Small Business Research Programs: Status of Prior Recommendations

Fast Facts

Agencies have awarded about $2 billion per year to small businesses through the Small Business Innovation Research and Small Business Technology Transfer programs.

Since 2013, we've made 20 recommendations to the Small Business Administration and two other agencies that participate in the programs. Only about one-third of those recommendations have been implemented.

Fully implementing the remaining recommendations could improve the programs by improving compliance with spending and reporting requirements; increasing participation in the administrative pilot program; and enhancing fraud, waste, and abuse prevention activities.

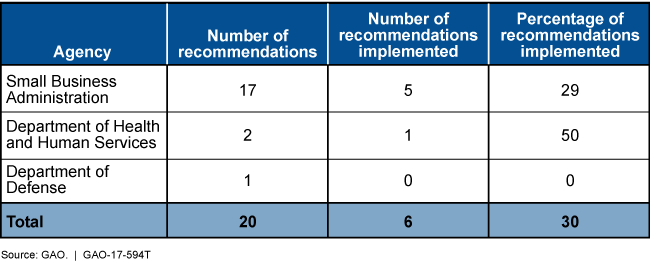

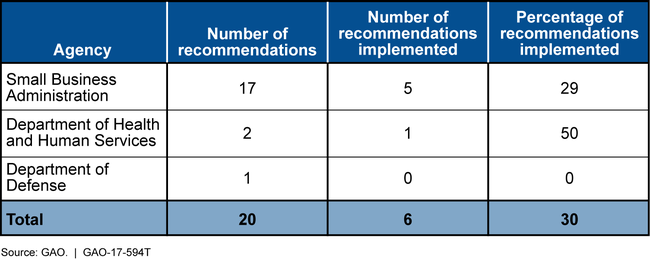

Number and Percentage of Prior GAO Recommendations Implemented as of April 2017

Table showing the number and percentage of prior recommendations implemented

Highlights

What GAO Found

The Small Business Administration (SBA), which oversees the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, and agencies participating in the programs have implemented about one-third of GAO's 20 prior recommendations regarding the programs. From September 2013 through April 2017, GAO made 17 recommendations to SBA and 3 to participating agencies to improve the oversight and implementation of spending requirements; reporting requirements; the administrative pilot program; and fraud, waste, and abuse prevention requirements. SBA has implemented 5 recommendations, and participating agencies have implemented 1 (see figure), although GAO made 4 of these recommendations to SBA and 2 to participating agencies in April 2017.

Number and Percentage of Prior GAO Recommendations Implemented as of April 2017

SBA and participating agencies have taken some actions to address GAO's recommendations. For example, in June 2014, GAO recommended that SBA clarify how agencies are to submit data on allowable spending. In response, SBA revised its annual report template, requesting that agencies identify obligations for the programs outside of awards. This change has improved the accuracy of the data that agencies report to SBA. However, SBA and the participating agencies have not fully implemented 14 recommendations that, if implemented, could improve the oversight and implementation of the programs. For example, in each of its four reports on agencies' compliance with spending and other reporting requirements, GAO found that SBA had not submitted required annual reports to Congress on the programs. SBA issued its most recent required report on the programs for fiscal year 2013 in March 2016. In a September 2013 report, GAO concluded that without more rigorous oversight by SBA and more timely and detailed reporting, it would be difficult for SBA to ensure that intended benefits of the programs were being attained and that Congress was receiving critical information to oversee these programs. GAO recommended that SBA provide Congress with a timely annual report, as required by the act. SBA agreed and stated that it planned to implement the recommendation. However, SBA has not yet done so and, as of April 2017, SBA did not have an estimated date for submitting its reports for fiscal years 2014 through 2016. GAO continues to believe that it is important for SBA to provide a timely annual report to Congress to further improve oversight of the programs.

Why GAO Did This Study

For about 35 years, federal agencies have made awards to small businesses for technology research and development through the SBIR program and, for the last 25 years, through the STTR program, totaling more than $40 billion. Currently, 11 agencies participate in the SBIR program, and 5 of these agencies also participate in the STTR program. The SBIR/STTR Reauthorization Act of 2011 included provisions for GAO to review aspects of the programs.

This statement addresses GAO's key findings and recommendations related to the SBIR and STTR programs since 2012. This statement is based on GAO reports issued in response to the act's provisions from November 2012 through April 2017. Those reports examined SBA's and agencies' compliance with spending and other reporting requirements for the programs and their implementation of fraud, waste, and abuse prevention measures. For those reports, GAO compared documentation from SBA and participating agencies with the respective requirements. In April 2017, GAO updated the status of its prior recommendations.

Recommendations

GAO has made 17 recommendations to SBA to improve oversight and implementation of the SBIR and STTR programs. SBA generally agreed with the recommendations. SBA has taken or described planned actions to address the recommendations, which GAO will continue to monitor.