Refundable Tax Credits: Comprehensive Compliance Strategy and Expanded Use of Data Could Strengthen IRS's Efforts to Address Noncompliance

Highlights

What GAO Found

The Earned Income Tax Credit (EITC), the Additional Child Tax Credit (ACTC), and the American Opportunity Tax Credit (AOTC) provide tax benefits to millions of taxpayers—many of whom are low-income—who are working, raising children, or pursuing higher education. These credits are refundable in that, in addition to offsetting tax liability, any excess credit over the tax liability is refunded to the taxpayer. In 2013, the most recent year available, taxpayers claimed $68.1 billion of the EITC, $55.1 billion of the CTC/ACTC, and $17.8 billion of the AOTC.

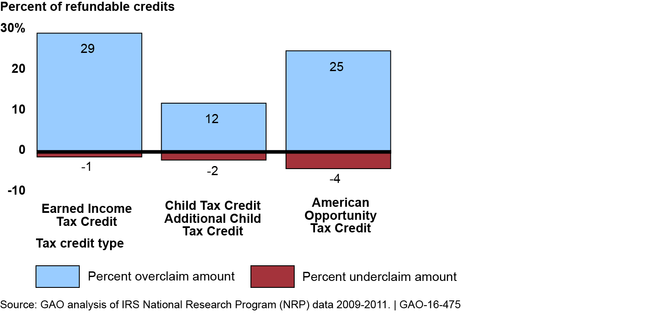

Eligibility rules for refundable tax credits (RTCs) contribute to compliance burden for taxpayers and administrative costs for the Internal Revenue Service (IRS). These rules are often complex because they must address complicated family relationships and residency arrangements to determine who is a qualifying child. Compliance with the rules is also difficult for IRS to verify due to the lack of available third party data. The relatively high overclaim error rates for these credits (as shown below) are a result, in part, of this complexity. The average dollar amounts overclaimed per year for 2009 to 2011, the most recent years available, are $18.1 billion for the EITC, $6.4 billion for the CTC/ACTC, and $5.0 billion for the AOTC.

Overclaims and Underclaims as a Percent of Total Credit Amount

IRS uses audits and automated filters to detect errors before a refund is sent, and it uses education campaigns and other methods to address RTC noncompliance. IRS is working on a strategy to address EITC noncompliance but this strategy does not include the other RTCs. Without a comprehensive compliance strategy that includes all RTCs, IRS may be limited in its ability to assess and improve resource allocations. A lack of reliable collections data also hampers IRS's ability to assess allocation decisions. IRS is also missing opportunities to use available data to identify potential noncompliance. For example, tracking the number of returns erroneously claiming the ACTC and AOTC and evaluating the usefulness of certain third party data on educational institutions could help IRS identify common errors and detect noncompliance.

Proposals to change the design of RTCs--such as changing eligibility rules--will involve trade-offs in effectiveness, efficiency, equity, and simplicity.

Why GAO Did This Study

Refundable tax credits are policy tools available to encourage certain behavior, such as entering the workforce or attending college. GAO was asked to review the design and administration of three large RTCs (the EITC, AOTC, and ACTC). The ACTC is sometimes combined with its nonrefundable counterpart, the Child Tax Credit. For this report GAO described RTC claimants and how IRS administers the RTCs. GAO also assessed the extent to which IRS addresses RTC noncompliance and reviewed proposed changes to the RTCs.

GAO reviewed and analyzed IRS data, forms and instructions for claiming the credits, and planning and performance documents. GAO also interviewed IRS officials, tax preparers, and other subject-matter experts.

Recommendations

GAO recommends 1) IRS develop a comprehensive compliance strategy that includes all RTCs, 2) use available data to identify potential sources of noncompliance, 3) ensure reliability of collections data and use them to inform allocation decisions, and 4) assess usefulness of third-party data to detect AOTC noncompliance. IRS agreed with three of GAO's recommendations, but raised concerns about cost of studying collections data for post-refund enforcement activities. GAO recognizes that gathering collections data has costs. However, a significant amount of enforcement activity is occurring in the post-refund environment and use of these data could better inform resource allocation decisions and improve the overall efficiency of enforcement efforts.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | To strengthen efforts to identify and address noncompliance with the EITC, ACTC, and AOTC, the Commissioner of Internal Revenue should direct Refundable Credits Policy and Program Management (RCPPM) to, building on current efforts, develop a comprehensive operational strategy that includes all the RTCs for which RCPPM is responsible. The strategy could include use of error rates and amounts, evaluation and guidance on the proper use of indicators like no-change and default rates, and guidance on how to weigh trade-offs between equity and return on investment in resource allocations. |

In April 2018, the Internal Revenue Service (IRS) completed a comprehensive refundable tax credit compliance strategy, as GAO recommended in May 2016. The strategy primarily focuses on three large refundable tax credits for individual taxpayers-the Earned Income Tax Credit, the Additional Child Tax Credit, and the American Opportunity Tax Credit. According to IRS, in 2016, these three credits had a combined outlay of almost $85 billion, and about 95% of all refundable tax credits. The new strategy evaluates the effect that various compliance treatments--such as taxpayer education and outreach campaigns, interventions focusing on paid preparers, and exams--have on different outcomes such as taxpayer burden, return on investment, and taxpayer behavior, among others. With that data, IRS developed a tool, the Exam Planning Scenario Tool, to help with exam planning. According to IRS, although exams are only a piece of the puzzle, the exam planning tool has made its planning process more efficient, although no savings estimate is currently available. For example, IRS reported that its previous process was manually intensive and the exam planning tool provides greater automation. It also allows officials to make adjustments and review proposed outcomes prior to settling on a final work plan each year. This new comprehensive approach has the potential to help IRS determine whether its current allocation of resources is optimal, and if not, what adjustments are needed.

|

| Internal Revenue Service | To strengthen efforts to identify and address noncompliance with the EITC, ACTC, and AOTC, the Commissioner of Internal Revenue should direct Refundable Credits Policy and Program Management (RCPPM) to assess whether the data received from the Department of Education's Postsecondary Education Participants System (PEPS) database (a) are sufficiently complete and accurate to reliably correct tax returns at filing and (b) provide additional information that could be used to identify returns for examination; if warranted by this research, IRS should use this information to seek legislative authority to correct tax returns at filing based on PEPS data. |

As of September 2017, the Internal Revenue Service (IRS) completed its assessment of the usefulness of data received from the PEPS database, as GAO recommended in May 2016. IRS determined that it is not a sufficiently complete database to confirm American Opportunity Tax Credit (AOTC) eligibility during return processing or post-processing. While this assessment of the PEPS database addressed our recommendation, IRS took additional steps to assist future compliance efforts by developing a table of schools and related employment identification numbers (EIN). IRS tested this table to determine if it could be used to validate EINs on tax year 2016 Forms 8863, Education Credits (AOTC and Lifetime Learning Credits). IRS reported that the test results, while promising, showed that 1.4 million or 17 percent of the returns with AOTC did not contain an EIN. As tax year 2016 was the first year an EIN was required on Form 8863, IRS expects a higher percentage of AOTC claims containing an EIN when it tests the EIN table again for tax year 2017. Depending on the results from the second year of the test, IRS said it will consider seeking math error authority to use the 3-year EIN table to reconcile EINs reported on Form 8863 during return processing.

|

| Internal Revenue Service | To strengthen efforts to identify and address noncompliance with the EITC, ACTC, and AOTC, the Commissioner of Internal Revenue should direct Refundable Credits Policy and Program Management (RCPPM) to take necessary steps to ensure the reliability of collections data and periodically review that data to (a) compute a collections rate for post-refund enforcement activities and (b) determine what additional analyses would provide useful information about compliance results and costs of post-refund audits and document-matching reviews. |

No executive action taken as of March 2024. The Internal Revenue Service (IRS) disagreed with GAO's May 2016 recommendation. IRS raised concerns about the cost of studying collections data for post-refund enforcement activities. GAO recognizes that gathering collections data has costs and the data have limitations, notably that not all recommended taxes are collected. However, use of these data--once IRS is able to verify their reliability--could better inform resource allocation decisions and improve the overall efficiency of enforcement efforts. By not taking necessary steps to ensure the reliability of these data and linking them to tax assessments to calculate a collections rate, IRS lacks critical information. Periodic reviews of collections data and analyses could help IRS officials more efficiently allocate limited enforcement resources by providing a more complete picture about compliance results and costs.

|

| Internal Revenue Service | To strengthen efforts to identify and address noncompliance with the EITC, ACTC, and AOTC, the Commissioner of Internal Revenue should direct Refundable Credits Policy and Program Management (RCPPM) to, as RCPPM begins efforts to track the number of erroneous returns claiming the ACTC or AOTC identified through pre-refund enforcement activities, such as screening filters and use of math error authority, it should develop and implement a plan to collect and analyze these data that includes such characteristics as identifying timing goals, resource requirements, and the appropriate methodologies for analyzing and applying the data to compliance issues. |

In April 2018, the Internal Revenue Service (IRS) completed a comprehensive refundable tax credit compliance strategy, as GAO recommended in May 2016. The strategy primarily focuses on three large refundable tax credits for individual taxpayers-the Earned Income Tax Credit, the Additional Child Tax Credit, the American Opportunity Tax Credit. According to IRS, in 2016, these three credits had a combined outlay of almost $85 billion, and about 95% of all refundable tax credits. The new strategy evaluates the effect that various compliance treatments-such as taxpayer education and outreach campaigns, interventions focusing on paid preparers, and exams-have on different outcomes-such as taxpayer burden, return on investment, and taxpayer behavior, among others. With that data, IRS developed a tool, the Exam Planning Scenario Tool, to help with exam planning. According to IRS, although exams are only a piece of the puzzle, the exam planning tool has made its planning process more efficient, although no savings estimate is currently available. For example, IRS reported that their previous process was manually intensive and the exam planning tool provides greater automation. It also allows officials to make adjustments and review proposed outcomes prior to settling on a final work plan each year. This information should help IRS deepen its understanding of common errors made by taxpayers claiming these credits; IRS can use these insights to develop strategies to educate taxpayers.

|