Taxpayer Service: IRS Could Improve the Taxpayer Experience by Using Better Service Performance Measures

Fast Facts

According to the IRS, providing top-quality service is a critical part of its mission. IRS plans call for improved taxpayer experiences and services.

However, the IRS doesn't have performance goals specifying the desired improvements. For example, one IRS division has broad plans to monitor the taxpayer experience and address identified issues. But it doesn't have performance goals with measures that would indicate whether the taxpayer experience had improved, e.g., a goal of reducing telephone assistance wait times by a specified amount.

Our 7 recommendations include that IRS identify taxpayer experience performance goals and measures.

Highlights

What GAO Found

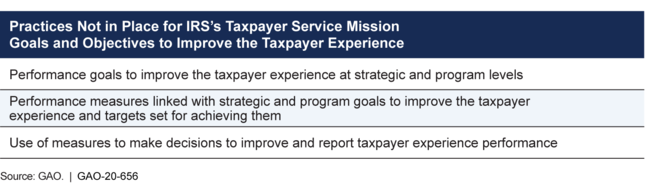

The Internal Revenue Service's (IRS) mission and strategic plan state expectations for IRS to improve the taxpayer experience and services it provides. However, IRS and its divisions that manage programs serving the largest taxpayer groups—the Wage and Investment (W&I) and the Small Business/Self-Employed (SB/SE) divisions—did not have performance goals to specify the desired improvements. For example, W&I aligned its service programs to IRS's strategic objectives for taxpayer services that state broad types of management activities such as monitoring the taxpayer experience and addressing issues. However, it did not have performance goals that specify outcomes to improve the taxpayer experience, such as reducing taxpayer wait times for telephone assistance.

Because IRS and these two divisions do not have performance goals for improving the taxpayer experience, IRS does not have related performance measures. IRS has many performance measures—including more than 80 for W&I and SB/SE—for assessing the services it provides, such as related to timeliness and accuracy of information provided to taxpayers. However, these existing measures do not assess improvements to the taxpayer experience, such as whether tax processes were simpler or specific services met taxpayers' needs. The division-level measures also lack targets for improving the taxpayer experience. Further, the existing measures do not capture all of the key factors identified in Office of Management and Budget guidance for how customers experience federal services, including customer satisfaction and how easy it was to receive the services. As a result, IRS does not have complete information about how well it is satisfying taxpayers and improving their experiences.

IRS analyzes its taxpayer service measures to compare performance with targets but the analyses provide few insights and no recommendations to improve the taxpayer experience, such as to provide more timely tax filing guidance. Also, IRS does not have a process to use service measures to guide decisions on allocating resources to improve the taxpayer experience. As a result, IRS is challenged to use performance data to balance resource allocation for efforts to improve the taxpayer experience compared with other IRS efforts. Finally, IRS reports limited information to the public about performance related to the taxpayer experience for transparency and accountability.

The table below summarizes important management practices that IRS did not fully follow to provide taxpayers a top-quality service experience.

Why GAO Did This Study

According to IRS, providing top-quality service is a critical part of its mission to help taxpayers understand and meet their tax responsibilities. Congress, the National Taxpayer Advocate, and the administration have recognized the importance of improving how taxpayers experience IRS services. Setting goals and objectives with related performance measures and targets are important tools to focus an agency's activities on achieving mission results.

GAO was asked to review IRS's customer service performance measures. This report assesses IRS's (1) goals and objectives to improve the taxpayer experience; (2) performance measures to support improved experiences; and (3) use of performance information to improve the experience, allocate resources, and report performance. To assess IRS's goals, measures, targets, and use of them, GAO compared IRS's practices to key practices in results-oriented management.

Recommendations

GAO is making 7 recommendations, including that IRS identify performance goals, measures, and targets; as well as analyze performance; develop processes to make decisions on resources needed; and report performance on improving the taxpayer experience. IRS indicated that it generally agreed with the recommendations, but that details around their implementation were under consideration and would be provided at a later date.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should identify agency-wide and division performance goals that align with IRS's strategic service goals and objectives for an improved taxpayer experience. (Recommendation 1) |

IRS agreed with the recommendation. IRS's Inflation Reduction Act (IRA) Strategic Operating Plan, which was published in April 2023, incorporates and supersedes prior strategies, according to IRS officials, and includes two taxpayer experience-related strategic objectives to improve services to help taxpayers meet their obligations and quickly resolve taxpayer issues when they arise. IRS's IRA Strategic Operating Plan Annual Update Supplement, which was published in April 2024, included 14 associated outcomes. According to IRS officials, these are IRS's strategic sub-goals for improving the taxpayer experience. However, the Supplement or other IRS documents did not clearly identify the sub-goals as performance goals. Also, our analysis showed that not all the sub-goals clearly stated intended outcomes for improving the taxpayer experience. When we shared this analysis with IRS officials, they provided supplemental information in December 2024 to explain how all the sub-goals are intended to improve the taxpayer experience. As of March 2025, IRS officials had not provided an expected date when IRS will formally state how all 14 sub-goals on improving taxpayer services will also improve the taxpayer experience. To fully implement these recommendations, IRS needs to clearly state performance goals for desired improvements in the taxpayer experience. Without clear goals, it will be challenging for IRS and stakeholders to assess progress made toward an improved taxpayer experience and providing top-quality service. Also, without such goals, IRS divisions that provide services to taxpayers do not have a clear picture of what specific actions would improve the taxpayer experience and would align with IRS's strategic objectives and vision for serving taxpayers as articulated in the Strategic Operating Plan. We will continue to monitor progress and periodically update this status as IRS documents its actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should identify performance measures with targets for improving the taxpayer experience that link with the related performance goals. (Recommendation 2) |

IRS agreed with this recommendation. IRS's Inflation Reduction Act Strategic Operating Plan, which was published in April 2023, incorporates and supersedes prior strategies, according to IRS officials, and includes two taxpayer experience-related strategic objectives to improve services to help taxpayers meet their obligations and quickly resolve taxpayer issues when they arise. IRS's IRA Strategic Operating Plan Annual Update Supplement, which was published in April 2024, included 14 associated outcomes. According to IRS, these are IRS's strategic sub-goals for improving the taxpayer experience. However, the Supplement or other IRS documents did not clearly identify the sub-goals as performance goals. Also, our analysis showed that not all the sub-goals clearly stated intended outcomes for improving the taxpayer experience. As of March 2025, IRS officials had not provided an expected date when IRS will formally state how all 14 sub-goals on improving taxpayer services will also improve the taxpayer experience and what measures will be aligned with the subgoals to track progress. To fully implement this recommendation, IRS needs to specify measures with targets for clearly stated performance goals for desired improvements in the taxpayer experience. Without such performance information, it will be challenging for IRS and stakeholders to assess progress made toward an improved taxpayer experience and providing top quality service. Without clear linkages between performance measures and related performance goals, IRS managers and staff who provide taxpayer service lack road maps showing how their daily activities can contribute to goals that relate to improving the taxpayer experience as envisioned in the Strategic Operating Plan. Without targets for the measures, Congress, IRS, and taxpayers are challenged to know whether performance is improving to desired levels as articulated in the plan. We will continue to monitor progress and periodically update this status as IRS documents its actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the taxpayer experience measures cover all of the factors for customer service identified in OMB guidance as well as service channels across the tax process phases. (Recommendation 3) |

IRS agreed with this recommendation and initially planned to implement it by January 2022. IRS provided documentation in October 2023, and met with GAO in December 2023, to describe efforts underway or planned to work with OMB guidance, particularly with respect to using customer experience surveys. IRS officials said that delays in staffing the Taxpayer Experience Office delayed progress on actions to implement this recommendation, including the selection of the Chief Taxpayer Experience Officer, which IRS announced in May 2024. In September 2024, IRS provided documentation showing completed actions to identify measures for taxpayer experience that cover the factors cited in OMB guidance and account for service channels across the tax process phases. More specifically, IRS developed the Customer Experience Measures Dashboard to provide IRS managers feedback based on taxpayers' service experiences. The Dashboard reports periodic survey measures results where taxpayers rate IRS on OMB-identified experience factors like how easy it was to get service (ease), how long it took (efficiency), and how well the service addressed the taxpayer's need (effectiveness). These survey measures, along with other experience-related measures in the Dashboard, range across IRS service channels including online account services (website), in-person taxpayer assistance centers, and correspondence-based services. In addition, the Dashboard measures cover a range of tax process phases including tax law assistance and payment services (tax return preparation, filing, and payment); dealing with notices (account resolution); and telephone operations for collecting taxes (collection). By providing measures data that address customer experience factors and cover core service program activities, the Dashboard gives IRS managers better information to identify opportunities to assess and improve IRS's performance in meeting taxpayer expectations for a top-quality service experience.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that taxpayer experience measures reflect the highest-impact taxpayer journeys and key transactions, as consistent with OMB guidance. (Recommendation 4) |

IRS agreed with this recommendation. IRS initially said it planned to implement our recommendation by January 2022. As of March 2025, IRS had identified several potential taxpayer journeys but did not clearly identify which were designated high-impact or reflected key transactions. Implementation of this recommendation depends on completion of the earlier recommendation on IRS's taxpayer experience measures. We will continue to monitor progress and periodically update this status as IRS documents its actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should regularly analyze and use the results of the performance measures and surveys on the taxpayer experience to help improve performance. (Recommendation 5) |

IRS agreed with this recommendation. IRS said it intended to use the results from analyzing the measures to inform decision making for investment prioritization, resource allocation, and strategic direction under the Taxpayer Experience Office. As of March 2025, efforts to develop these surveys and measures were still underway. Implementation of this recommendation depends on completion of the earlier recommendations on IRS's taxpayer experience measures as well as evidence that the analyses of results were used to improve performance. We will continue to monitor progress and periodically update this status as IRS documents its actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should develop processes for using performance results on the taxpayer experience as part of resource allocation decisions intended to improve performance. (Recommendation 6) |

IRS agreed with this recommendation. In response, IRS updated Internal Revenue Manual (IRM) 1.5.1 performance measures guidance to include references to OMB's customer experience guidance. In January 2023, IRS officials described IRS's process for developing its budget request. However, it is not clear how the revised guidance, or the description of the budget development process, documents how IRS will use performance data to make resource allocation decisions that improve the taxpayer experience. A key reason that IRS has not clearly identified a process to guide these resource decisions to improve taxpayer experience is that IRS has not established performance goals with measures and targets for experience. Without that performance information, IRS cannot analyze the gap between actual and target performance for taxpayer experiences and identify actions to improve the experience to target levels. Without such a process, IRS cannot consider important issues in a rigorous manner needed to allocate limited resources. Further, without a process to use all available quantitative and qualitative data on alternate resource decisions, IRS risks not optimally balancing the resources across competing interests to help improve taxpayer experiences. We will continue to monitor progress and periodically update this status as IRS documents its actions to implement the recommendation, as we requested in July 2025.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should publicly report available information on taxpayer experience performance, including the measures and related targets, for example by providing it on IRS.gov and in IRS publications. (Recommendation 7) |

IRS agreed with this recommendation. This recommendation cannot be fully implemented until IRS implements earlier recommendations on the measures and targets. We will continue to monitor progress and periodically update this status as IRS documents its actions to implement the recommendation, as we requested in July 2025.

|