2020 Lobbying Disclosure: Observations on Lobbyists' Compliance with Disclosure Requirements

Fast Facts

We audited compliance with the Lobbying Disclosure Act, which requires paid lobbyists to disclose their activities, political contributions, and certain criminal convictions.

In our interviews, documentation reviews, and sample of lobbying disclosure reports, we found that

Most lobbyists provided documentation for key elements of their disclosure reports to demonstrate compliance with the act

Lobbyists complied with reporting requirements regarding criminal convictions

The U.S. Attorney’s Office for the District of Columbia enforces noncompliance by having lobbyists terminate their registrations or by imposing civil and criminal penalties

This page was updated to clarify the role of the U.S. Attorney’s Office for the District of Columbia in enforcing non-compliance.

Highlights

What GAO Found

For the 2020 reporting period, most lobbyists provided documentation for key elements of their disclosure reports to demonstrate compliance with the Lobbying Disclosure Act of 1995, as amended (LDA). For lobbying disclosure (LD-2) reports and political contribution (LD-203) reports filed during the third and fourth quarters of 2019 and the first and second quarters of 2020, GAO estimates that

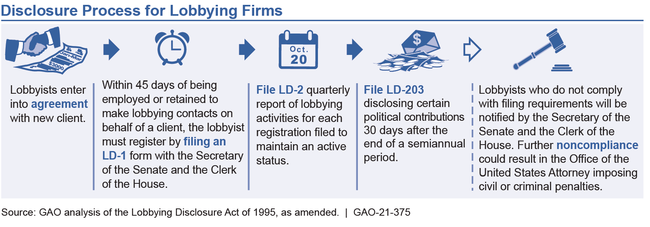

91 percent of lobbyists who filed new registrations also filed LD-2 reports as required for the quarter in which they first registered (the figure below describes the filing process and enforcement);

99 percent of all lobbyists who filed could provide documentation for lobbying income and expenses;

29 percent of all LD-2 reports did not properly disclose one or more previously held covered positions as required; and

8 percent of LD-203 reports were missing reportable contributions.

These findings are generally consistent with GAO's findings since 2011. Under the Justice Against Corruption on K Street Act of 2018, lobbyists are required to report certain criminal convictions. GAO found that, of the 210 individual lobbyists in our sample, none failed to report a conviction.

GAO found that most lobbyists in a sample of 129 lobbyists reported some level of ease in complying with disclosure requirements and in understanding the definitions of terms used in the reporting. However, some disclosure reports demonstrated compliance difficulties, such as failures to disclose covered positions or misreporting of income or expenses.

The U.S. Attorney's Office for the District of Columbia (USAO) tries to resolve noncompliance by having lobbyists file their reports, terminate their registrations, or by imposing civil and criminal penalties. USAO received 3,956 referrals from both the Secretary of the Senate and the Clerk of the House for failure to comply with reporting requirements cumulatively for years 2011 through 2020. Of the 3,956 referrals, about 36 percent are now compliant and about 63 percent are pending further action. The remaining 1 percent did not require action or were suspended because the lobbyist or client was no longer in business or the individual lobbyist was deceased.

Why GAO Did This Study

The LDA, as amended, requires lobbyists to file quarterly disclosure reports and semiannual reports on certain political contributions. The law also includes a provision for GAO to annually audit lobbyists' compliance with the LDA.

This report (1) determines the extent to which lobbyists can demonstrate compliance with disclosure requirements, (2) identifies challenges or potential improvements to compliance that lobbyists report, and (3) describes the efforts of USAO in enforcing LDA compliance. This is GAO's 14th annual report under the provision.

GAO reviewed a stratified random sample of 97 quarterly disclosure LD-2 reports filed for the third and fourth quarters of calendar year 2019 and the first and second quarters of calendar year 2020. GAO also reviewed two random samples totaling 160 LD-203 reports from year-end 2019 and midyear 2020.

This methodology allowed GAO to generalize to the population of 52,289 disclosure reports with $5,000 or more in lobbying activity and 29,447 reports of federal political campaign contributions. GAO also interviewed USAO officials.

We provided a draft of this report to the Department of Justice for review. The Department of Justice did not have comments.

For more information, contact Yvonne D. Jones at (202) 512-2717 or jonesy@gao.gov.