Customs and Border Protection: Risk Management for Tariff Refunds Should Be Improved

Fast Facts

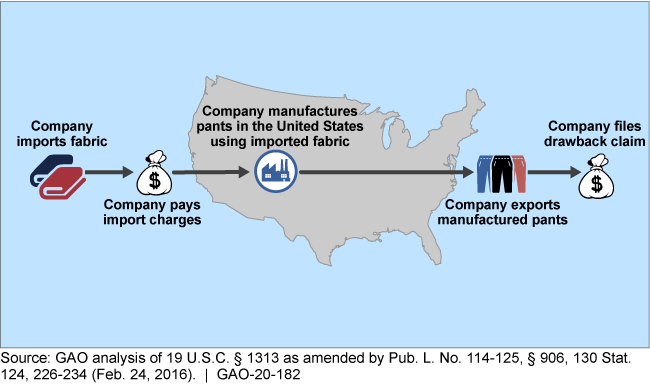

Since 1789, the U.S. government’s drawback program has encouraged manufacturing and exports by refunding certain customs duties. For example, a merchant who paid duties on imported fabric, made it into clothes, and then exported the clothes could claim a refund for import duties paid. The program refunds about $1 billion a year.

We found problems in how CBP checks these claims. For example, CBP’s new electronic records system doesn’t include enough details on exports. CBP must manually check claims but currently isn’t doing so. It could be issuing refunds it shouldn’t issue.

We made 6 recommendations to address this and other problems.

Example of Potential Drawback

Illustration showing that company imports fabric, pays import charges, manufactures pants using imported fabric, exports manufactured pants, and files drawback claim

Highlights

What GAO Found

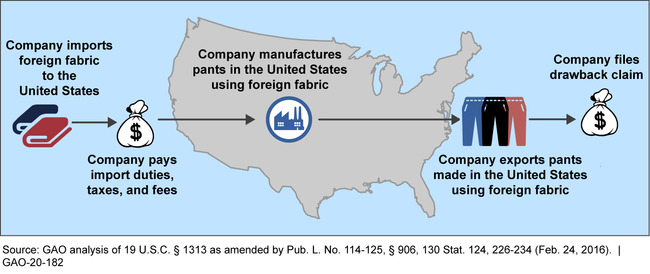

The Trade Facilitation and Trade Enforcement Act of 2015 (TFTEA) generally expanded eligibility for the drawback program, which provides refunds to claimants of up to 99 percent of certain customs duties, taxes, and fees. For example, a claimant could claim a drawback refund on exported pants made in the United States using imported foreign fabric. The expansion from TFTEA has resulted in Customs and Border Protection (CBP) facing a growing workload. According to CBP officials, the most significant change from TFTEA is that it is now easier to qualify for certain drawback refunds. Industry representatives explained that new claimants are seeking drawback refunds and existing claimants are able to increase claim amounts. However, CBP has not adequately managed the increased workload and has not developed a plan for doing so. As a result, CBP faces delays in processing drawback claims that could result in uncertainty for industry, potentially impeding trade.

GAO Example of One Potential Drawback Claim

CBP has taken some steps to address risks of improper payments in the drawback program, but several risks remain. To help ensure it does not overpay funds, CBP now electronically verifies drawback claims against underlying import information. However, CBP cannot verify drawback claims against underlying export information because it does not maintain detailed information about exports in its new electronic system. To compensate for this lack of automated controls, CBP requires manual full desk reviews of a selection of claims to mitigate improper payment risks. However, CBP has not targeted certain claims for a full desk review since switching to the new system on February 24, 2018. The lack of review for claims, which numbered over 35,000 and represented an estimated $2 billion in claims filed as of August 23, 2019, increases the risk of improper payments.

CBP has not produced a reliable assessment of the economic impact of the changes to drawback refund eligibility because of data availability constraints, systems limitations, and other factors. CBP has not prioritized developing a plan to revisit its economic analysis, although new data and systems capabilities are becoming available. Without such a plan, CBP will not have a reliable assessment of the impact of the changes on industry and government.

Why GAO Did This Study

The United States enacted the drawback program in 1789 to create jobs and encourage manufacturing and exports, according to CBP. CBP has primary responsibility for overseeing the drawback program. It disburses about $1 billion in drawback refunds per year.

According to CBP, TFTEA modernized the drawback program, generally broadening the scope of potential claims and allowing electronic filing starting February 24, 2018. As of February 24, 2019, claimants could only file claims under the drawback statute as amended by TFTEA. TFTEA also included a provision for GAO to assess drawback modernization.

This report examines the extent to which (1) modernization affects drawback refund eligibility and CBP's management of its workload, (2) CBP has taken steps to address risks of improper payments in the program, and (3) CBP has analyzed the impact of the changes to the program on industry and government. GAO reviewed statutory, regulatory, and agency documents, and interviewed agency officials and industry representatives.

Recommendations

GAO is making six recommendations, including that CBP develop a plan for handling its drawback workload, improve its validation activities, and prioritize developing a plan for an economic analysis of the regulation to understand its impact. CBP concurred with all six recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of the Commissioner | The Commissioner of CBP should ensure that the Office of Field Operations, in consultation with the Office of Trade, develops a plan for managing its increased workload. (Recommendation 1) |

CBP concurred with this recommendation and developed a plan to address the increased drawback workload. As of March 2021, CBP is implementing the plan including issuing updated guidance on electronic processing of claims, ruling and privilege applications, and expediting certain low risk claims. CBP also received additional resources from other offices to temporarily support the drawback office.

|

| Office of the Commissioner |

Priority Rec.

The Commissioner of CBP should ensure that the Office of Trade assesses the feasibility of flagging excessive export submissions across multiple claims and takes cost-effective steps, based on the assessment, to prevent over claiming. (Recommendation 2) |

CBP agreed with GAO's December 2019 recommendation and has taken steps to address it. In March 2023, CBP drafted a white paper examining the feasibility of attaching a unique identifier to exported merchandise in the Automated Commercial Environment (ACE) and mandating a uniform reporting requirement of the exported merchandise's unique identifier. Based on the assessment, CBP determined that tracking export submissions across drawback claims is not feasible because current law, ACE programming, and staff resources do not support the uniform reporting requirement CBP was considering. CBP officials said that tracking export submissions across drawback claims will require a long-term plan to develop ACE capabilities, set priorities, and align resources. As of September 2024, CBP developed a projected plan with milestones to deliver a system of record for tracking export submissions across drawback claims. The plan is estimated to take a minimum of 12 years to implement and is contingent on securing funding for system development. By developing a plan, CBP should be better positioned to meet its goal of flagging excessive export submissions across multiple claims. Because claimants could over claim drawback refunds by using nonexistent, insufficient, or falsified export documentation, or by reusing export documentation across multiple claims for merchandise that was never exported, having the ability to flag excessive export submissions across multiple claims would enhance CBP's protection against over claiming.

|

| Office of the Commissioner |

Priority Rec.

The Commissioner of CBP should ensure that the Office of Trade develops a plan, with time frames, to establish a reliable system of record for proof of export. (Recommendation 3) |

CBP agreed with GAO's December 2019 recommendation and has taken steps to address it. In November 2023, CBP drafted a white paper examining the suitability of the Automated Export System (AES) as an electronic means of establishing proof of export. Based on the assessment, CBP determined that AES cannot support electronic proof of export for drawback claims in its current state. CBP officials said that establishing a reliable system of record for proof of export will require a long-term plan to develop AES capabilities. As of September 2024, CBP had developed a projected plan with milestones to deliver a system of record for electronic proof of export for drawback claims. The plan is estimated to take a minimum of 12 years to implement and is contingent on securing funding for system development. By developing a plan, CBP should be better positioned to meet its longstanding goal of designating AES as an electronic means of establishing proof of export. Further, establishing electronic proof of export would facilitate CBP's ability to systematically validate a company's proof of export and thus reduce potential loss of revenue related to duplicate or excessive drawback claims.

|

| Office of the Commissioner |

Priority Rec.

The Commissioner of CBP should ensure that the Office of Trade turns the claim selection feature in ACE back on and finalizes and implements procedures to target claims for review that were accepted into ACE during the period in which the selection feature was disabled. (Recommendation 4) |

CBP agreed with GAO's December 2019 recommendation and has taken steps to address it. For drawback claims that were submitted when the ACE claim targeting feature was disabled, CBP took steps to review claims on an ongoing basis during fiscal years 2020, 2021, 2022, and 2023. As of August 2023, CBP estimated that over the 4-year period it denied $163,370,381 (or $164,691,014 in fiscal year 2023 dollars using a net present value calculation) in improper refunds as a result of these reviews. In addition, as of February 2023, CBP enabled the claim targeting feature in ACE to randomly target claims for review. In March 2023, CBP issued new guidance instructing the drawback offices to perform a full desk review on claims randomly targeted for review by ACE. By enabling the claim targeting feature in ACE to randomly target claims for review, CBP should be better positioned to protect U.S. trade revenue from improper refunds of drawback claims.

|

| Office of the Commissioner | The Commissioner of CBP should ensure that the Office of Trade analyzes the results of its targeting of claims for review and designs responses to mitigate identified risks. (Recommendation 5) |

CBP concurred with this recommendation and has taken corrective action in response. Specifically, CBP officials told us that, in March 2020, CBP completed an analysis of the data captured in CBP's claim processing system, which identified variations in staff recording of certain data elements for claims targeted for review. As a result, CBP provided training to staff and our review of the training materials show that CBP addressed the deficiencies it identified.

|

| Office of the Commissioner | The Commissioner of CBP should ensure that the Office of Trade prioritizes developing a plan to conduct an ex post analysis of the impact on industry and government of key changes to the drawback program, including time frames and methodology. (Recommendation 6) |

CBP concurred with this recommendation. In July 2020, CBP finalized a preliminary plan to conduct an ex post analysis of the impact on industry and government of key changes to the drawback program. CBP's analytical plan included a timeline and methodology for assessing changes to the program.

|