Government Efficiency and Effectiveness: Opportunities to Address Pervasive Management Risks and Challenges while Reducing Federal Costs

Fast Facts

The federal government is on a long-term, unsustainable fiscal path—it is spending more money than it is collecting. We've made hundreds of recommendations through our High Risk list and our work on duplicative, overlapping, and fragmented federal programs that could help the government save tens of billions of dollars.

In this testimony, we discuss some of these recommendations, including reducing improper payments (particularly in the areas of Medicare, Medicaid, and the Earned Income Tax Credit), improving IT management and cybersecurity of federal IT systems, and better managing federal real property.

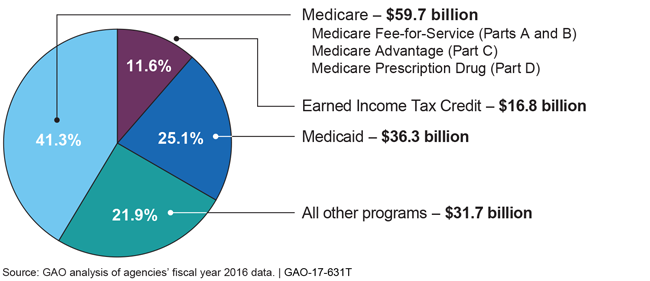

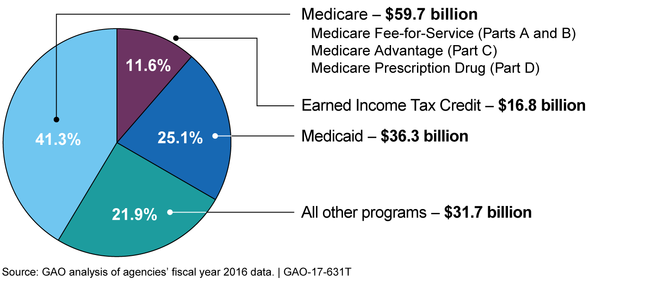

Reported Improper Payment Estimates for Fiscal Year 2016

Pie chart showing improper payment estimates for fiscal year 2016.

Highlights

What GAO Found

GAO's prior work has resulted in hundreds of billions of dollars in financial benefits over the last decade as agencies and Congress acted on its recommendations. However, there are significant opportunities for further action to address government-wide challenges by implementing GAO's recommendations that would result in billions of dollars in additional benefits.

Action Needed to Address Growth in Improper Payments. Reducing payments that should not have been made or that were made in an incorrect amount could yield significant savings. The reported government-wide improper payment estimate for fiscal year 2016 was over $144 billion. This estimate was attributable to 112 programs spread among 22 agencies. Since fiscal year 2003, cumulative estimates have totaled over $1.2 trillion.

Reported Improper Payment Estimates for Fiscal Year 2016

Improvements Needed in Information Technology (IT) Acquisition and Operation and in Addressing Cybersecurity Challenges. The government is projected to invest more than $89 billion on IT in fiscal year 2017. However, historically, these investments have frequently failed, incurred cost overruns and schedule slippages, or contributed little to mission-related outcomes. Better managing IT could result in billions of dollars in savings and much more efficient and effective government. Opportunities also exist to better ensure the security of federal information systems and cyber critical infrastructure and protect the privacy of personally identifiable information.

Challenges Remain in Reducing Unneeded Federal Facilities and Managing the Federal Fleet of Vehicles. Continuing to maintain unneeded facilities puts the government at risk for wasting resources due to ongoing maintenance costs as well as lost revenue from failing to sell surplus property. In addition, in fiscal year 2015, federal agencies spent about $4.3 billion on over 640,000 vehicles that agencies own or lease. In prior work, GAO found that selected agencies were spending over $20 million annually on vehicles that may not have been fully utilized. It is likely that additional cost savings are possible through enhanced agency practices.

Why GAO Did This Study

The federal government faces a long-term, unsustainable fiscal path based on an imbalance between federal revenues and spending. To put the government on a more sustainable long-term path, policymakers will need to have a broad fiscal plan that considers reducing spending, increasing revenue, or more likely, a combination of the two. While addressing this structural imbalance will require fiscal policy changes, in the near term, opportunities exist to act in a number of areas to improve this situation.

This statement highlights several areas in which the federal government is facing government-wide management challenges and the opportunities to act: improper payments; IT acquisitions, operations, and cybersecurity; and federal real property. This statement draws from GAO's 2017 High-Risk List, the 2017 annual report on fragmentation, overlap, and duplication, and other related work.

Properly managing government resources can help address the federal government's fiscal challenges by preventing fraud, waste, and abuse and ensuring funds are put to the best possible use. Although these actions alone cannot put the U.S. government on a sustainable fiscal path, they would improve both the fiscal situation and the federal government's operations.

For more information, contact J. Christopher Mihm at (202) 512-6806 or mihmj@gao.gov, or Susan J. Irving at (202) 512-6806 or irvings@gao.gov.