2018 Tax Filing: IRS Managed Processing Challenges and Enhanced Its Management of Tax Law Changes

Fast Facts

IRS had multiple challenges during the 2018 tax filing season, yet it improved its customer service and met target dates for processing returns and issuing refunds. This happened despite a system outage on tax filing day. IRS also took steps to handle changes, such as tax rate revisions, under the 2017 Tax Cuts and Jobs Act.

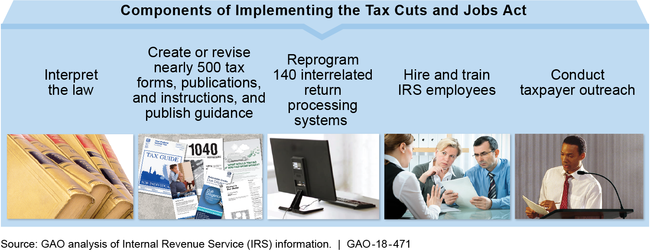

Before the 2019 filing season begins, IRS needs to reprogram its computer systems to process tax returns, revise nearly 500 forms and instructions, hire and train employees, and help taxpayers understand the changes when filing taxes in 2019. To do this, IRS set up a central office to coordinate efforts across the agency.

Placard showing where the Internal Revenue Service Building is in Washington, D.C.

Highlights

What GAO Found

The Internal Revenue Service (IRS) generally improved its customer service during the 2018 filing season compared to prior years and managed multiple return processing challenges. For the third year in a row, IRS improved its telephone service by answering 80 percent of calls seeking live assistance and reducing wait times to about 5 minutes, as of the end of the 2018 filing season. This compares to 37.5 percent of calls answered with an average wait time of about 23 minutes during the 2015 filing season. Taxpayer use of online services also increased, including irs.gov and its online account tool for taxpayers to view their balances due. However, answering taxpayer correspondence remains a challenge—IRS was late responding to about 37 percent of correspondence as of the end of the 2018 filing season compared to about 26 percent at the same time in 2017. In 2015, GAO recommended that the Department of the Treasury (Treasury) include timeliness in handling taxpayer correspondence as part of its performance goals, but as of June 2018 Treasury had not done so. Overall, despite multiple challenges including mid-filing season changes to tax law and a computer system failure, IRS met its processing targets for individual tax returns.

In 2018, IRS began taking steps to implement significant tax law changes from Public Law 115-97—commonly referred to by the President and many administrative documents as the Tax Cuts and Jobs Act. To implement the changes, IRS established a centralized office to coordinate implementation across IRS offices and divisions. IRS officials cited the broad scope and complexity of the changes—which will require extensive changes to tax forms, publications, and computer systems—along with the 1 year time frame as key implementation challenges. Although IRS has taken steps to address these challenges, such as developing a project planning tool, GAO found that the new coordination office did not initially fully include the Human Capital Office (HCO), the division responsible for managing the agency's workforce. Based on GAO's discussions with IRS officials, representatives from HCO now attend weekly coordination meetings discussing and planning the tax law changes. Involving HCO in these discussions will better position IRS to hire new employees and train them and the existing workforce. It will also help HCO better understand training requirements and staffing needs ahead of the 2019 filing season.

IRS Steps to Implement the Tax Cuts and Jobs Act

Why GAO Did This Study

During the tax filing season, generally from January to mid-April, IRS processes over 100 million individual tax returns and provides telephone, correspondence, online, and in-person service to tens of millions of taxpayers. In 2018, IRS had to begin taking steps to implement major tax law changes passed in what is commonly referred to as the Tax Cuts and Jobs Act that affect both individuals and businesses.

GAO was asked to review IRS's performance during the 2018 filing season and its efforts to implement the Tax Cuts and Jobs Act. GAO assessed IRS's (1) performance providing service to taxpayers and processing individual tax returns and (2) early efforts to implement the Tax Cuts and Jobs Act.

GAO analyzed IRS documents and data and interviewed IRS officials.

Recommendations

Because HCO is now attending the weekly meetings, GAO is not making a related recommendation. In addition, GAO believes that its 2015 recommendation to Treasury to include timeliness in handling correspondence as part of its performance goals, which Treasury neither agreed or disagreed with, is still valid. IRS generally concurred with GAO's findings but noted concerns with interpreting the percentage of correspondence considered “overage” (more than 45 days old). GAO clarified its report but notes that while the open inventory of overage correspondence at the end of the fiscal year is not representative of total overage items for the year, the overage rates are relatively consistent throughout the year.