Tax Administration: Taxpayer Input Could Strengthen IRS's Online Services

Fast Facts

IRS offers a range of online services, including services that allow taxpayers to track refunds or view their accounts. Although IRS recognizes that taxpayers want more online options, it hasn’t considered taxpayer input in developing new services. Also, its efforts to determine whether current online services meet taxpayer needs haven’t yet been sufficient to make decisions about how to move forward.

IRS has long relied on private companies to help taxpayers file electronically, but it hasn’t given adequate consideration to the benefits and costs of this agreement with industry.

We made 7 recommendations to address these and other challenges.

A person looking at the IRS website

Highlights

What GAO Found

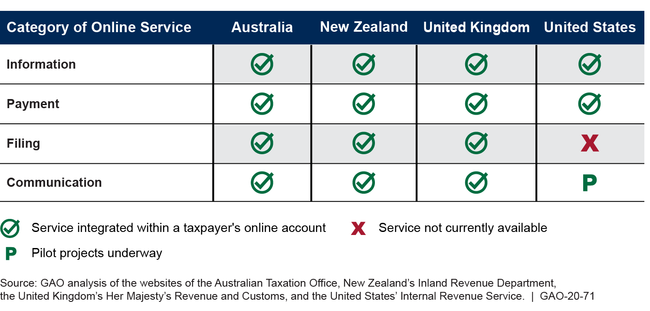

The Internal Revenue Service's (IRS) online services for individual taxpayers primarily provide taxpayers one-way communication of key information derived from their tax return, such as when an anticipated refund should arrive, or allow taxpayers to pay money owed or make payment arrangements. IRS has done little research or reporting on the extent to which its online services are satisfying taxpayers' needs. Also, IRS has not set a target for using online services to help reduce taxpayer burden. Selected foreign and state revenue agencies' online services have developed online filing and communication capabilities, such as filing a tax return on the agency's website and offering electronic chats between revenue agency employees and taxpayers (see figure).

The U.S. Internal Revenue Service's and Three Foreign Revenue Agencies' Online Services

IRS has long-term planning documents which detail online services it intends to develop, which include services to communicate digitally with taxpayers, to achieve its goal of modernizing the taxpayer experience. However, GAO found that IRS has not sufficiently considered taxpayer input in the prioritization process for these new services and instead prioritizes services primarily based on the potential benefit to IRS operations or how quickly a service might be developed. Without considering taxpayer input on user needs and preferences, IRS risks developing services that taxpayers do not use.

A group of private sector tax preparation companies known as Free File, Inc., has a long-standing agreement with IRS in which the companies provide free electronic tax preparation and filing services to eligible taxpayers in exchange for IRS not offering its own filing capability. However, few taxpayers use these services and GAO found that IRS has given inadequate consideration to the full benefits and costs of the Free File agreement to all parties. Not considering these costs and benefits has implications for the future evolution of IRS's online services, including helping taxpayers electronically file amended returns.

Why GAO Did This Study

IRS recognizes that taxpayers want more choices in how they interact with IRS, including through online services. GAO was asked to review IRS's online services—those which allow IRS and individual taxpayers to exchange personalized information electronically. This report (1) examines what is known about how IRS's current online services are meeting taxpayers' needs, and provides information about selected foreign and state revenue agencies' online services; (2) evaluates the extent to which IRS's strategy for identifying and prioritizing the development of new online services is consistent with relevant requirements and leading practices; and (3) examines how IRS is addressing key challenges in providing online services.

GAO assessed IRS's online services against relevant requirements, agency goals, and leading practices; interviewed IRS officials; and identified additional services and practices from six foreign and state revenue agencies selected for offering multiple online services for exchanging personalized information with taxpayers.

Recommendations

GAO is making seven recommendations to IRS, including measuring and reporting on the effect of online services on satisfaction and taxpayer burden and setting a target for reducing burden, considering taxpayer input when prioritizing new online services, and ensuring that any renewal of the Free File agreement reflects benefits and costs. IRS agreed with six recommendations, but disagreed on setting a target to reduce burden. GAO continues to believe IRS should set such a target.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of the IRS should ensure that information is collected on taxpayers' experiences with all online services and the extent to which the services are meeting taxpayers' needs. (Recommendation 1) |

IRS agreed with this recommendation and in November 2021, IRS provided examples of the new OMB approved surveys that IRS officials stated would allow the IRS to better measure the customer experience with specific online services. Specifically, IRS surveyed selected users of the Direct Pay, Online Accounts, and Tax Pro Accounts online services to ask questions about whether the taxpayer's needs were addressed and if the taxpayer was satisfied with the service, among other questions. The surveys also allow taxpayers to provide additional open ended comments about the different online services. The format of these surveys is consistent with OMB guidelines. In addition, officials told us that the new irs.gov main site survey provides feedback about the other online services our report evaluated because officials can determine the user's primary task and whether the user was able to complete a task. IRS's new surveys should make it easier for officials to assess how effectively their online services are meeting taxpayers' needs and inform efforts to make further improvements to the taxpayer experience.

|

| Internal Revenue Service | The Commissioner of the IRS should ensure that information collected on taxpayers' experiences with online services is summarized in the document serving as IRS's performance plan and report. (Recommendation 2) |

IRS agreed with this recommendation. In June 2020, IRS reported that it was working to implement new surveys to better capture customer experience data and reported that it intended to publish this information on Performance.gov. Further, IRS said that it would "evaluate and identify the most appropriate medium each year for publication of the data based on statutory and other requirements." As of December 2021, OMB, IRS, and other agencies have compiled customer experience information on various federal services on Performance.gov. Specifically, IRS published on Performance.gov customer experience data regarding taxpayers' experience using online accounts, which our report identified as an increasingly used online service, and customer experience data regarding the rest of irs.gov, which officials noted encompasses taxpayers who visit irs.gov to use other online services such as refund tracking. The information IRS has posted on Performance.gov should make it easier for external audiences, such as OMB staff and congressional staff, to understand the importance of IRS's online services to taxpayers and work with IRS on continued improvements.

|

| Internal Revenue Service | The Commissioner of the IRS should direct the Director of OLS and the Chief Research and Analytics Officer to work together to analyze the potential effects of online services on taxpayer burden. (Recommendation 3) |

IRS agreed with our recommendation and in October 2020 officials provided documentation showing the recommended research had been completed in May 2020. Specifically, officials with IRS's Research, Applied Analytics, and Statistics office evaluated the most recently completed Individual Taxpayer Burden Survey (for tax year 2017) and the Taxpayer Compliance Burden Survey (for calendar year 2014) and divided respondents to these surveys into different segments depending on whether or not they had used irs.gov or an IRS app for the 2017 survey. IRS' analysis of the 2017 survey determined that taxpayers who had used irs.gov reported a higher time burden, more money spent on tax preparation and filing software, and less money spent on fees for paid preparers than those who had not used irs.gov. Further, IRS's analysis identified possible explanations for these findings and identified additional online services survey respondents would like, such as immediate error checks when filing and ability to electronically communicate with IRS.

|

| Internal Revenue Service | The Commissioner of the IRS should ensure that taxpayer input is included as an element of IRS's identification and prioritization process for new online services. (Recommendation 4) |

IRS agreed with the recommendation. In November 2021, IRS officials provided documentation showing how they have updated their overall approach and philosophy for creating and upgrading online services by incorporating user feedback. Specifically, the documentation shows that IRS completed additional usability tests and made design changes for the Digital Notices and Letters (DNL) and the Tax Withholding Estimator (TWE). For DNL, IRS testing from December 2019 to March of 2020 showed that a large majority of taxpayers participating in the test said they would be open to receiving notices in digital form provided that IRS designed and deployed the service with the proper features and functionality. Further, IRS officials stated that based on an evaluation of taxpayers' experiences with DNL they refined and simplified the language, they included links to allow for more management of taxpayer's communication preferences, and they added the option to go paperless. For the TWE, IRS conducted tests with 21 taxpayers in July 2020 and found that while all participants found the calculator helpful for figuring out the right amount of federal income tax to have withheld from their paycheck, there were also areas for improvement. For example, officials told us that they accelerated implementation of several new features in response to taxpayer feedback, such as a warning message when users exceed the estimated parameters. IRS officials stated that these changes led to increased completion rates and reduced taxpayer confusion. Giving more consideration to what taxpayers want should help IRS provide more helpful services to the taxpayers who visit irs.gov.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of the IRS should work with relevant officials to set a target to reduce taxpayer burden through the development of new online services. (Recommendation 5) |

While IRS disagreed with the recommendation because it did not believe a measurable target could be set, the agency stated that it would continue to look for opportunities to reduce taxpayer burden through the development of new online services. In April 2023, IRS identified a strategic objective of improving taxpayer services, which included expanding digital services and decreasing filing burdens for taxpayers. IRS officials provided documentation in July 2025 which showed they had previously quantified the estimated taxpayer burden changes due to two new online services. In 2020, IRS began allowing taxpayers to file amended returns electronically, which an IRS document stated would save taxpayers approximately 150,000 hours and decrease compliance costs by approximately $4 million in fiscal year 2021. In 2024 and 2025, IRS offered a new Direct File online service which assisted individual taxpayers in preparing and filing a tax return, which other IRS documents stated would save taxpayers $21 million in fiscal year 2024 and $41 million in fiscal year 2025. IRS also estimated that Direct File would have a negligible effect on the time taxpayers spent in fiscal year 2024 and would increase the time burden in fiscal year 2025 due to some taxpayers who previously used a paid preparer switching to Direct File, which IRS did not charge taxpayers to use.

|

| Internal Revenue Service | The Commissioner of the IRS should direct the Chief Information Officer and the Director of OLS to ensure that planned future capabilities of digital communication platforms are tested or piloted before deployment with a particular focus on mitigating the risks that were identified in prior pilots of digital communication services, such as challenges in establishing common objectives and enrolling taxpayers. (Recommendation 6) |

IRS agreed with this recommendation and took actions to implement it. Specifically, IRS documentation provided in October 2024 showed that the agency established a Taxpayer Digital Communication Program Office to improve secure messaging processes; developed procedures IRS managers should follow to ensure successful secure messaging deployment; and identified key performance indicators to assess long-term performance, including measuring taxpayer satisfaction with secure messaging. The Taxpayer Digital Communication Program Office also collaborated with relevant IRS offices by holding regular meetings and identifying goals for each meeting and action items. IRS officials also reported in August 2023 that there exist additional identity verification options for taxpayers seeking to use digital communications with customer support, which officials reported had increased taxpayer identity verification rates. IRS's actions should help taxpayers and IRS employees make more effective use of digital communication capabilities.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of the IRS should direct the Commissioner of W&I to work with the Director of OLS to ensure that future decisions regarding whether to renew the Free File agreement incorporate findings from a comprehensive examination of the benefits and costs of the agreement as it relates to long term plans for IRS's online services, including plans to file amended returns electronically. (Recommendation 7) |

IRS agreed with this recommendation. A March 2021 IRS analysis addressed a portion of the recommendation by identifying potential benefits, such as the lower cost of processing electronic returns compared to paper ones. However, IRS did not discuss how the Free File program should be coordinated with online services offered to taxpayers, such as online accounts. In April 2024, IRS and Free File, Inc. extended the term of their agreement until October 2029. IRS officials reported in April 2024 that they had not analyzed the potential benefits and costs of the Free File program prior to renewing the agreement because, in their view, no requirements were added. IRS officials also stated that the agency had not analyzed how the Free File program should relate to longer-term plans to expand IRS online services. IRS officials believe that the Free File program would not conflict with plans for expanding online services. In September 2024, IRS officials reiterated that the only costs for IRS are three employees who support the program, that the Free File program is coordinated with online accounts, and that the program contributes to IRS's strategic plan for using Inflation Reduction Act of 2022 funds to improve taxpayer services. However, our prior work found that IRS did not sufficiently consider potential benefits and costs before signing prior extensions of the Free File agreement and circumstances have continued to evolve with IRS's Direct File program. Further, in July 2025, Congress passed and the President signed P.L. 119-21, which contains a provision appropriating $15 million for IRS to report on the cost of enhancing public-private partnerships for free tax filing and replace IRS's Direct File program, assess the feasibility of a new approach that is consistent and simple for taxpayers and provides features to address taxpayer needs, and the cost of developing and running a free direct e-file tax return system. The provision also directs IRS to study taxpayer opinions and preferences regarding a government service or a private sector service. In October 2025, the Department of the Treasury reported to Congress that IRS was suspending the government run Direct File system. The report stated that IRS anticipates dedicating resources in the coming year to expand promotion of the Free File program, strengthen IRS oversight of the program, and take additional actions to evaluate the user experience and improve the design of Free File. While Treasury does not estimate the costs of these planned actions, Treasury states that the agency and IRS will issue a supplemental report for Congress which will assess the costs of promoting and improving existing free filing programs. To fully implement our recommendation, IRS needs to undertake a more complete analysis of the current Free File agreement and planned actions to improve the Free File program in order to inform decisions about the future direction of online services for individual taxpayers. Without a more rigorous examination, IRS is not positioned to manage the risks of its reliance on the Free File agreement or consider how Free File fits within its portfolio of IRS-provided online services.

|