Puerto Rico: Factors Contributing to the Debt Crisis and Potential Federal Actions to Address Them

Fast Facts

View Spanish version of Highlights (PDF, 1 page).

Puerto Rico has roughly $70 billion in outstanding debt, and since August 2015 has defaulted on over $1.5 billion in debt.

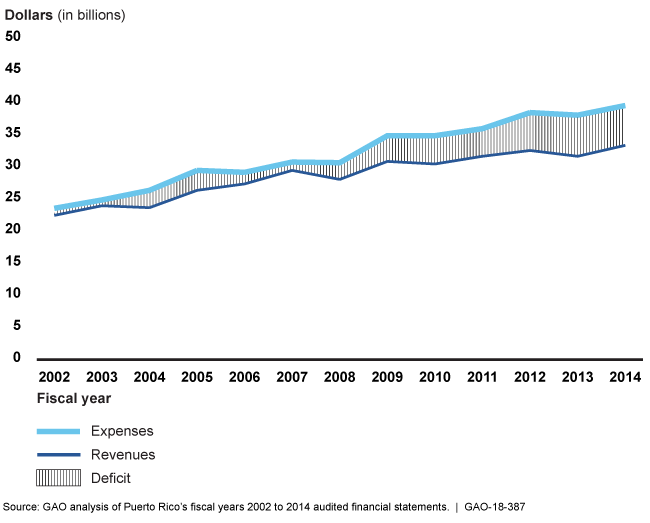

One factor contributing to Puerto Rico’s debt levels is the Puerto Rico government's persistent annual deficits, where expenses exceeded revenues. Puerto Rico’s government has borrowed money to finance its operations, rather than cutting spending, raising taxes, or both.

We identified various potential federal actions that could help address factors contributing to the debt crisis. These include altering the tax-exempt status of Puerto Rico municipal debt, and applying federal investor protection laws to Puerto Rico.

Puerto Rico Has Run Persistent Annual Deficits

This graphic shows consistent deficits--that expenses have not met revenues--from 2002 through 2014.

Highlights

View Spanish version of Highlights (PDF, 1 page).

What GAO Found

The factors that contributed to Puerto Rico's financial condition and levels of debt relate to (1) the Puerto Rico government running persistent annual deficits—where expenses exceed revenues—and (2) its use of debt to cope with deficits. Based on a literature review and interviews with current and former Puerto Rico officials, federal officials, and other relevant experts, GAO identified factors that contributed to Puerto Rico's persistent deficits:

- The Puerto Rico government's inadequate financial management and oversight practices. For example, the Puerto Rico government frequently overestimated the amount of revenue it would collect and Puerto Rico's agencies regularly spent more than the amounts Puerto Rico's legislature appropriated for a given fiscal year.

- Policy decisions by Puerto Rico's government. For example, Puerto Rico borrowed funds to balance budgets and insufficiently addressed public pension funding shortfalls.

- Puerto Rico's prolonged economic contraction. Examples of factors contributing to the contraction include outmigration and the resulting diminished labor force, and the high cost of importing goods and energy.

Additional factors enabled Puerto Rico to use debt to finance its deficits, such as high demand for Puerto Rico debt. One cause of high demand was that under federal law, income from Puerto Rico bonds generally receives more favorable tax treatment than income from bonds issued by states and their localities.

Based on an assessment of relevant literature and input from current and former Puerto Rico officials, federal officials, and other relevant experts, GAO identified three potential federal actions that may help address some of these factors. GAO also identified considerations for policymakers related to these actions.

- Modify the tax exempt status for Puerto Rico municipal debt. Making interest income from Puerto Rico bonds earned by investors residing outside of Puerto Rico subject to applicable state and local taxes could lower demand for Puerto Rico debt. However, reduced demand could hinder Puerto Rico's ability to borrow funds for capital investments or liquidity.

- Apply federal investor protection laws to Puerto Rico. Requiring Puerto Rico investment companies to disclose risks with Puerto Rico bonds and adhere to other requirements could lower demand for the bonds. However, this action could also limit Puerto Rico's ability to borrow funds.

- Modify the Securities and Exchange Commission's (SEC) authority over municipal bond disclosure requirements. SEC could be allowed to require timely disclosure of materials—such as audited financial statements—associated with municipal bonds. Over the past decade, Puerto Rico often failed to provide timely audited financial statements related to its municipal bonds. Timely disclosure could help investors make informed decisions about investing in municipal bonds. However, a broad requirement could place additional burdens on all U.S. municipal issuers, such as the costs of standardizing reporting.

Why GAO Did This Study

Puerto Rico has roughly $70 billion in outstanding debt and $50 billion in unfunded pension liabilities and since August 2015 has defaulted on over $1.5 billion in debt. The effects of Hurricanes Irma and Maria will further affect Puerto Rico's ability to repay its debt, as well as its economic condition. In response to Puerto Rico's fiscal crisis, Congress passed the Puerto Rico Oversight, Management, and Economic Security Act (PROMESA) in 2016, which included a provision for GAO to review Puerto Rico's debt.

This report describes the factors that contributed to Puerto Rico's financial condition and levels of debt and federal actions that could address these factors. Consistent with PROMESA, GAO focused on actions that would not increase the federal deficit.

To address these objectives, GAO reviewed documents and interviewed officials from the Puerto Rico and federal governments and conducted a review of relevant literature. GAO also interviewed former Puerto Rico officials and experts in Puerto Rico's economy, the municipal securities markets, and state and territorial budgeting, financial management, and debt practices, as well as officials from the Financial Oversight and Management Board for Puerto Rico (created by PROMESA).

GAO is not making recommendations based on the federal actions identified because policymakers would need to consider challenges and tradeoffs related to implementation.

The Puerto Rico government generally agreed with the factors we identified and provided additional information. GAO incorporated technical comments from SEC as appropriate.

For more information, contact Heather Krause at (202) 512-6806 or krauseh@gao.gov.