Medicare and Medicaid: CMS Should Assess Documentation Necessary to Identify Improper Payments

Fast Facts

Medicare and Medicaid review medical record documentation to ensure that they're only paying eligible doctors and hospitals for medically necessary, covered services. These reviews found an estimated $27.5 billion in payment errors due to insufficient documentation in FY 2017.

We found that Medicare and Medicaid have different documentation requirements for some of the same services, contributing to substantially different estimated error rates.

We recommended that the programs look into their documentation requirements, and more.

Both programs are on our High Risk List.

Stethoscope on a computer keyboard

Highlights

What GAO Found

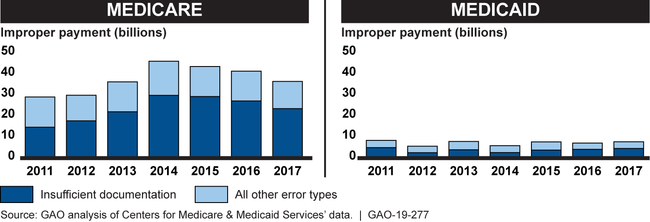

The Centers for Medicare & Medicaid Services (CMS) uses estimates of improper payments to help identify the causes and extent of Medicare and Medicaid program risks and develop strategies to protect the integrity of the programs. CMS estimates Medicare and Medicaid fee-for-service (FFS) improper payments, in part, by conducting medical reviews—reviews of provider-submitted medical record documentation to determine whether the services were medically necessary and complied with coverage policies. Payments for services not sufficiently documented are considered improper payments. In recent years, CMS estimated substantially more improper payments in Medicare, relative to Medicaid, primarily due to insufficient documentation (see figure).

Estimated Improper Payments Identified through Medical Review in Medicare and Medicaid Fee-for-service, Fiscal Years 2011-2017

For certain services, Medicare generally has more extensive documentation requirements than Medicaid. For example, Medicare requires additional documentation for services that involve physician referrals, while Medicaid requirements vary by state and may rely on other mechanisms—such as requiring approval before services are provided—to ensure compliance with coverage policies. Although Medicare and Medicaid pay for similar services, the same documentation for the same service can be sufficient in one program but not the other. The substantial variation in the programs' improper payments raises questions about how well the programs' documentation requirements help identify causes of program risks. As a result, CMS may not have the information it needs to effectively address program risks and direct program integrity efforts.

CMS's Medicaid medical reviews may not provide the robust state-specific information needed to identify causes of improper payments and address program risks. In fiscal year 2017, CMS medical reviews identified fewer than 10 improper payments in more than half of all states. CMS directs states to develop corrective actions specific to each identified improper payment. However, because individual improper payments may not be representative of the causes of improper payments in a state, the resulting corrective actions may not effectively address program risks and may misdirect state program integrity efforts. Augmenting medical reviews with other sources of information, such as state auditor findings, is one option to better ensure that corrective actions address program risks.

Why GAO Did This Study

In fiscal year 2017, Medicare FFS had an estimated $23.2 billion in improper payments due to insufficient documentation, while Medicaid FFS had $4.3 billion—accounting for most of the programs' estimated FFS medical review improper payments. Medicare FFS coverage policies are generally national, and the program directly pays providers, while Medicaid provides states flexibility to design coverage policies, and the federal government and states share in program financing.

Among other things, GAO examined: (1) Medicare and Medicaid documentation requirements and factors that contribute to improper payments due to insufficient documentation; and (2) the extent to which Medicaid reviews provide states with actionable information. GAO reviewed Medicare and Medicaid documentation requirements and improper payment data for fiscal years 2005 through 2017, and interviewed officials from CMS, CMS contractors, and six state Medicaid programs. GAO selected the states based on, among other criteria, variation in estimated state improper payment rates, and FFS spending and enrollment.

Recommendations

GAO is making four recommendations to CMS, including that CMS assess and ensure the effectiveness of Medicare and Medicaid documentation requirements, and that CMS take steps to ensure Medicaid's medical reviews effectively address causes of improper payments and result in appropriate corrective actions. CMS concurred with three recommendations, but did not concur with the recommendation on Medicaid medical reviews. GAO maintains that this recommendation is valid as discussed in this report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Centers for Medicare & Medicaid Services |

Priority Rec.

The Administrator of CMS should institute a process to routinely assess, and take steps to ensure, as appropriate, that Medicare and Medicaid documentation requirements are necessary and effective at demonstrating compliance with coverage policies while appropriately addressing program risks. (Recommendation 1) |

The Department of Health and Human Services concurred with this recommendation. In February 2020, the Centers for Medicare & Medicaid Services (CMS) noted that it had clarified and amended several Medicare documentation requirements as part of an agency initiative to assess such requirements. CMS further stated that Medicaid documentation requirements are generally established at the state level, and that the agency has taken steps to identify best practices for documentation requirements and share them with states. In March 2025, CMS noted that it had implemented a process to identify and mitigate program integrity vulnerabilities. This process involves identifying and implementing effective program integrity approaches and lessons learned across Medicare and Medicaid. However, the agency did not describe how this process had been used to assess documentation requirements and better understand how the variation in the programs' requirements affects estimated improper payment rates. Without an assessment of how the programs' documentation requirements affect estimates of improper payments, CMS may not have the information it needs to ensure that Medicare and Medicaid documentation requirements are effective at demonstrating compliance and appropriately address program risks.

|

| Centers for Medicare & Medicaid Services | The Administrator of CMS should take steps to ensure that Medicaid medical reviews provide robust information about and result in corrective actions that effectively address the underlying causes of improper payments. Such steps could include adjusting the sampling approach to reflect state-specific program risks, and working with state Medicaid agencies to leverage other sources of information, such as state auditor and the Department of Health and Human Services' Office of the Inspector General findings. (Recommendation 2) |

The Department of Health and Human Services (HHS) did not concur with this recommendation. As of February 2025, HHS has stated that it does not plan to implement this recommendation because the agency believes the resource requirement is not justified based on the potential improper payment findings. HHS further stated that the agency already uses a variety of sources to identify and take corrective actions to address underlying causes of improper Medicaid payments. However, we found that the Centers for Medicare & Medicaid Services (CMS) and state Medicaid agencies are expending time and resources developing and implementing corrective actions that may not be representative of the underlying causes of improper payments in their states. Without robust information to effectively identify the underlying causes of improper payments, CMS and state Medicaid agencies may not develop corrective actions that effectively address Medicaid program risks.

|

| Centers for Medicare & Medicaid Services | The Administrator of CMS should take steps to minimize the potential for Payment Error Rate Measurement (PERM) medical reviews to compromise fraud investigations, such as by directing states to determine whether providers selected for PERM medical reviews are also under fraud investigation and to assess whether such reviews could compromise investigations. (Recommendation 3) |

In response to our recommendation, the Centers for Medicare & Medicaid Services (CMS) now directs states to determine whether providers selected for Payment Error Rate Measurement (PERM) medical reviews are also under fraud investigation, and to assess whether such reviews could compromise the investigations. Based on information provided to GAO in September 2021, CMS informs states of this requirement during PERM program kickoff meetings. By implementing this requirement, CMS will better prevent the possibility of PERM reviews potentially compromising ongoing fraud investigations.

|

| Centers for Medicare & Medicaid Services | The Administrator of CMS should address disincentives for state Medicaid agencies to notify the PERM contractor of providers under fraud investigation. This could include educating state officials about the benefits of reporting providers under fraud investigation, and taking actions such as revising how claims from providers under fraud investigation are accounted for in state-specific FFS improper payment rates, or the need for corrective actions in such cases. (Recommendation 4) |

In response to our recommendation, the Centers for Medicare & Medicaid Services (CMS) no longer requires states to develop a corrective action plan if a state Medicaid agency opts to remove a provider from the state's Payment Error Rate Measurement (PERM) medical reviews due to a fraud investigation, based on information provided to GAO in September 2021. This will remove a disincentive for state Medicaid agencies to notify the PERM contractor of providers under fraud investigation, which will better prevent the possibility of PERM reviews potentially compromising ongoing fraud investigations.

|