Paycheck Protection Program: SBA Added Program Safeguards, but Additional Actions Are Needed

Fast Facts

In response to COVID-19, Congress created the Paycheck Protection Program to help small businesses get low-interest loans. The Small Business Administration guarantees the loans—so if a borrower defaults, SBA will buy the loan from the lender.

But there's not yet a process for lenders to actually get SBA to buy any defaulted loans. While lenders wait, their capital is unavailable for making new loans.

In addition, SBA has tools to communicate with lenders, but its responses are not timely. This communication problem has created confusion and uncertainty for lenders and borrowers.

Our recommendations address these and other issues.

Highlights

What GAO Found

The Small Business Administration (SBA) quickly implemented the Paycheck Protection Program (PPP) in April 2020 to assist small businesses adversely affected by COVID-19. But SBA's initial limited program safeguards resulted in improper payments and fraud risks. In June 2020 and March 2021, GAO recommended that SBA do more to oversee PPP and identify and respond to fraud risks. In response, SBA implemented compliance checks for applications submitted in 2021 and stated it would conduct a fraud risk assessment.

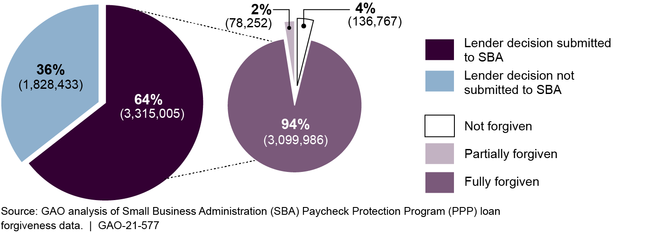

PPP loans are fully forgivable (do not have to be repaid) if borrowers meet certain conditions. As of May 2021, SBA had made determinations on 3.3 million loan forgiveness applications (see figure) but had not issued guidance for key aspects of the forgiveness process. Specifically:

- SBA had not yet finalized a process on how lenders can claim the SBA guarantee if the loan is not fully forgiven or when they have evidence the business ceased operations or declared bankruptcy. Without such a process, lenders' capital will remain tied up, limiting their ability to make non-PPP loans to small businesses.

- SBA had not implemented, nor sought exceptions to, a statutory requirement to purchase loans prior to loan forgiveness upon submission of reports by lenders concerning the amount expected to be forgiven.

SBA Loan Forgiveness Determinations on PPP Loans Made During Round 1, as of May 17, 2021

SBA has enhanced its oversight of PPP, such as by conducting in-depth reviews of selected loans, but it has not documented certain loan review steps or developed a process to improve communication with lenders.

- SBA has not yet finalized procedures for senior-level reviews of borrower eligibility and loan forgiveness decisions, increasing the risk of inconsistent or incorrect loan determinations.

- Although SBA has developed tools such as a web portal to communicate with lenders, it has not developed a process to ensure its responses to lenders are timely. Some lenders responding to GAO's survey said SBA had not responded in a timely manner or at all to inquiries on loan forgiveness applications, which has created confusion and uncertainty for lenders and borrowers and made it difficult for them to make management decisions.

Why GAO Did This Study

Since March 2020, Congress has provided commitment authority of about $814 billion for PPP, which provides small businesses with low-interest loans that SBA fully guarantees.

The CARES Act includes a provision for GAO to monitor funds provided for the COVID-19 pandemic. This report examines (1) safeguards that SBA put in place during the PPP loan approval process, (2) the PPP loan forgiveness process, including processes for unforgiven loans, and (3) SBA's oversight of PPP loans and lenders.

GAO reviewed SBA documentation; surveyed a generalizable sample of PPP lenders; analyzed data on loan forgiveness applications; compared SBA processes against federal guidance on credit programs; and interviewed staff from SBA, the Department of the Treasury, and four trade associations representing lenders.

Recommendations

GAO recommends that SBA (1) finalize a process for claiming the PPP loan guarantee, (2) implement the statutory requirement to purchase PPP loans in advance of loan forgiveness or seek statutory exceptions to the requirement, (3) finalize procedures for the steps of its loan review process that are not yet documented, and (4) develop and implement a process to ensure timely communication with lenders. SBA generally agreed with the four recommendations, including seeking statutory flexibility or repeal of the requirement to purchase PPP loans in advance of loan forgiveness.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Small Business Administration | The SBA Administrator should establish timeframes for finalizing and issuing a PPP-specific loan guarantee purchase process, including allowing lenders to claim the SBA guarantee when they have evidence the business ceased operations or declared bankruptcy. (Recommendation 1) |

On July 15, 2021, SBA issued guidance on the guarantee purchase process for PPP loans. According to the procedural notice, SBA will honor its guarantee and purchase 100 percent of the outstanding balance of the loan in applicable circumstances provided that the lender has complied with all the PPP requirements, including the lenders' underwriting requirements and the document collection and retention requirements. The process outlined in the procedural notice would also apply to loans to businesses that have permanently closed and do not plan to submit a forgiveness application or have filed for Chapter 7 bankruptcy protection, among other circumstances.

|

| Small Business Administration | The SBA Administrator should implement the advance purchase provision in the CARES Act or report to Congress why the agency has not complied, including seeking statutory flexibilities or exceptions believed appropriate. (Recommendation 2) |

SBA included in its fiscal year 2023 Congressional Budget Justification and fiscal year 2021 Annual Performance Report a request that Congress repeal the requirement that SBA purchase PPP loans. In its justification, SBA noted that the option was not used, there was no interest in the advance purchase option from lenders, and lenders were able to obtain liquidity to make PPP loans from the Federal Reserve's PPP Liquidity Facility.

|

| Small Business Administration | The SBA Administrator should establish timeframes for finalizing and issuing its procedures for higher authority reviews and reviews conducted by a committee of senior managers. (Recommendation 3) |

SBA provided us with guides for higher authority reviews and reviews conducted by a committee of senior managers in March 2022. Among other things, the guides provide overviews of the reviews, information on the scope of the reviews, and how the relevant staff should conduct them and record their findings. The guides also include templates for communicating with the lender responsible for the loan forgiveness application being reviewed.

|

| Small Business Administration | The SBA Administrator should develop and implement a process to ensure it responds in a timely manner to PPP lender inquiries on loan reviews. (Recommendation 4) |

In March 2022, SBA provided us with documentation on procedures its customer service staff are to follow and templates for responses to questions. The procedures describe how SBA staff are to respond and track lender inquiries SBA receives through the platform lenders use to submit loan forgiveness decisions to SBA. In the sample templates created following our recommendation, SBA provided its staff with draft responses for communicating with lenders. For example, one template provides draft language to help lenders submit additional documentation when there is an identified problem but the platform does not accept the submission, allowing the process to continue.

|