Public Companies: Disclosure of Environmental, Social, and Governance Factors and Options to Enhance Them

Fast Facts

Nonfinancial information about how a company does business (e.g., a bank’s cybersecurity program) could be an indicator of its long-term financial performance.

Investors have been asking companies to disclose more on these environmental, social, and governance topics (known as “ESG”).

We reviewed disclosures from 32 companies. Most included some of this information, but it wasn’t always clear or useful. For example, it was hard to compare climate or resource-related information when companies used different calculation methods or reported results in different units of measurement.

We discussed several options to improve these disclosures.

Wall Street

Highlights

What GAO Found

Most institutional investors GAO interviewed (12 of 14) said they seek information on environmental, social, and governance (ESG) issues to better understand risks that could affect company financial performance over time. These investors added that they use ESG disclosures to monitor companies' management of ESG risks, inform their vote at shareholder meetings, or make stock purchasing decisions. Most of these institutional investors noted that they seek additional ESG disclosures to address gaps and inconsistencies in companies' disclosures that limit their usefulness.

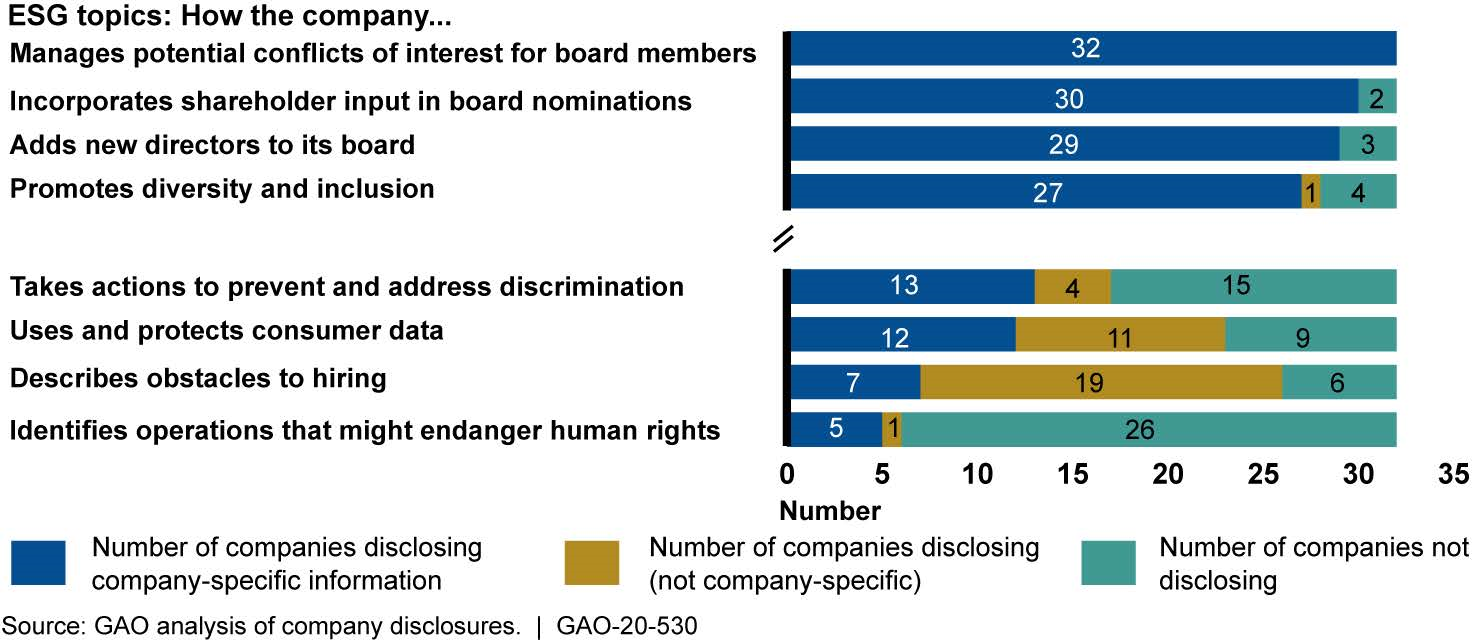

GAO's review of annual reports, 10-K filings, proxy statements, and voluntary sustainability reports for 32 companies identified disclosures across many ESG topics but also found examples of limitations noted by investors. Twenty-three of 32 companies disclosed on more than half of the 33 topics GAO reviewed, with board accountability and workforce diversity among the most reported topics and human rights the least. Disclosure on an ESG topic may depend on its relevance to a company's business. As shown in the figure, most companies provided information related to ESG risks or opportunities that was specific to the company, though some did not include this type of company-specific information.

The Four Environmental, Social, and Governance (ESG) Disclosure Topics GAO Reviewed with the Most and Least Company-Specific Disclosures, Generally Covering Data from 2018

Note: GAO reviewed 32 companies' 10-Ks, proxy statements, annual reports, and voluntary sustainability reports (generally with data from 2018, and some with data from 2017 and 2019).

Additionally, differences in methods and measures companies used to disclose quantitative information may make it difficult to compare across companies. For example, companies differed in their reporting of carbon dioxide emissions.

Policy options to improve the quality and usefulness of ESG disclosures range from legislative or regulatory action requiring or encouraging disclosures, to private-sector approaches, such as using industry-developed frameworks. These options pose important trade-offs. For example, while new regulatory requirements could improve comparability across companies, voluntary approaches can provide flexibility to companies and limit potential costs.

Why GAO Did This Study

Investors are increasingly asking public companies to disclose information on ESG factors to help them understand risks to the company's financial performance or other issues, such as the impact of the company's business on communities. The Securities and Exchange Commission requires public companies to disclose material information—which can include material ESG information—in their annual 10-K filings and other periodic filings.

GAO was asked to review issues related to public companies' disclosures of ESG information. This report examines, among other things, (1) why investors seek ESG disclosures, (2) public companies' disclosures of ESG factors, and (3) the advantages and disadvantages of ESG disclosure policy options.

GAO analyzed 32 large and mid-sized public companies' disclosures on 33 selected ESG topics. Among other criteria, GAO selected companies within eight industries that represented a range of sectors in the U.S. economy and selected ESG factors that were frequently cited as important to investors by market observers. GAO also reviewed reports and studies on ESG policy proposals and interviewed 14 large and mid-sized institutional investors (seven private-sector asset management firms and seven public pension funds), 18 public companies, 13 market observers (such as ESG standard-setting organizations, academics, and other groups), and international government, stock exchange, and industry association representatives.

For more information, contact Michael Clements at (202) 512-8678 or ClementsM@gao.gov.