Tax Expenditures: Opportunities Exist to Use Budgeting and Agency Performance Processes to Increase Oversight

Highlights

What GAO Found

Federal budget formulation processes include fewer controls and reviews, and provide less information on tax expenditures—which represented an estimated $1.23 trillion in forgone revenues in fiscal year 2015—than for discretionary or mandatory spending. For example, in the President’s budget, tax expenditure revenue loss estimates are presented separately from related spending, making their relative contributions toward national priorities less visible than spending programs. Likewise, only proposed tax expenditures or those that expire are subject to review within congressional budget processes, similar to mandatory spending. Existing, non-expiring tax expenditures are not subject to such review.

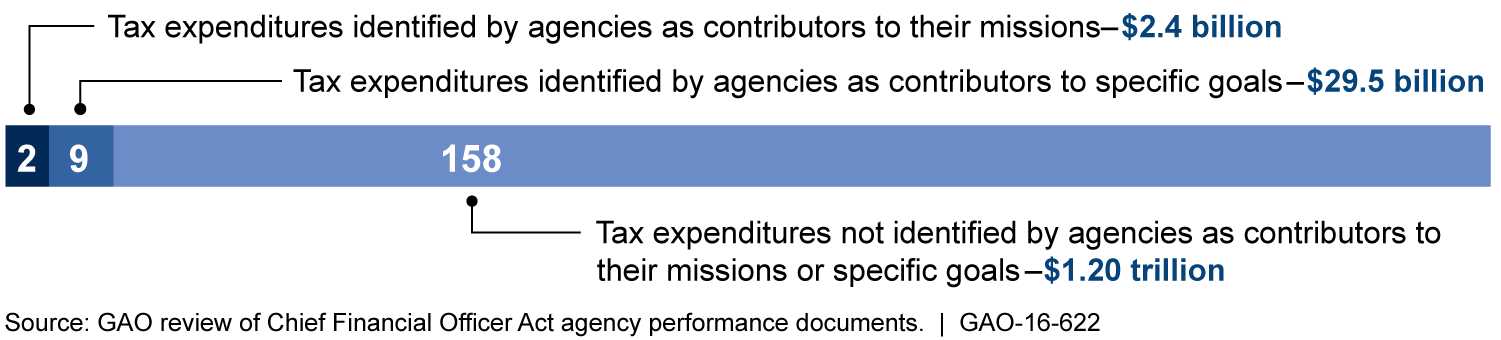

The Office and Management and Budget (OMB) and agencies have made limited progress identifying tax expenditures’ contribution to agency goals. As of January 2016, 7 of the 24 Chief Financial Officer (CFO) Act agencies identified tax expenditures as contributors to their agency goals—as directed in OMB guidance—or agency missions. The tax expenditures they identified accounted for only 11 of the 169 tax expenditures included in the President’s Budget for Fiscal Year 2017, representing an estimated $31.9 billion of $1.23 trillion in forgone revenues for fiscal year 2015. Based on interviews with agencies and reviewing past GAO work, GAO found that a lack of clarity about agencies’ roles leads to inaction in identifying tax expenditures that contribute to agency goals. To address this, OMB guidance previously stated that it would work with the Department of the Treasury (Treasury) and other agencies to identify where tax expenditures align with agency goals. OMB removed that language in June 2015, citing capacity constraints. Without additional OMB and Treasury assistance, agencies may continue to have difficulty identifying whether, or which of, the remaining 158 tax expenditures—representing $1.20 trillion in forgone revenues—contribute to their goals.

Tax Expenditures Identified by Agencies As Contributing to Agency Goals or Missions, As of January 2016

Based on an assessment of budget and tax experts’ input and prior GAO work, GAO found that options to further incorporate tax expenditures into budgeting processes could help achieve various benefits; but policymakers would need to consider challenges and tradeoffs in deciding whether or how to implement them. For example, one option is to require that all, or some subset of, tax expenditures expire after a finite period. This option could result in greater oversight, requiring policymakers to explicitly decide whether to extend more or all tax expenditures. However, this option could lead to frequent changes in the tax code, such as from extended or expired tax expenditures, which can create uncertainty and make tax planning more difficult, as GAO has reported previously.

Why GAO Did This Study

Tax expenditures—special credits, deductions, and other tax provisions that reduce taxpayers’ tax liabilities—represent a substantial federal commitment. If Treasury’s estimates are summed, an estimated $1.23 trillion in federal revenue was forgone from the 169 tax expenditures reported for fiscal year 2015, an amount comparable to discretionary spending. Tax expenditures are often aimed at policy goals similar to those of federal spending programs.

GAO was asked to identify the extent to which tax expenditures are incorporated into federal budget processes. This report (1) compares the treatment of tax expenditures and other spending in federal budgeting processes; (2) evaluates the extent to which OMB and agencies have identified tax expenditures’ contributions to agency goals; and (3) examines options to further incorporate tax expenditures in federal budgeting processes. To address these objectives, GAO reviewed agency budget documents, OMB guidance, prior GAO reports, and performance plans and reports available as of January 2016 for all 24 CFO Act agencies. GAO also held a roundtable discussion with budget and tax experts to examine options for further incorporating tax expenditures into budgeting processes.

Recommendations

GAO recommends that OMB, in collaboration with Treasury, work with agencies to identify which tax expenditures contribute to agency goals. OMB generally agreed with GAO’s recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of Management and Budget |

Priority Rec.

To help ensure that the contributions of tax expenditures toward the achievement of agency goals are identified and measured, the Director of OMB, in collaboration with the Secretary of the Treasury, should work with agencies to identify which tax expenditures contribute to their agency goals, as appropriate--that is, they should identify which specific tax expenditures contribute to specific strategic objectives and agency priority goals. |

As of March 2025, OMB had not begun to work with agencies to identify which tax expenditures contribute to the agencies' specific strategic objectives and agency priority goals, as GAO recommended in 2016. OMB stated that, although it agreed with the recommendation, it was not pursuing the effort due to competing priorities, as well as capacity and resource constraints. As of March 2025, OMB does not plan to address this recommendation. GAO continues to believe that OMB, in collaboration with the Department of the Treasury, needs to assist agencies in identifying tax expenditures that relate to agency goals so that the agencies have a more complete understanding of how a broader range of federal investments contributes to their goals. In January 2025, OMB included tax expenditures along other types of programs, such as grants, loans, and direct assistance to individuals, in its federal program inventory. The inventory could serve as a resource to help OMB, Treasury, and agencies more efficiently and effectively identify relevant tax expenditures. Without additional OMB assistance, agencies may continue to have difficulty identifying whether or which of the dozens of tax expenditures--representing an estimated $1.6 trillion in forgone revenues in fiscal year 2024 (last revised estimates available)--contribute to their goals.

|