Tax Fraud and Noncompliance: IRS Could Further Leverage the Return Review Program to Strengthen Tax Enforcement

Fast Facts

The Return Review Program is one of IRS's key systems for detecting tax fraud and preventing bad refunds—preventing about $4.4 billion in bad refunds during the 2017 filing season.

IRS monitors the program's performance and adjusts it to address new threats, but we found ways to improve and expand use of the program.

For example, we recommended ways to increase the amount of data available to the program, including loading W-2 data into it more frequently and digitizing paper returns. We also recommended using the program for other tax enforcement activities such as selecting returns for audits or checking them for underreported income.

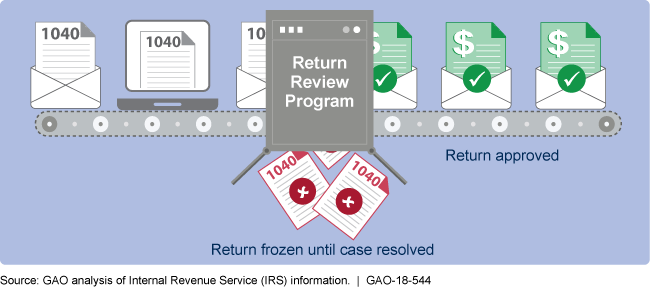

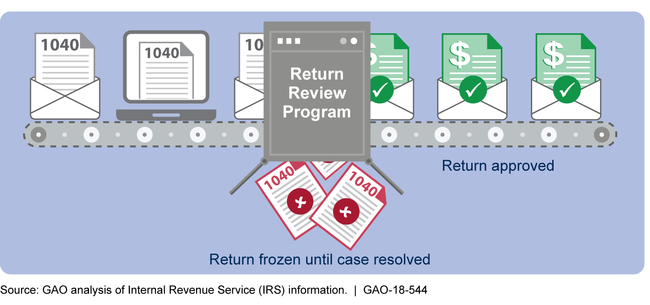

The Return Review Program Screens Individual Tax Returns Before IRS Issues Refunds

Image showing the Return Review Program screening legitimate and fraudulent tax returns.

Highlights

What GAO Found

The Internal Revenue Service's (IRS) Return Review Program (RRP) detects and selects potentially fraudulent returns to prevent the issuance of invalid refunds. According to IRS, RRP uses advanced analytic techniques and various data sources, including prior-year tax returns, to assign multiple scores to individual returns based on characteristics of identity theft and other refund fraud.

The Return Review Program Screens Returns Before IRS Issues Refunds

GAO found that IRS routinely monitors RRP's performance and adapts RRP to improve detection and address evolving fraud threats. Each year IRS updates RRP's detection tools to improve accuracy for the next filing season.

IRS has plans to continue developing RRP to further prevent invalid refunds, including using RRP to analyze and detect fraudulent business returns. However, GAO identified other opportunities for IRS to improve RRP's fraud detection and to use RRP for other enforcement activities:

- RRP's ability to accurately detect and select suspicious returns could benefit from having information on Forms W-2, Wage and Tax Statements (W-2) available for analysis more frequently. As of April 2018, IRS officials said they were drafting but had not yet approved a work request to load W-2s into RRP daily instead of weekly for the 2019 filing season.

- IRS could collect more information electronically from paper filers. One approach IRS evaluated in 2012 is to digitize some paper returns using barcoding technology, but it has not updated that analysis or expanded it to consider other digitizing technologies. IRS requested that Congress require that returns prepared electronically but filed on paper include a scannable code printed on the return, but Congress had not done so as of May 2018.

- IRS could apply RRP's capabilities to improve other tax enforcement activities, such as audit selection or underreporting detection. Individuals' underreporting of tax liabilities accounts for hundreds of billions in lost tax revenue. Until IRS evaluates the costs and benefits of expanding RRP to analyze returns not claiming refunds, IRS will not have the information needed to make decisions that could help streamline processes for detecting and treating additional types of noncompliance and fraud.

Why GAO Did This Study

Tax noncompliance, including refund fraud, threatens the integrity of the tax system and costs the federal government hundreds of billions of dollars annually. RRP is IRS's primary pre-refund system for detecting and preventing the issuance of invalid refunds. IRS reported that between January 2015 and November 2017 RRP prevented the issuance of more than $6.51 billion in invalid refunds.

GAO was asked to examine RRP's capabilities. This report (1) describes how RRP detects and selects suspicious returns and prevents invalid refunds; (2) assesses how IRS monitors and adapts RRP; and (3) examines what else, if anything, IRS can do to strengthen RRP and use it to address other enforcement issues.

GAO reviewed IRS plans for RRP and documents on its performance. GAO compared IRS's efforts to federal internal control standards, GAO's Fraud Risk Framework and IRS's strategic plan. GAO interviewed IRS officials who work on and use RRP.

Recommendations

GAO suggests Congress consider legislation to require that returns prepared electronically but filed on paper include a scannable code. GAO is also making five recommendations to IRS, including that IRS take action to make incoming W-2s available to RRP more frequently, update and expand a 2012 analysis of the costs and benefits of digitizing returns filed on paper, evaluate the costs and benefits of expanding RRP to analyze returns not claiming refunds, and take any appropriate action based on those evaluations. IRS agreed with GAO's recommendations.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider legislation to require that returns prepared electronically but filed on paper include a scannable code printed on the return. (Matter for Consideration 1) | No legislation enacted requiring a scannable code, as of February 13, 2026. In the 118th and 119th Congresses, the Senate and House introduced bills that would require federal tax returns that are prepared electronically-but printed and filed on paper-to have a scannable code that converts the data in the return to an electronic format. (118th Congress: S. 3660 and H.R. 2688; 119th Congress: S. 452 and H.R. 6956) Enacting such legislation would allow IRS to scan and digitize information from these returns and could strengthen IRS's tax enforcement efforts, resulting in increased compliance revenue. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should increase the frequency at which incoming W-2 information is made available to RRP. (Recommendation 1) |

In January 2019 IRS increased the frequency at which incoming W-2 information is made available to RRP. IRS loads W-2 data onto the Information Return Master File (IRMF), which then makes the data available to RRP. In August 2018 we found that IRS provided incoming W-2 information to RRP once per week because this was how frequently IRS loaded incoming W-2 information onto IRMF. IRS officials also told us in August 2018 that the agency planned to increase the frequency at which W-2 information would be loaded onto IRMF. In July 2019, IRS provided documentation demonstrating that the agency had begun loading the information onto IRMF on a daily basis beginning in January 2019. Doing so will enable IRS to expand its efforts to systemically verify wage information reported on tax returns and avoid issuing invalid refunds.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should update and expand a 2012 analysis of the costs and benefits of digitizing returns filed on paper to consider any new technology or additional benefits associated with RRP's enhanced enforcement capabilities. (Recommendation 2) |

IRS agreed with this recommendation and in December 2019, IRS officials reported that the agency plans to begin scanning and digitizing individual tax returns filed on paper beginning in October 2021. Consistent with GAO's recommendation, IRS is also considering additional benefits that digitization of paper returns could have on the Return Review Program's enhanced enforcement capabilities. In November 2018, IRS reported that digitizing paper returns at intake would allow IRS to use the same RRP filtering on all paper and electronic forms, allow more pre-refund audits or investigations, and reduce processing time, among other benefits.

|

| Internal Revenue Service |

Priority Rec.

Based on the assessment in recommendation 2, the Commissioner of Internal Revenue should implement the most cost-effective method to digitize information provided by taxpayers who file returns on paper. (Recommendation 3) |

IRS agreed with GAO's July 2018 recommendation and has taken steps to modernize the processing of individual and business paper returns in recent years. Steps include accessing electronic amended returns, an internet portal for businesses to e-file forms, and making 20 more tax forms available for electronic filing. For the 2024 filing season, IRS expanded a project using outside vendors to scan and extract data from some individual paper tax returns and employer returns., As of May 2025, IRS reports that about 5 percent (517,000) of the nearly 10 million paper Forms 940, 941, and 1040 that IRS had received during the 2025 filing season were processed through the vendor project. As of June 2025, IRS had plans to move forward with a zero paper initiative that would support its goal to digitally process 100 percent of paper-filed tax returns and information documents, consistent with this recommendation. Digitizing paper returns benefits taxpayers and IRS. Reduced processing time would result in faster refunds to taxpayers and easier access to more data for customer service. Also, IRS could use the Return Review Program (RRP) fraud filters on all paper and electronic forms and allow more pre-refund compliance checks or investigations.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should evaluate the costs and benefits of expanding RRP to analyze individual returns not claiming refunds to support other enforcement activities. (Recommendation 4) |

IRS agreed with GAO's July 2018 recommendation, noting that an agency goal is to expand the use of RRP to improve tax compliance and enforcement. IRS reported in January 2022 that it completed its extended evaluation to quantify the potential benefits of expanding RRP. According to IRS data, the evaluation showed an overall 15 percent improvement in taxpayer compliance and other benefits that increased revenue and led to increased efficiencies in IRS's work processes. This analysis is consistent with GAO's recommendation and demonstrates how RRP helps in streamlining the detection and treatment of fraud and can increase taxpayer compliance.

|

| Internal Revenue Service |

Priority Rec.

Based on the assessment in recommendation 4, the Commissioner of Internal Revenue should expand RRP to support identified activities. (Recommendation 5) |

IRS agreed with GAO's July 2018 recommendation and has taken steps to expand its use of RRP's technology. For example, in October 2022, IRS started using RRP to check for fraud and other withholding errors on digitized amended returns, helping examiners prioritize thousands of amended returns for manual review before a refund is issued. In May 2025, IRS reported that it is testing additional opportunities to leverage RRP. To fully implement this recommendation, IRS needs to consider ways to leverage RRP's screening capability at the time of filing. Expanding RRP to screen and filter all individual and business tax returns--not just those seeking refunds--could support key compliance goals. For example, taxpayer issues could more quickly be resolved by enhancing systemic checks on tax returns to identify issues at the point of filing and notify taxpayers.

|