progress has been made to resolve interdepartmental variances. Specifically, assess quarterly, the number of (1) unsupported JV line items and (2) milestones completed and outstanding by component. As of January 2025, the expected completion timeframe for these actions is October 2025. We will continue to follow up with DOD on the status of this recommendation.

|

| Department of Defense | The Under Secretary of Defense (Comptroller), in conjunction with the Director of DFAS, should ensure that DFAS and DOD components update their SOPs to include the requirements of OUSD (Comptroller)'s May 2019 policy memorandum, Financial Management Requirements for Trading Partner Eliminations, such as the removal of "seller-side rules" and "waived entity" language. (Recommendation 4) |

The Department of Defense (DOD) concurred with this recommendation. The Office of the Under Secretary of Defense (OUSD) (Comptroller) stated that they plan to issue a task to the components to update and forward copies of their standard operating procedures to reflect the requirements of the OUSD (Comptroller) May 2019 policy memorandum. The estimated completion date for the implementation of this recommendation was December 2021. In December 2023, we received documentation from DOD to support the closure of this recommendation and confirmed that the policies were updated to reflect the requirements of the May 2019 memorandum. If fully adhered to, these procedure revisions should increase DFAS and selected components adherence to DOD policy, decreasing the risk of material misstatement in DOD's financial statements.

|

| Department of Defense | The Under Secretary of Defense (Comptroller), in conjunction with the Director of DFAS, should (1) update policies and procedures department-wide to require the performance of trading partner reconciliations at least monthly, where possible, to avoid large numbers of differences that need to be resolved at quarter end, and (2) for DOD components that are unable to perform monthly reconciliations because of system limitations, evaluate alternative methods to capture the data needed to perform trading partner reconciliations, such as buyer and seller trading partner codes and document identification numbers. (Recommendation 5) |

DOD concurred with this recommendation. In response, in July 2021, DOD issued a policy memorandum requiring DOD components to perform monthly intradepartmental transaction reconciliations; and to assist with these reconciliations, in December 2021, DOD developed an Intragovernmental Transactions Reconciliation tool. Additionally, DOD performed a data call to identify components that were unable to use the tool and verified that those components had alternative procedures in place to capture the data needed to perform these reconciliation. If fully adhered to, these updates should increase the consistency of intradepartmental reconciliations, decreasing the risk of material misstatement in DOD's financial statements.

|