Partnerships and S Corporations: IRS Needs to Improve Information to Address Tax Noncompliance

Highlights

What GAO Found

The full extent of partnership and S corporation income misreporting is unknown. The Internal Revenue Service's (IRS) last study of S corporations, using 2003-2004 data, estimated that these entities annually misreported about 15 percent (an average of $55 billion for 2003 and 2004) of their income. IRS does not have a similar study for partnerships. Using IRS data and the study results, GAO derived a rough-order-of-magnitude estimate of $91 billion per year of partnership and S corporation income being misreported by individuals for 2006 through 2009.

IRS examinations and automated document matching have not been effective at finding most of the estimated misreported income. For example, IRS reported that examinations identified about $16 billion per year of misreporting in 2011 and 2012, the bulk of which related to partnerships. However, such information about compliance results is not reliable. IRS estimated that 3 to 22 percent of the misreporting by partnerships was double counted due to some partnership income being allocated to other partnerships or related parties. Further, IRS does not know how income misreporting by partnerships affects taxes paid by partners. IRS does not have a strategy to improve the information. As a result, IRS does not have reliable information about its compliance results to fully inform decisions about allocating examination resources across different types of businesses.

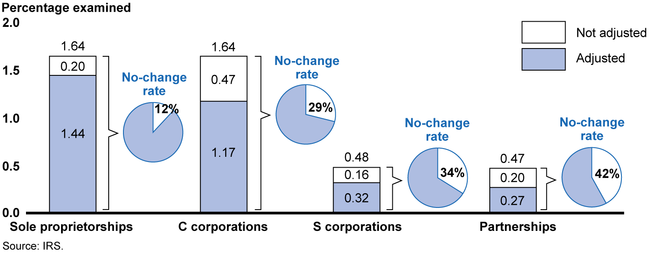

IRS's processes for selecting returns to examine could be improved. Not all partnership and S corporation line items from paper returns are digitized, and IRS officials said that having more return information available electronically might improve examination selection. In 2011, about 65 percent of partnerships and S corporations electronically filed (e-filed). Certain large partnerships and S corporations are required by statute to e-file. Expanding the mandate would increase digitized data available for examination selection. Further, in 1995 GAO found that IRS's computer scoring system for selecting partnership returns to examine used outdated information. IRS does not have a strategy to update and use this information to select partnerships for examination. Relatively few partnerships are examined compared to other business entities, and many examinations result in no change in taxes owed. Improved examination selection based on more current information could generate more revenue and reduce IRS examinations of compliant taxpayers.

Fiscal Year 2012 Examination and Adjustment Rates for Different Types of Tax Returns

Why GAO Did This Study

Since 1980, partnerships' and S corporations' share of business receipts increased greatly. These entities generally do not pay income taxes. Instead, income or losses (hundreds of billions of dollars annually) flow through to partners and shareholders to include on their income tax returns. GAO has previously reported that the misreporting of income by partners and shareholders poses a tax compliance risk.

GAO was asked to assess IRS's efforts to ensure compliance by partnerships and S corporations. This report (1) describes what is known about misreporting of flow-through income, (2) assesses how much misreporting IRS identifies, and (3) analyzes possible improvements in IRS's use of data to better identify partnerships and S corporations to consider examining. Comparing partnership, S corporation, and other entities' examination results, GAO analyzed 2003-2012 IRS data and evaluated possible improvement ideas stemming, in part, from prior GAO work, for how IRS identifies examination workload.

Recommendations

GAO suggests that Congress consider requiring more partnerships and corporations to e-file their tax returns. GAO recommends, among other things, that IRS (1) develop a strategy to improve its information on the extent and nature of partnership misreporting, and (2) use the information to potentially improve how it selects partnership returns to examine. IRS stated it would consider all the recommendations and identify appropriate actions.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider expanding the mandate for partnerships and corporations to electronically file their tax returns to cover a greater share of filed returns. | Congress has passed and the President has signed legislation lowering the electronic filing (e-file) threshold for partnership and corporation returns as GAO suggested in May 2014. Section 301 of the Tax Technical Corrections Act of 2018, division U of the Consolidated Appropriations Act, 2018, lowered the threshold of electronic filing by partnerships incrementally over time--from 250 returns to 20 returns in calendar years after 2021 (Public Law 115-141). Subsequently, Section 2301 of the Taxpayer First Act incrementally lowered the threshold of electronic filing for both partnerships and corporations from 250 returns to 10 returns in calendar years after 2021 (Public Law 116-25). Requiring greater e-filing of tax return information will help the Internal Revenue Service (IRS) identify which partnership and corporation tax returns would be most productive to examine, and could reduce the number of compliant taxpayers selected for examination. Further, expanded e-filing will reduce IRS's tax return processing costs. |

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should develop and implement a strategy to better estimate (1) the extent and nature of partnership misreporting, and (2) the effectiveness of partnership examinations in detecting this misreporting. |

In January 2016, IRS launched the Partnership Research Study (PRS), a research program to measure strategic level compliance, including filing and reporting compliance. IRS's Small Business and Self-Employed division worked with IRS's Research, Applied Analytics, and Statistics division to design this study, which includes mandatory issues that will be audited. The study will include a minimum of 2,000 examined returns. As of July 2017, IRS had started examining 1,750 returns for the study and 500 more will be delivered for examination in November 2017. The study will provide IRS with numeric values that will be utilized in a statistical formula to determine the extent and nature of partnership compliance and misreporting and the effectiveness of partnership examinations.

|

| Internal Revenue Service |

Priority Rec.

The Commissioner of Internal Revenue should use the better information on noncompliance and program effectiveness to determine (1) whether the differences in examination rates across different types of business entities are justified, and (2) whether an improved tool for selecting partnerships for examination, such as an updated partnership discriminant function, should be developed. |

In January 2016, IRS launched the Partnership Research Study (PRS), a research program to measure strategic level compliance, including filing and reporting compliance. The study will include a minimum of 2,000 examined returns. As of July 2017, IRS had started examining 1,750 returns for the study and 500 more will be delivered for examination in November 2017. Although IRS will not have useable data based on this study for a couple of years, ultimately the study will allow IRS to make better informed decisions about its allocation of enforcement resources and about whether or not to update its major partnership examination selection tool.

|

| Internal Revenue Service | While IRS works to improve the quality of its Schedule K-1 data, the Commissioner of Internal Revenue should develop a plan for conducting testing or other analysis to determine whether the improved Schedule K-1 data, perhaps combined with other IRS information about businesses and taxpayers, could be used more effectively to ensure compliance with the reporting of flow-through income. |

IRS stated that it understands the objective of this recommendation and, at such time that resources are available to enhance capabilities, it would consider the proposed methodology of advanced testing. However, based on current and anticipated budget constraints, it does not expect its plans to change in the near future. As of April 2025, IRS did not mention plans to use information returns and specifically Schedule K-1s for increased compliance efforts and is undergoing a workforce restructuring that will likely change its compliance focus. As such we will continue to monitor progress as IRS increases compliance efforts.

|